Rebound of New U.S. Home Sales is Impressive, But Level Remains Close to Record Low

Housing-Market / US Housing May 25, 2011 - 09:33 AM GMTBy: Asha_Bangalore

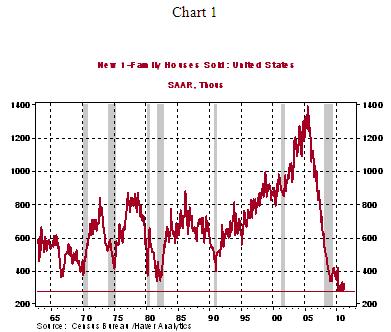

Sales of new single-family homes rose 7.3% to an annual rate of 323,000 in April after an 8.3% increase in March. The record low sales mark of new single-family homes is 278,000 seen in August 2010 (see Chart 1). Essentially, sales of new homes continue to bounce around the record low reading after seven quarters of economic growth.

Sales of new single-family homes rose 7.3% to an annual rate of 323,000 in April after an 8.3% increase in March. The record low sales mark of new single-family homes is 278,000 seen in August 2010 (see Chart 1). Essentially, sales of new homes continue to bounce around the record low reading after seven quarters of economic growth.

Sales of new homes increased across all regions of the nation, with the West posting the largest gain (+15.0%) and the South the smallest increase (+4.4%), while the sales performance in the Midwest (+4.9%) and Northeast (+7.7%) was moderate.

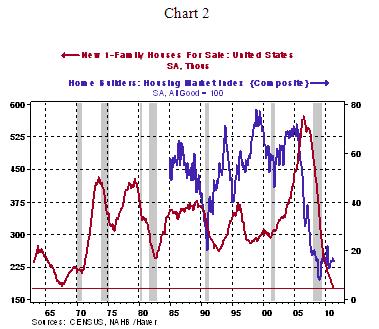

The number of homes for sale in April at 175,000 hit a new all-time low (see Chart 2), which is encouraging for home building activity. But, the home builders survey continues to send pessimistic signals.

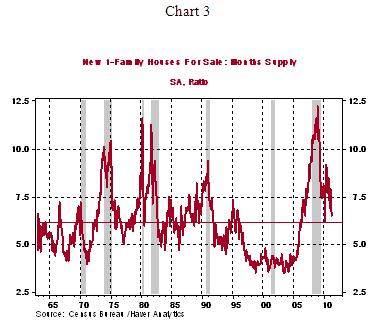

The inventory of unsold new homes fell to a 6.5-month supply in April, which is close to the historical mean of 6.3 months. The median price of new single-family homes rose to $127,900 in April from $214,500 in March and posted a 4.6% increase from a year ago.

The April report of new home sales shows an improvement in terms of higher median price, lower inventory of unsold homes, and an increase in sales. However, a near term sustained increase in home sales is unlikely until a sustained drop of the employment rate emerges.

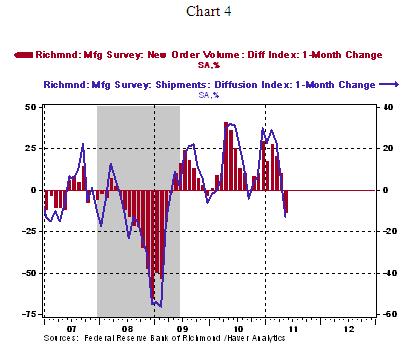

In other economic news, the Richmond Fed factory survey paints slowing conditions in the region much like the Philadelphia Fed survey indicated on May 19. The composite index and measures tracking new orders and shipments declined in May (see Chart 4). The national factory survey will be published on June 1, which will help sort out if the factory sector has indeed shifted gears. The composite index of the ISM manufacturing survey fell to 60.4 in April from 61.2 in March. A decline of the ISM manufacturing composite index in May would mark the third consecutive monthly decline.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.