U.S. Existing Home Sales Decline, Housing Market Slump Continues

Housing-Market / US Housing Jun 22, 2011 - 03:55 AM GMTBy: Asha_Bangalore

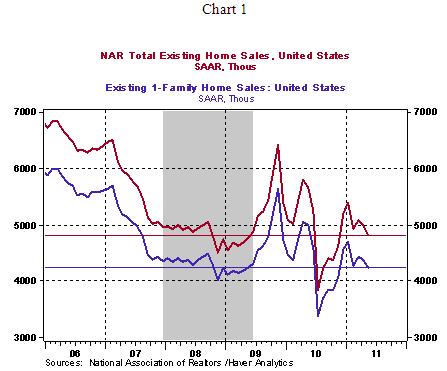

Sales of existing homes fell 3.8% to an annual rate of 4.81 million units in May, the lowest level since November 2010. As shown in Chart 1, the sales mark of existing home sales remains close to recession lows after two years of an economic recovery. On a regional basis, sales of existing homes fell in the Northeast (-2.5%), Midwest (-6.4%), and South (-5.1%) but held steady in the West.

Sales of existing homes fell 3.8% to an annual rate of 4.81 million units in May, the lowest level since November 2010. As shown in Chart 1, the sales mark of existing home sales remains close to recession lows after two years of an economic recovery. On a regional basis, sales of existing homes fell in the Northeast (-2.5%), Midwest (-6.4%), and South (-5.1%) but held steady in the West.

Essentially, the continued slump in the housing market leaves policymakers in a tight spot about how to correct this worrisome situation. Mortgage underwriting standards need to be more customer friendly, labor market conditions need to improve, and the excess supply of unsold homes has to shrink for stability of the housing market.

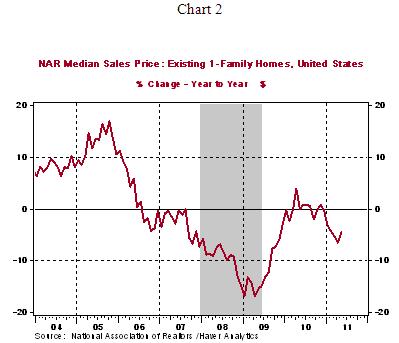

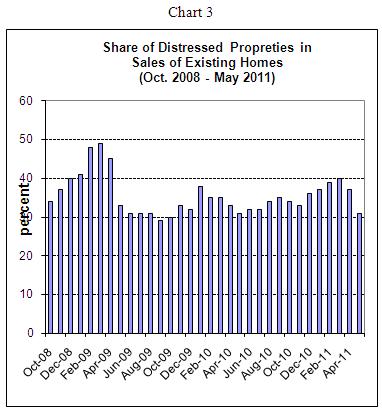

The median price of an existing single-family home at $166,700 has declined 4.5% from a year ago. The large inventory of unsold existing homes (9.3-month supply in May vs. 9.0-month mark in April) and existence of foreclosed properties (31% of homes sold in May vs. 37%, see Chart 3) continue to hold down prices of homes.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.