Sales of New U.S. Homes Rose in September, But Trend is Unimpressive

Housing-Market / US Housing Oct 27, 2011 - 03:08 AM GMTBy: Asha_Bangalore

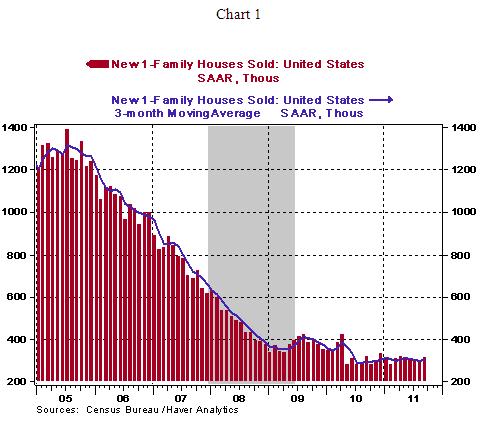

Sales of new single-family homes rose 5.7% to an annual rate of 309,000 in September, the second highest level for the year after the 316,000 mark seen in April. The picture is less impressive when we put things in a historical perspective. The 3-month moving average of existing home sales at 302,000 has held nearly steady since mid-2010 (see Chart 1) after the first-time home buyer program expired.

Sales of new single-family homes rose 5.7% to an annual rate of 309,000 in September, the second highest level for the year after the 316,000 mark seen in April. The picture is less impressive when we put things in a historical perspective. The 3-month moving average of existing home sales at 302,000 has held nearly steady since mid-2010 (see Chart 1) after the first-time home buyer program expired.

The good news is that the inventory of unsold new homes dropped to 6.2-month supply in September from 6.6-month supply mark in August. The latest reading is the historical mean. Going forward, as economic momentum improves and employers are more willing to hire, the low inventory situation bodes positively for the construction of new homes.

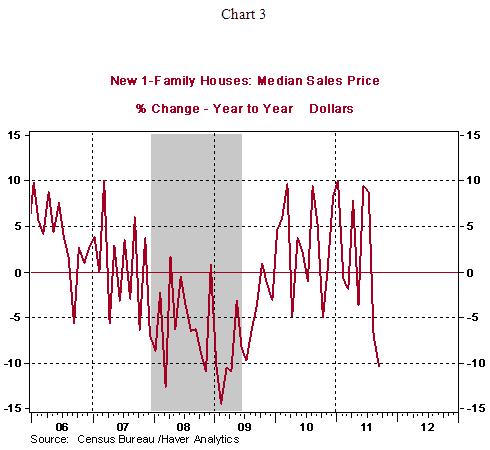

The median price of a new single-family home fell 3.1% during September to $204,400 from August. On a year-to-year basis, the decline in the median home price is 10.4% and the largest drop since April 2009 (see Chart 3). The availability of comparable foreclosed homes, marked down significantly, is the primary reason for the sharp drop in prices of new homes.

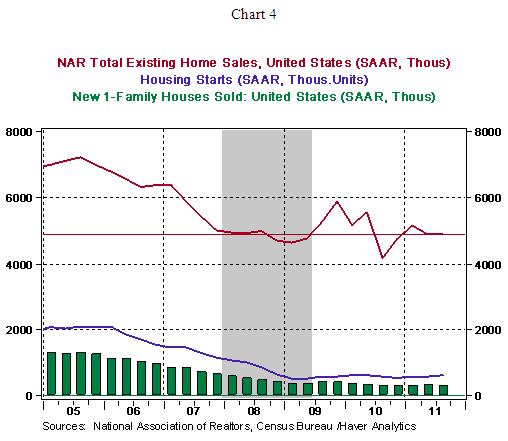

We now have data for sales of new and existing homes and housing starts for the third quarter. The message from Chart 4 is that sales and starts of homes have not made a dent despite nine quarters of economic growth. The wide swings in the 2009-2010 period of existing home sales is related to the temporary boost from the first-time home-buyer program.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.