U.S. Home Construction Advanced in June, But Inadequate to Declare the Housing Market Recovery is Here

Housing-Market / US Housing Jul 20, 2011 - 03:26 AM GMTBy: Asha_Bangalore

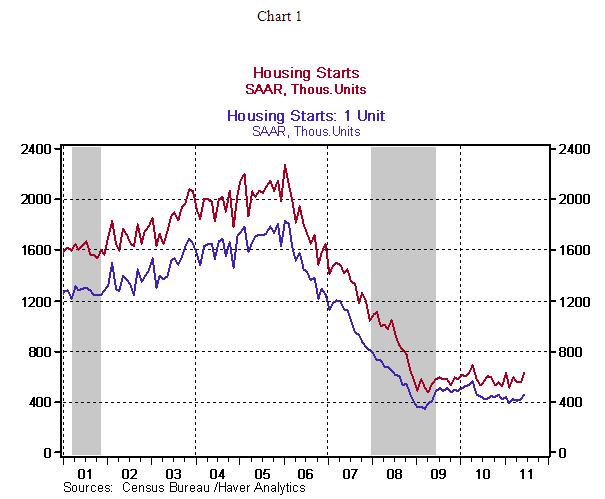

Housing starts rose 14.6% to an annual rate of 629,000 in June, the first increase since March. Construction of single-family units moved up 9.4% to annual rate of 453,000 in June, the highest level since October 2010. These improvements in home building activity are a positive development but the level of total housing starts is about 72% below the peak registered in January 2006 (2.273 million units).

Housing starts rose 14.6% to an annual rate of 629,000 in June, the first increase since March. Construction of single-family units moved up 9.4% to annual rate of 453,000 in June, the highest level since October 2010. These improvements in home building activity are a positive development but the level of total housing starts is about 72% below the peak registered in January 2006 (2.273 million units).

However, housing starts in the second quarter fell at an annual rate of 4.5% to 576,000 vs. a 582,000 mark in the first quarter. On a regional basis, the Northeast (+35.1%) posted the largest gain of housing starts, while the Midwest (+25.3%), South (+10.6%) and West (+5.4%) posted relatively smaller increases. The downside of an increase in supply of new homes is a further reduction of home prices if firms fail to increase payrolls.

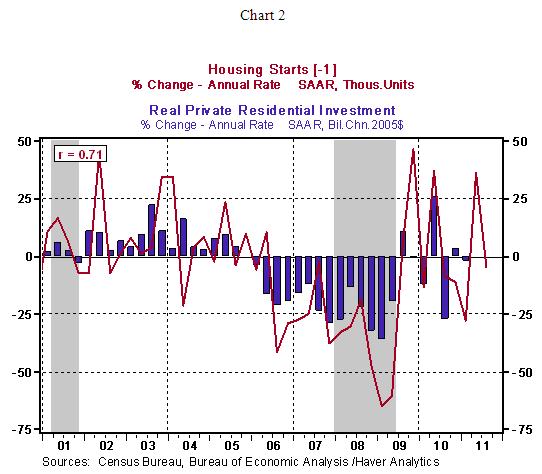

The annualized change in housing starts advanced one quarter has a strong positive correlation with residential investment expenditures (see Chart 2). Based on this relationship, the 36% jump in housing building activity in the first quarter should translate into an increase in residential investment expenditures in the second quarter, while the 4.5% decline recorded in the second quarter would imply a drop in the residential investment expenditure component in the third quarter.

Residential investment expenditures fell at an annual rate of 2.0% in the first quarter.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.