U.S. Housing Market Few Positives Remain Inadequate

Housing-Market / US Housing Jun 30, 2011 - 04:29 AM GMTBy: Asha_Bangalore

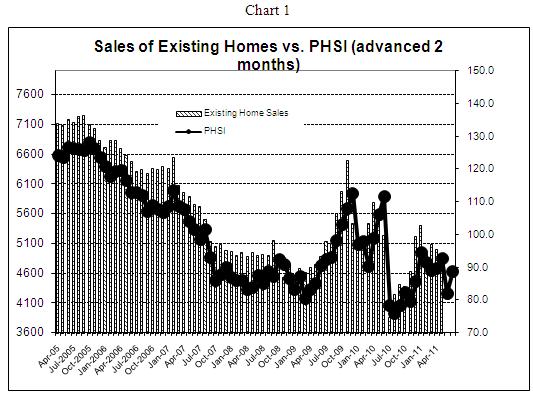

The National Association of Realtors reported an 8.2% jump of the Pending Home Sales Index (PHSI) in May to 88.8. The PHSI when advanced by two months tracks sales of existing homes closely (see Chart 1).

The National Association of Realtors reported an 8.2% jump of the Pending Home Sales Index (PHSI) in May to 88.8. The PHSI when advanced by two months tracks sales of existing homes closely (see Chart 1).

The PHSI of May has risen for the first time from a year ago since April 2010. On a regional basis, the PHSI rose in the Northeast, Midwest, and West but dropped in the South. Is the increase of the PHSI a sign that underlying fundamentals are changing in the housing market? The answer is that negatives of the housing market continue to outweigh the positives.

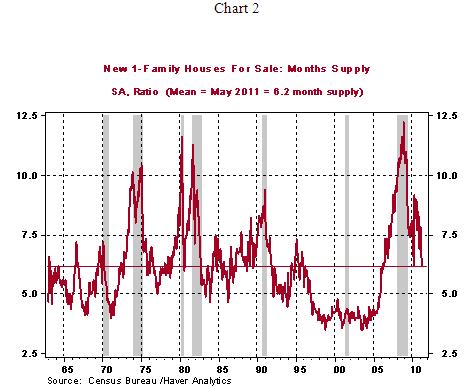

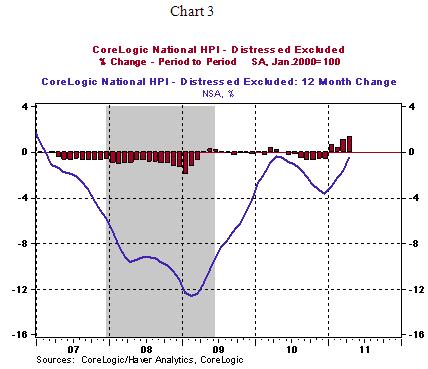

On the positive side, in addition to the increase of the May PHSI, the inventory-sales ratio of unsold new homes matches the long-term average now (see Chart 2), the home price index of non-distressed properties have posted four consecutive monthly gains (see Chart 3), and the year-to-year change in prices of non-distressed properties is inching towards positive territory (see Chart 3).

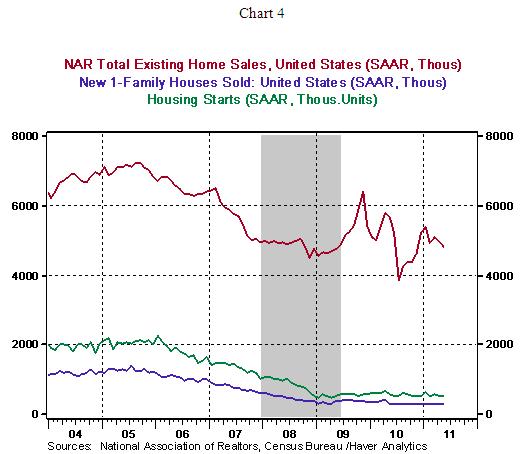

On the negative side, the level of homes sales and starts continue to move around recession lows (Chart 4) after two years of economic recovery and foreclosures made up 31% of sales of existing homes during May, down from 37% in April and unchanged from a year ago.

More than one month's pickup of the PHSI is necessary to restore stability in the housing sector but a few positive signs remain encouraging.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.