Case Shiller Home Price Index Confirms U.S. Housing Market Concern

Housing-Market / US Housing Jun 01, 2011 - 03:05 AM GMTBy: Asha_Bangalore

The seasonally adjusted Case-Shiller Home Price Index of 20 metro areas slipped 0.2% in March. This is the ninth consecutive monthly decline after the index posted gains in the second-half of 2009 and first-half of 2010. The temporary gain of the Case-Shiller Home Price Index was largely due to the first-time home buyer program which expired in April 2010.

The seasonally adjusted Case-Shiller Home Price Index of 20 metro areas slipped 0.2% in March. This is the ninth consecutive monthly decline after the index posted gains in the second-half of 2009 and first-half of 2010. The temporary gain of the Case-Shiller Home Price Index was largely due to the first-time home buyer program which expired in April 2010.

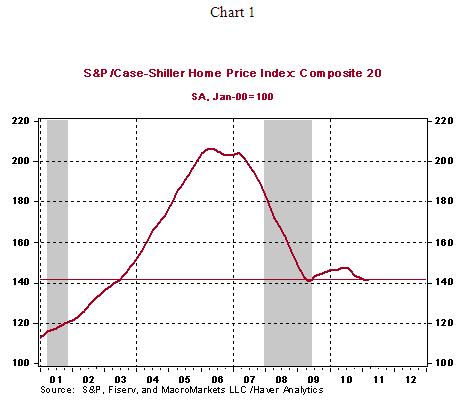

The level of the home price index is the lowest since June 2003, excluding the cycle low seen in May 2009 (see Chart 1). The Case-Shiller Home Price index has dropped nearly 32% from the peak in April 2006.

Currently, the 30-year mortgage rate is at a level that is comparable to what prevailed when the first-time home buyer credit program was in place (see Chart 2) and was last quoted at 4.61%.

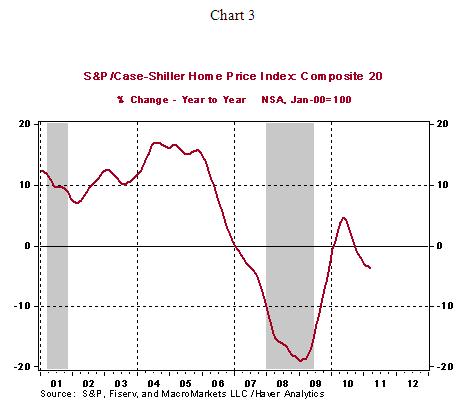

Although the seasonally adjusted home price indexes of seven metro areas (Los Angeles, Miami, San Francisco, Seattle, Tampa, Phoenix and Washington) posted increases in March compared with February, only Washington posted a month-to-month and year-to-year gain in March of the 20-metro areas. The composite index fell 3.6% from a year ago (see Chart 3).

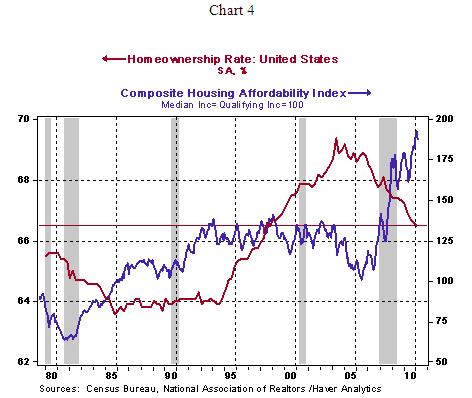

Home prices and mortgage rates are attractive but soft labor market conditions have held back the pace of home sales. The homeownership rate has fallen to 66.5%, the lowest since fourth quarter of 1998 even as the Housing Affordability Index is close to the historical high (see Chart 4). The main message is that the housing market hangover persists and continues to generate serious concern.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.