Striking Portfolio Balance with Gold Stocks

Commodities / Gold & Silver Stocks Dec 19, 2011 - 03:11 PM GMTBy: Frank_Holmes

Gold stocks have historically ranked among some of the most volatile asset classes. Over any given one-year period, it is a non-event for gold stocks to move plus or minus 38 percent. This DNA of volatility is about three times that of gold bullion, which carries an annual volatility around 13 percent.

Gold stocks have historically ranked among some of the most volatile asset classes. Over any given one-year period, it is a non-event for gold stocks to move plus or minus 38 percent. This DNA of volatility is about three times that of gold bullion, which carries an annual volatility around 13 percent.

Despite this volatility, our research shows that investors can use gold stocks to enhance returns without adding risk to the portfolio.

In 1989, Wharton School finance professor Jeffrey Jaffe completed an academic study that illustrated the effects of portfolio diversification into gold stocks. Jaffe’s original study covered the period from September 1971, just after President Nixon ended convertibility between gold and the dollar, to June 1987.

During Jaffe’s study period, the average monthly return for the S&P 500 Index was 0.89 percent. Gold stocks, as measured by the Toronto Stock Exchange Gold and Precious Minerals Total Return Index, converted to U.S. dollars, performed considerably better, returning an average monthly return of 1.42 percent.

On the risk side, gold stocks had greater volatility (measured by standard deviation) than the S&P 500. But Jaffe found that, because of their low correlation to U.S. stocks, adding a small percentage of gold-related assets to a diversified portfolio slightly reduced overall risk.

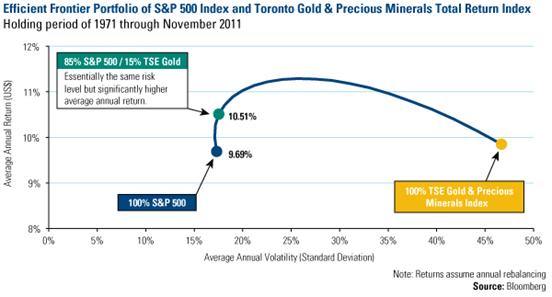

Here is an updated version of Jaffe’s results.

To find an optimal portfolio allocation between gold stocks and the S&P 500, the efficient frontier plots different portfolios, ranging from a 100 percent allocation to U.S. stocks (the S&P 500) and no allocation to gold stocks, and gradually increases the share of gold stocks while decreasing the allocation to U.S. equities.

Assuming an investor rebalanced annually, our research found that a portfolio holding an 85 percent allocation to the S&P 500 and a 15 percent allocation to gold equities* had essentially the same volatility as the S&P 500 (horizontal axis) but delivered a higher return (vertical axis). In other words, the addition of a small allocation to gold stocks increased portfolio returns with no increase in the portfolio’s volatility.

Between September 1971 and November 2011, the S&P 500 averaged a 9.69 percent annual return. A 15 percent allocation to gold equities and an 85 percent allocation to U.S. stocks, with annual rebalancing to maintain the allocations, would have yielded, on average, an additional 0.82 percent per year.

How much is 0.82 percent per year?

Let’s use a hypothetical $100 investment as an illustration. A $100 investment in gold stocks in 1971 would have grown to nearly $5,100 at the end of November 2011, while the same amount in the S&P 500 would be worth about $4,800.

But look what happens when you combine the two. Assuming the same average annual returns since 1971 and annual rebalancing over 40 years, a hypothetical $100 investment in a portfolio with 15 percent gold stocks would be worth about $6,600. That is 37 percent greater than the $4,800 for the portfolio solely invested in the S&P 500, while adding virtually zero risk.

U.S. Global Investors consistently suggests allocating up to 10 percent gold in a portfolio, so we also looked at returns for investors at that level. In dollar terms, a hypothetical $100 investment in the 90-10 portfolio would grow to $6,022 over the ensuing 40 years (assuming annual rebalancing), compared to $4,820 for the portfolio solely invested in the S&P 500.

And when you look at the efficient frontier in the chart, a portfolio with a 10 percent weighting of gold stocks and a 90 percent allocation to the S&P 500 has also historically increased return with no additional volatility.

More than two decades and many ups and downs have passed since Jaffe published his study, but our follow-up research shows that the relationship among gold, outsized returns and volatility has remained consistent through the past four decades.

If you haven’t already completed your annual portfolio rebalancing, this may be an opportune time recalibrate your portfolio with gold stocks.

*Time series for Toronto Gold & Precious Minerals Index is a composite of this index’s returns from 1970 to 2000. Thereafter, the S&P/TSX Gold Index is used. Both series are analyzed based on their returns achieved in US dollar terms.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Toronto Stock Exchange Gold and Precious Minerals Total Return Index is the total return version of the Toronto Stock Exchange Gold and Precious Minerals Index with dividends reinvested.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Diversification does not protect an investor from market risks and does not assure a profit.

For more updates on global investing from Frank and the rest of the U.S. Global Investors team, follow us on Twitter at www.twitter.com/USFunds or like us on Facebook at www.facebook.com/USFunds. You can also watch exclusive videos on what our research overseas has turned up on our YouTube channel at www.youtube.com/USFunds.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.