US and UK Housing Market Outlook

Housing-Market / US Housing May 17, 2011 - 06:49 AM GMTBy: John_Hampson

House prices globally tend to follow cycles lasting around 16 years: patterns of 12 years of rises followed by 4 years of declines (at a steeper rate than the rises). With US house prices having peaked in 2006 and UK house prices 2007, cycles suggest a new bull market should now emerge. So do historical measures support this?

House prices globally tend to follow cycles lasting around 16 years: patterns of 12 years of rises followed by 4 years of declines (at a steeper rate than the rises). With US house prices having peaked in 2006 and UK house prices 2007, cycles suggest a new bull market should now emerge. So do historical measures support this?

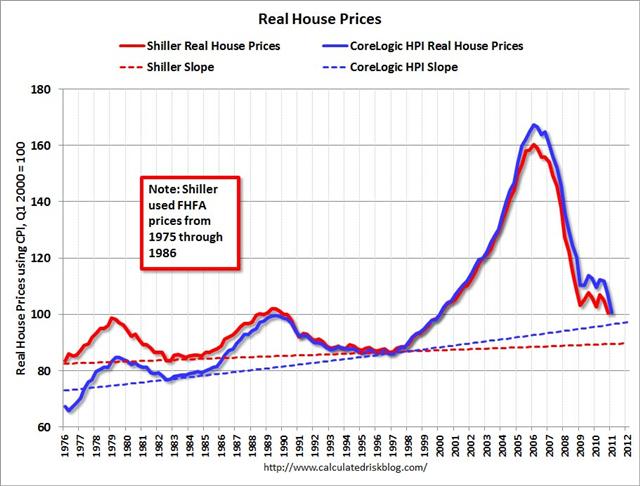

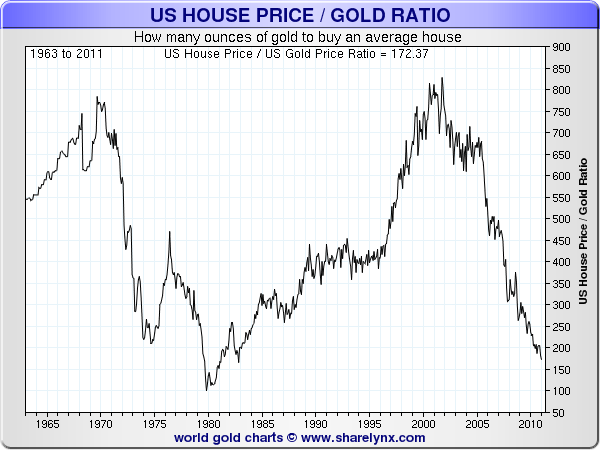

Let's look at US real house prices regression to trend and relative to gold:

Source: Calculatedriskblog.com

Source: Sharelynx.com

By both measures a bottom looks close. Now let's do the same for UK housing:

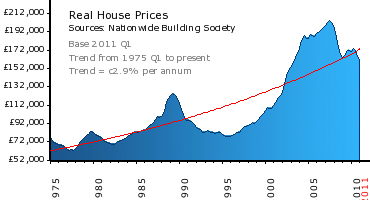

Source: Nationwide

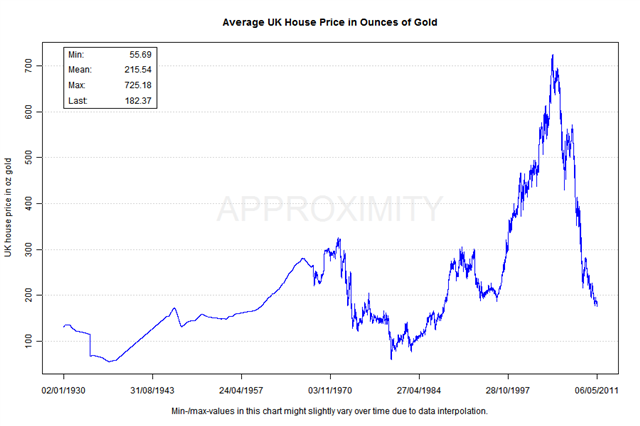

Source: Approximity

Again getting towards a bottom but not as close as in the US, and that fits with housing in the UK having peaked a lttle later.

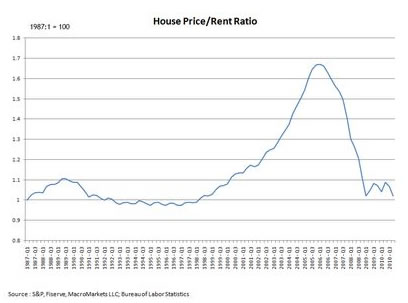

Looking at other indicators such as median income to median home price, cost of renting versus cost of ownership, and housing value as a percentage of GDP, we see a similar picture of getting back towards reasonable value.

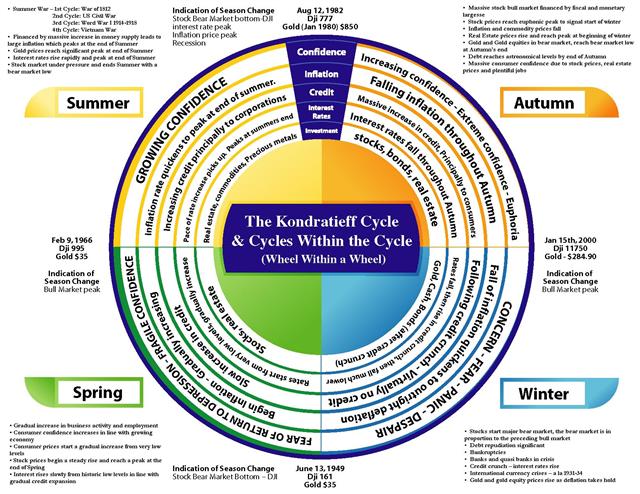

US House Price / Rent Ratio 1987-2011 - Source: Dave Altig

But note that real estate bottoms tend to be rounded. A gradual basing is made and a slow acceleration of prices in a new cyclical bull market gradually gathers pace. I expect US housing to bottom in 2011 and UK housing in 2012 but for the basing period to last until the other side of the next recession, which I forecast to be 2013-2014. After that we will enter a Kondratieff Spring phase in which real estate enters a bull market and stocks begin a secular bull market, and the two asset classes compete in popularity.

Source: The Long Wave Group

In summary I believe we are close to a real estate bottom, but given that the basing phase usually lasts a couple of years or more, it is not yet desirable as an investment. My strategy is to pursue the commodities secular bull into my projected conclusion of 2013, then to look to reinvest into real estate (and stocks) after that.

John Hampson

John Hampson, UK / Self-taught full-time trading at the global macro level / Future Studies

www.amalgamator.co.uk / Forecasting By Amalgamation.

© 2011 Copyright John Hampson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.