PIMCO Missed the Trade of the Year in the U.S. Treasury Bond Market

Interest-Rates / US Bonds Aug 29, 2011 - 05:35 AM GMTBy: EconMatters

PIMCO who specializes in Bonds, having the largest bond fund in the world could not have been more wrong about an asset class, which is surprising considering their experience in this sector. Bill Gross`s official declaration that his firm was shorting the US Treasury Market on April 11th of this year to the day marked the literal double bottom in price/high in yield for the year, and it has been one heck of a one-way trade in the opposite direction ever since.

PIMCO who specializes in Bonds, having the largest bond fund in the world could not have been more wrong about an asset class, which is surprising considering their experience in this sector. Bill Gross`s official declaration that his firm was shorting the US Treasury Market on April 11th of this year to the day marked the literal double bottom in price/high in yield for the year, and it has been one heck of a one-way trade in the opposite direction ever since.

Major Move - Trend Traders Dream

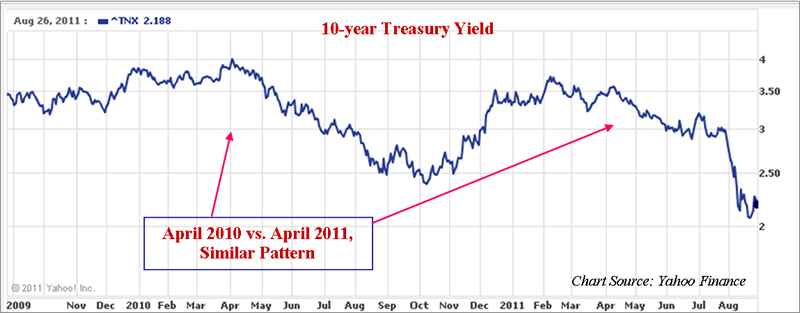

On April 11th the 10-Year Treasury was yielding 3.57% and on August 19th it reached a low yield of 2.06% that is a 151 basis point move in a little more than four months. Somebody at PIMCO is going to be receiving the lower end of their discretionary bonus range at the end of the year that`s for sure. But how could they make this mistake in the first place?

"Sell in May, and Go Away" - Pattern Recognition?

We, at EconMatters, used last year as a template and forecast the exact opposite trade around the same time in April as Bill Gross was going short the Treasury Market. We stated in one of several pieces on the subject our hypothesis for the summer:

"If we look back at last year for guidance, we remember that the Greek and European crisis was known for months, the selloff only occurred when conditions were optimal. As in, the Fed removing stimulus from asset prices, limited upside gains versus substantial downside correction losses.

Then all of the sudden we had a crisis on our hands, only differentiated by the fact that Sellers stepped into the market, and all the sudden, bad news was everywhere. It is only bad news in market terms if buyers decide to sell, and just like in 2010, the above reasons serve as likely catalysts for similar selling this year around this time. Think along the lines of a 20-25% correction in most asset classes over the next 4 to 5 months. Just think how much better your portfolio would look if you locked in your profits last April, parked your money in a money market fund, waited for the Summer selloff, and then got back in the market during the historically stronger investment months for the last quarter of the year, (October-December) where money managers push up asset prices into the year end to make their numbers."

Well, what PIMCO and Bill Gross should have noticed is that around April 6th of 2010 the very same time Treasuries went on a similar run with a 3.97% yield on that date running to a 2.38% yield on October 8th in an eerily similar 159 basis point move in the subsequent six month time period (See Chart above). What were they thinking?

End of QE2 = Start of Risk-Off Trades

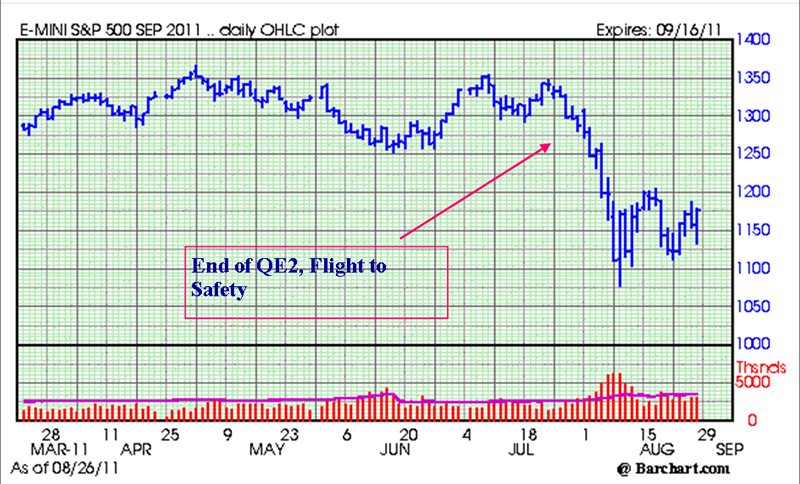

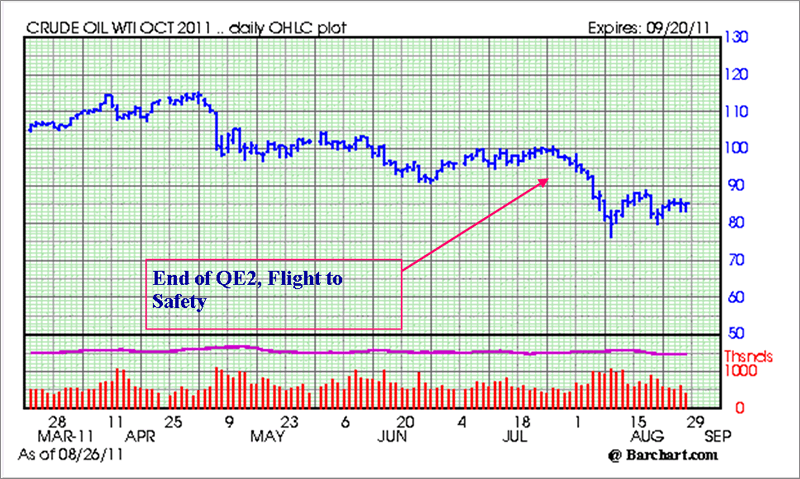

The obvious signs are that if you have a 25% correction in asset classes as highs are reached in early April, and QE2 comes to an end, removing artificially inflated stimulus it was obvious that we were going to experience the same sort of “flight to safety” trade as 2010 where bad news was really bad news because there was a huge artificial support that was being taken away from the market, and that when this flight to safety occurred, that bonds were going to be the main beneficiary. You do not get a 25% correction in risk asset classes like Oil and Equities and not have a stampede run into the “Safety Trade”. There are two main fundamental trades in play these days, the “Risk On Trade” where you go out of Bonds and into Risk Assets like Commodities and Equities. After all, this was Bernanke`s stated goal to incentivize investors to take on more risk by getting out of deflationary safe assets like bonds and into the riskier classes.

Well, when QE2 ended it was logical that the trade was going to morph into the other trade, the “Flight to Safety Trade” where investors go out of riskier assets like Commodities and Equities and seek return of capital in Bonds and Treasuries. Bond King's Cardinal Sin PIMCO made the cardinal sin of buying at the proverbial top of the Treasury market in terms of yield, or put another way, selling at the bottom of the Treasury market in terms of price. And yes at times this can be a respectable technically based trading strategy, but not in the context of other macro events taking place regarding debt concerns in the US and Europe.

Flawed Inflationary Bias

I think part of the flaw in PIMCO`s analysis is that they looked around at commodities like Oil and this confirmed their inflationary bias, i.e., a 70`s style inflation era of high commodity prices and bond vigilantes demanding higher yield for financing any debt.

But the flaw is that we were in a true inflationary period in the 1970`s due to high commodity prices and high interest rates, but the main difference between the two eras is that we are in a major deflationary era because of high debt issues on governmental balance sheets. Moreover, higher oil prices actually are deflationary this time around because they are not due to fundamental supply shortages like the 1970`s but rather artificial monetary policies. So when you couple weak demand and high artificially inflated Oil prices you get a deflationary stunt of economic growth and increase the chances of sending the economy into a prolonged recession because the real economy cannot support higher Commodity prices. And in any deflationary period the “Safety Trade” is going to prevail over the “Risk On Trade”. I think this is one of the main errors in PIMCO`s analysis, they took the wrong reading from artificially high Oil prices, they thought that these prices were here to stay when the demand levels were at a negative year-over-year 3% reading moving to the 5% negative level.

Flawed Assumptions in Model

The other main contributing flaw in PIMCO`s analysis is probably that they viewed the financial world as it was at the beginning of April, and not how it was going to be in May. PIMCO looked around and surveyed their surroundings, and then just extrapolated the status quo at the time forward utilizing some forward looking modeling assumptions, but they never really questioned whether there was something amiss with their status quo in the first place. The real fault was not recognizing that the status quo was only a temporary phenomenon and about to change in a radical way after the options expiration in April; and the template for knowing this was staring them in the face the entire time because the almost exact carbon copy happened the year before.

"Group Think" Scenario?

There are a lot of smart minds at PIMCO, and I am sure they realized they were wrong at some point on this trade and cut their losses. But oh what could have been? I guess a couple of possible takeaways from this failed strategic analysis and subsequent trade on behalf of PIMCO is to have enough divergent views within an organization so that enough challenging of ideas and assumptions takes place in order to ferret out potential shortcomings in one`s original hypothesis before capital is ever allocated to the trade. It seems that PIMCO suffered from a major dose of “Group Think”.

Questionable Decision-making Process

The more troubling part would be that analysts within PIMCO were not listened to at the analyst level, and the strategic decisions were made solely at the Executive level. The third alternative is that the analysts were afraid to speak up once a base hypothesis was formed within PIMCO, and they didn`t feel comfortable “Rocking the Boat” so to speak.

History Sometimes Repeats Itself

The other lesson to be gleaned by this failed trade is that even the experts, the specialists within their field make mistakes, so the Bond Experts messed up what was probably one of the easiest bond trades of the last five years. It was the perfect setup, and all PIMCO had to do was read the correct tea leaves, and make a fortune for their clients. A simple look back to last year was the writing on the wall that PIMCO missed in their faulty Treasury short.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.