U.S. Housing Market is Still Sick

Housing-Market / US Housing May 17, 2011 - 06:43 AM GMTBy: John_Mauldin

Everyone is curious about the state of housing in the US. My friend Gary Shilling recently did a lengthy issue on housing as it is today. I asked him to give us a shorter version for Outside the Box, and he graciously did. And you want to know what Gary thinks, because he is one of the guys who really got it right early, from subprime to the bubble and the price collapse, and has been right all along. No one is better. This very readable edition is full of charts and fast reasoning.

Everyone is curious about the state of housing in the US. My friend Gary Shilling recently did a lengthy issue on housing as it is today. I asked him to give us a shorter version for Outside the Box, and he graciously did. And you want to know what Gary thinks, because he is one of the guys who really got it right early, from subprime to the bubble and the price collapse, and has been right all along. No one is better. This very readable edition is full of charts and fast reasoning.

The quid pro quo for getting him to give us something that is normally behind a velvet rope is that I put a link in to let you subscribe to his wonderful monthly letter. He really is one of the better analysts out there. He has spoken at my conference the last two years and is one of our highest-rated speakers.

You can subscribe and mention the OTB and get 13 issues for the price of 12, plus Gary’s January 2011 report laying out his investment strategies for the year. $275 is the price via e-mail. Call them at 1-888-346-7444 or e-mail insight@agaryshilling.com .

And for those in the Dallas area, it is now my intention to meet some friends at the Zaza after the Tuesday night Mavericks-Thunder game, so drop on by.

Your living the internet-driven life analyst,

John Mauldin, Editor

Outside the Box

Still Home Sick

(Excerpted from the May 2011 edition of A. Gary Shilling's INSIGHT)

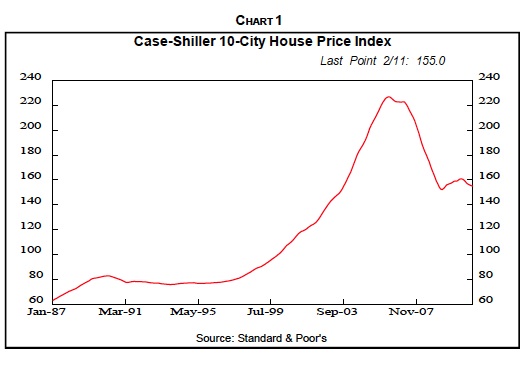

All may be well. That’s what many housing optimists proclaimed a year ago when prices appeared to have stabilized, indeed, started to recover from their collapse (Chart 1). As Insight readers are well aware, we emphatically disagreed. We pointed out that the earlier extremes in the housing market made rapid revival—or any revival for that matter—extremely difficult. In the earlier salad days, housing was propelled by low mortgage rates, lax or nonexistent underwriting standards, securitization of mortgages that passed seemingly creditworthy and highly-rated but really toxic assets on the unsuspecting buyers, laissez-faire regulation, and most of all, almost universal conviction that house prices never fall on a nationwide basis—which they hadn’t since the 1930s.

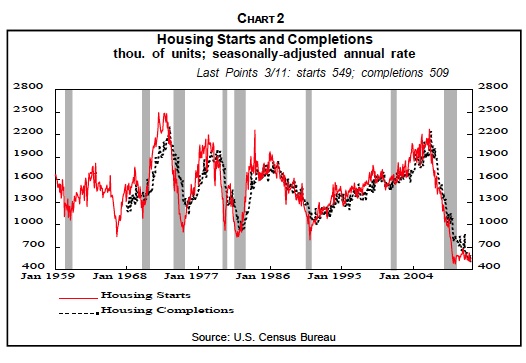

But housing activity remains at post- World War II lows (Chart 2).

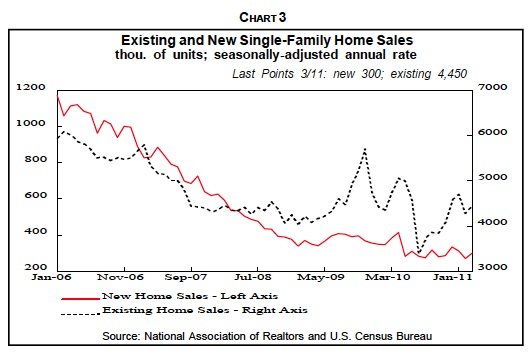

The Administration's Home Affordable Modification Program (HAMP) was a bust. Tightening lending standards, the renewed decline in house prices, fears of job loss as unemployment remains high and the drying up of mortgage securitization have handily offset the positive effects of low mortgage rates and new homeowner tax credits. Indeed, the jumps in home sales in anticipation of the tax credit expiration first in November 2009 and then in April 2010 were promptly retraced and followed by still-weaker sales (Chart 3).

Mortal Enemy

Most of all, in making the case for continuing housing weakness, we’ve continually hammered home the ongoing negative effect of excess inventories on house sales, prices, new construction and just about every other aspect of residential real estate. In housing, as in every goods-producing sector, excess inventories are the mortal enemy of prices. It’s that simple. Lower prices are needed to unload surplus inventory, but in turn lower prices bring forth more inventory from anxious sellers. And the anxiousness of house sellers and reluctance of buyers is enhanced by the realization that house prices can fall, and are falling for the first time in 70 years.

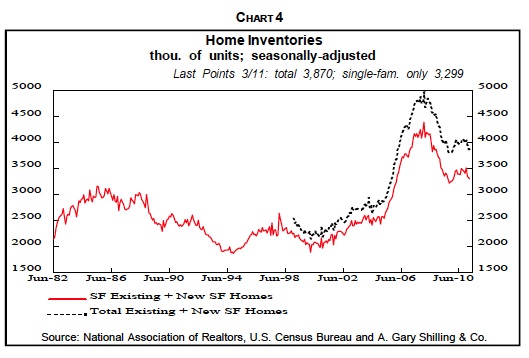

Just how big are excess house inventories and how long will it take to absorb them? As discussed in many past Insights, we measure excess house inventories by the excess over the earlier trendless norm of about 2.5 million (Chart 4). We consider 2.5 million to be the normal working level for total existing units and new single-family houses (new multi-family inventories are not reported). Notice that this flat pattern, except for the recent extreme volatility, matches the equal trendless patterns of housing starts and completions over time. Note also that total inventories jumped to 5 million as housing collapsed, and still equals 4 million, or 1.5 million over and above the norm.

Hidden House Inventory

But wait! There’s more! The Census Bureau, in its estimate of housing inventory, lists a category called “Held off the market for other reasons”— very descriptive! This category leaped by over 1 million between the first quarter of 2006 and the first quarter of this year. It includes unspecified numbers of houses that have been foreclosed but not yet sold and units that people want to sell—first or second homes—but have not listed due to current market conditions. Of course, if those in foreclosed houses and those who want to sell finally do so and move into other abodes, they’re still occupying housing units and total inventories don’t change. But if they’re unloading extra and vacant houses or doubling up with family and friends, additional excess inventories are created. Many are now beginning to give up hope of higher prices as they continue to fall and throwing their houses on the market for whatever they will bring.

How Long?

Our total estimate of 2 million to 2.5 million excess house inventories, then, may well rise with further foreclosures that will be spurred by falling prices. This surplus is already huge since in the long run the U.S. builds about 1.5 million houses per year (Chart 2). To forecast the length of time to work off this excess inventory, we need to project supply and demand for residential units. New conventional construction of single-family house and apartment units plus manufactured home shipments is running about 700 thousand at annual rates. There’s no reason to expect this rate to change in the next few years, given falling prices excess inventories and other constraining factors. About 300,000 of these units are offset each year by dilapidated houses that are torn down, houses converted to nonresidential purposes and other factors that remove them from the housing stock. So the net supply will probably continue to average about 400,000 annually.

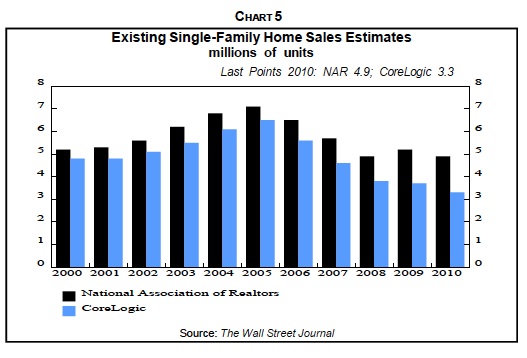

On the demand side, house sales data, especially existing house sales reported by the National Association of Realtors, appear to be overstated. Well, what did you expect? Did you ever meet a residential realtor who isn’t wildly optimistic about house sales and prices? The NAR uses models to expand its actual survey to national total sales numbers. With the collapse in housing activity, many of the multi-listing services that trade group samples have consolidation so the sales of those remaining expanded because their area of coverage has grown. Since the NAR doesn't correct for this, the sales numbers are likely overstated. Also, the NAR doesn’t sample but estimates the share of sales by owners that don’t go through multi-listing services. That segment of the market collapsed with the housing bust but the NAR has not subsequently adjusted its estimates downward.

In contrast, CoreLogic measures sales by checking property transfer records at local court houses and reports that its data covers about 85% of all house sales. Its numbers are consistently lower than the NAR numbers (Chart 5). In 2010, NAR reported 4.9 million in sales, down 5.7% from 5.2 million in 2009. But CoreLogic recorded only 3.3 million in 2010, a drop of 10.8% from 3.7 million in 2009. So the NAR data may overstate home sales by a third.

If so, and if house inventory data reported by the NAR are correct, it will take much longer to unload excess inventories at current sales rates. In March, NAR reported inventories of existing houses would take 8.4 months to sell at the trade group’s reported sales rate. That’s down from 12.5 months in July of last year but still almost about twice the level of healthy markets. And if NAR sales data are overstated by a third, the month’s supply is still back in double digits.

Household Formation

Because of the NAR's likely overstatement of sales and for other reasons, we prefer to rely on household formation data gathered by the Census Bureau to forecast housing demand. Now, there’s a lot of misunderstanding about household formation numbers. Many assume that there is a one-to-one relationship between the growth in the population and the number of new households formed. With population growing around 1% per year, or by about 3 million, then with an average 2.77 people per household, 1.08 million new households will be formed, the reasoning goes. But the link between demographics and household formation is at best a very tenuous one, especially in a cyclical time frame.

In the 2001-2010 decade, household formation averaged 888.5 thousand per year. Since those years included boom and bust years, this average, about 900 thousand per year, seems like a reasonable, probably optimistic forecast for the years ahead, given the likely further fall in house prices, high unemployment and declining real incomes in the years ahead. So if demand is averaging 900 thousand per year while supply runs 400 thousand, about 500 thousand of the excess housing inventory will be absorbed per annum. Consequently, it will take four or five years to absorb the 2 million to 2.5 million housing units, over and above normal working inventory, that we believe exist at a minimum.

Prices Down Another 20%

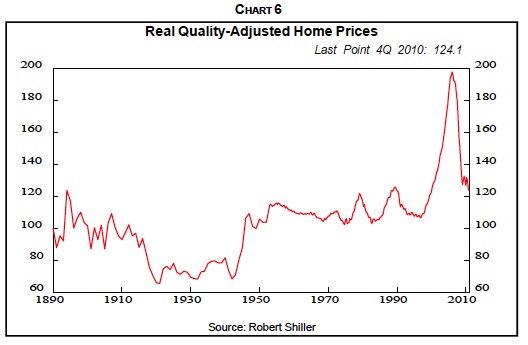

Four or five years is plenty of time for the inventory overhang to depress prices another 20% as we’ve been forecasting. Prices, after reviving somewhat with the new homeowner tax credit, are now essentially back to their April 2009 lows (Chart 1). Another 20% drop would bring the total decline from the peak in April 2006 to 45% and take them back to their longrun flat trend (Chart 6). In that graph, median single-family house prices are corrected for two types of inflation. The first is general inflation affecting all goods and services. The second is the tendency over time of houses to get bigger and, therefore, intrinsically more expensive. As living standards rise, people want more bathroom, fancier kitchens, etc. in their homes. A further 20% price drop may be an optimistic forecast since declines tend to overshoot on the downside just as bubbles expand to the stratosphere.

Other forecasters are coming into agreement with our forecast, dire as it is. The Dallas Federal Reserve Bank states that a 23% decline is needed to return house prices to their long-run trend. Prof. Robert Shiller of Yale says there is a “substantial risk” of another 15% or 20% decline in house prices. The NAR’s March survey of members revealed that 42% of everoptimistic realtors expect home prices in their areas to fall in the next 12 months. Starting last year, Shiller’s firm, Macro Markets LLC, asked us and 110 other housing experts to forecast house prices over the next five years. Since that survey commenced, we have consistently forecast a 20% cumulative decline for 2011-2013, with an 11% drop this year. Last June, the average forecast was a 1.3% price rise this year, but the last survey in early March reported a 1.4% drop.

There are other reasons to expect house prices to fall sharply in coming quarters. Now that the moratoria while mortgage modifications were attempted and during the robo-signing flap are over, foreclosures are likely to resume in earnest. And, as noted earlier, lenders and servicers tend to dump foreclosed houses on the market for quick sales, regardless of prices. These fire-sale prices put more homeowners under water and lead to more foreclosures, but they do attract investors looking for cheap houses who often pay all cash.

Cash-Ins

Many underwater homeowners, of course, still are committed to service their financial obligations, or want to stay in their abodes. Some are even doing cash-in refinancing, the reverse of the cash-outs of yesteryear, and contributing money from other sources to reduce their mortgage balances. A total of $1.1 trillion was withdrawn in 2006 and 2007, and at the peak of the housing bubble in 2006, cash-outs ran $80 billion per quarter and accounted for 90% of refinancings. By the fourth quarter of 2010, however, cash-outs dropped to 16% of refinancings and cash-ins jumped to 33%.

Homeowner deleveraging through cash-ins reduces the vulnerability to further house price declines, but they also reduce the funds available for other investments and current spending. So, too, do the higher downpayments lenders are requiring on house purchases, which also freeze out many potential buyers and otherwise discourage home ownership. Regulators are proposing 20% downpayments for high-quality new mortgages underwritten by private lenders, and Wells Fargo, the country’s largest mortgage lender, has suggested 30%.

For these loans, borrowers will also need to maintain 75% loans-to-market value ratios, 75% for refinancings and 70% for cash-out refinancings. Borrowers can't have missed two consecutive payments on any consumer debt within two years. Mortgage-related debt payments can be no more than 28% of income and total debt service can't exceed 36% of income. And mortgage loans must be fully amortizing—no interest-only borrowing. According to CoreLogic, 46% of all mortgagors at the end of 2010 had less than 20% equity in their homes.

Mortgages that don’t meet these standards will be subject to 5% retention by the original lender if they are sold to others or securitized. In other words, regulators intend to end the days when subprime mortgages were packaged as securities by the original lender and sold with no further recourse. Buy them, securitize them, sell off the securitized tranches and forget them was the strategy.

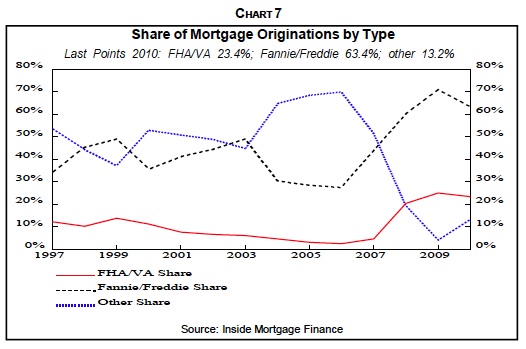

In fact, median downpayments on conventional mortgages already were 22% last year in nine major U.S. cities, according to an analysis by Zillow.com, up from 4% in the fourth quarter of 2006. Those cities are Chicago, Stockton, Calif., Las Vegas, Los Angeles, Miami-Fort Lauderdale, Phoenix, San Diego, San Francisco and Tampa. To be sure, private lenders are now making very few mortgages, with most initiated by Government-Sponsored Enterprises (Chart 7). The Federal Housing Administration, which required only 3.5% up front, accounted for 23.4% of residential mortgages last year. In contrast, in 1950, the median downpayment for FHA first mortgages was 35%, for Veterans Administration first mortgages, 8%, and 35% for non-government conventional first mortgages. Underwriting standards have tightened, but are still loose by those earlier standards.

The elimination of home equity for most mortgages will no doubt have severe detrimental effects on consumer sentiment and spending. It also will magnify the mortgage delinquencies and defaults, and severely depress the value of existing mortgages and derivatives backed by them In recent quarters, banks have booked profits as they reduced their reserves against potential loan losses, but that process will be dramatically reversed. And it goes without saying that mortgage lenders and servicers will severely tighten their mortgage underwriting standards with a further 20% drop in house prices. The top 10 mortgage servicers account for the majority of the market and include the nation’s largest banks.

Needless to say, another big decline in house prices almost guarantees another recession because of its financial impact. At the same time, further declines in residential construction won't matter much to the overall economy. It was 6.3% of GDP at its peak in the fourth quarter of 2005, but plummeted to a mere 2.2% in the first quarter of this year.

No Help to the Economy

Conversely, we don't look for any revival of homebuilding in the years ahead that will boost the economy. The housing collapse prevented residential construction from serving its usual role in spurring economic recovery from the recession. Rather than contribute meaningfully, residential construction actually declined in the first seven quarters of recovery. The ongoing housing crisis will probably continue to trouble financial markets, depress consumer spending and keep residential construction depressed for years.

Keep ‘Em Out – Or In?

From a regulator standpoint, tighter controls will continue to discourage homeownership. The Dodd-Frank financial overhaul law requires banks to retain 5% of the credit risks on lower-quality residential mortgages that are securitized and sold to others. These new rules will obviously discourage mortgage loans to all but the most creditworthy borrowers. Also, since Fannie Mae and Freddie Mac are backed by the U.S. government, they are exempt from the retention rules, which therefore will drive mortgage loans to these Government-Sponsored Enterprises. Still, their fates are uncertain.

Government attitudes toward homeownership also appear to have shifted with the housing collapse. On Oct. 15, 2002, when the housing boom was inflating, President George W. Bush said at the White House Conference on Increasing Minority Homeownership, “We want everybody in America to own their own home. That’s what we want…An ownership society is a compassionate society.”

In contrast, in February 2011, the white paper released by the Treasury Department and Department of Housing and Urban Development, which addressed the future of Fannie and Freddie, also stated that homeownership isn’t for every American. “The Administration believes that we must continue to take the necessary steps to ensure that Americans have access to an adequate range of affordable housing options. This does not mean, however, that our goal is for all Americans to become homeowners. Instead, we should make sure that all Americans who have the credit history, financial capacity, and desire to own a home have the opportunity to take that step. At the same time, we should ensure that there are a range of affordable options for the 100 million Americans who rent, whether they do so by choice or necessity.”

“Become Renters Again”

The statement echoes the muchmaligned comments by then-Treasury Secretary Henry Paulson of the Bush Administration in the midst of the housing collapse. He said in a December 2007 online Q&A session: “And let me be clear—we will not avoid all foreclosures. Borrowers who are struggling even with the lower initial ARM rate are unlikely to be eligible for assistance, and likely will become renters again.”

Furthermore, Congressional Republicans are proposing the end of tax deductibility of mortgage interest, which would further reduce the appeal of owning abodes. This is the largest of the “tax expenditures” and will cost the federal government $600 billion from 2009 to 2013, according to the Congressional Joint Committee on Taxation. Whether this tax break aids homeowners is questionable, however. In the European Union, where mortgage interest is not tax deductible, the homeownership rate is 75% compared with the earlier U.S. peak of 69%. Furthermore, lack of mortgage interest deductibility may encourage homeowners to pay off their loans faster, and avoid that false assumption that owning an abode is cheaper than renting.

At the same time, homeownership continues to be very political powerful, and many recent government actions can certainly be viewed as an unstated attempt to keep people in their homes, even those who clearly can't afford to own them. The reality that many foreclosures have tossed homeowners out is powerful not only to those affected directly, but also to many others in and out of Washington. Our friend and superb housing analyst Tom Lawler has taken a hard look at the numbers and worked his way through the many assumptions needed to determine the number of homeowners who lost their homes to foreclosure last year. He concludes it was about 1 million. Tom goes on to point out that many others have really lost their homes but not technically since foreclosures are not yet completed. These "owners" may still be living in those houses— rent-free, by the way!

There’s also sympathy for the many who, despite concerted efforts, have been unable to reduce their mortgage and other debts such as auto, student and credit card loans. Their total debt in relation to disposable personal income (after-tax income) peaked in the third quarter of 2007 at 131%. Debt itself peaked three quarters later in the second quarter of 2008. From then through the fourth quarter of 2010, mortgage debt dropped $517.9 billion and consumer (other) debt has fallen $174.6 billion for a total decline of $691.5 billion.

No Debt Repayment

But in those same 10 quarters, $542.2 billion in mortgage debt was charged off and $333.8 billion in consumer debt for an $875.9 billion total. As shown in the last three columns, after accounting for charge-offs, mortgage debt actually rose a bit, $24.2 billion to $10 trillion, consumer debt climbed $159.2 billion to $2.4 trillion and the total rose $183.4 billion to $12.4 trillion. The rise in mortgage debt ex charge-offs is so small that it’s merely a rounding error, but it’s surprising that it didn’t fall significantly. Perhaps financially stressed homeowners who didn’t lose their homes to foreclosure have not been able to reduce their mortgage debt.

To encourage home-buying, Washington enacted tax credits for new homeowners, which initially expired in November 2009 and then was renewed until April 2010. HAMP’s goal is to stave off foreclosures for underwater homeowners by making their mortgage payments more affordable. The government essentially told major mortgage lenders and servicers to forestall foreclosures while HAMP modifications were being attempted. More recently, 14 large financial institutions have been ordered by regulators to revise their mortgage servicing practices to encourage more successful modifications and speed up foreclosures. Those 14 have until mid-June to establish their plans and then 60 days to implement them.

Among other things, the mortgage servicers will be required to have a single point of contact for borrowers to avoid their being bounced from one servicer employee to another and getting lost in the shuffle. They also must set “appropriate deadlines” for deciding whether borrowers can qualify for a loan workout, and have enough staff to deal with the multitude of troubled mortgages. The goal is to get servicers to contact borrowers earlier and more frequently after one missed payment in order to have a better chance of modifying troubled loans.

Fannie and Freddie

The U.S. Treasury-HUD white paper cited earlier indicates that the Administration, like many other Democrats as well as Republicans, wants a significantly smaller role for government in housing finance, including a “winding down” of Fannie and Freddie and a smaller role for the FHA. House Republicans want Fannie and Freddie eliminated and only the FHA left as a source of federal backing. Currently, federal agencies including Fannie and Freddie guarantee 87% of new mortgages.

As discussed in our new book, The Age of Deleveraging, back in mid-2008, many FDIC-insured institutions were heavily leveraged but still had an average capital-to-asset ratio of 7.9%. In contrast, Freddie and Fannie had less than 2%, so for each buck of capital, they owned or guaranteed $50 in mortgages. Lobbyists from the two convinced Congress that they didn’t need more capital since defaults would be tiny as house prices rose forever. But when the housing sector nosedived, Fannie and Freddie’s houses of cards fell apart. So in September 2008, both were seized by the government in a legal structure called conservatorship. They are regulated, indeed controlled, by the Federal Housing Finance Agency. Initially, each had up to $200 billion backing from the Treasury, but it later was made open-ended through 2012.

Washington regarded Freddie and Fannie as part of the government. Assistant Treasury Secretary Michael Barr said that because they are “owned by the taxpayers in the biggest housing crisis in 80 years, it is logical that they be used to stabilize the housing market.” But since the two technically remain private corporations, their finances remain off the federal budget and their huge prospective losses from sour mortgages don’t need to be counted in the federal deficit. It’s ironic that the government is using Fannie and Freddie as the biggest off-balance-sheet financing vehicles in the economy at the same time it blasted banks for using off-balance-sheet entities in earlier years.

Also, by using these GSEs to support housing, with an open credit line to the Treasury, the Administration doesn’t have to approach Congress for funding bit by bit. The Treasury simply injects enough money, quarter by quarter, to cover their losses. As of Feb. 25, 2011, that was $153 billion for the pair, and the Congressional Budget Office estimates the losses through 2020 at almost $400 billion. Treasury Secretary Timothy Geithner in March 2010 said, “There is a quite strong economic case, quite strong public policy case for preserving, designing some form of guarantee by the government to help facilitate a stable housing finance market,” even after Fannie and Freddie are restructured or unwound.

More Private Capital

Nevertheless, the February 2011 white paper advocated a number of short-term measures to attract private capital into the mortgage market—with higher costs for house financing and its detrimental effects on home ownership. These include allowing the maximum loan limits to fall to $625,000 from $729,750 as scheduled on October 1, increasing downpayments on Fannie and Freddie guaranteed loans to 10%, and increasing FHA insurance premiums, which subsequently was announced to rise by 0.25 percentage points on 30- and 15-year loans to 1.15% on low downpayment loans.

The Administration believes that given the fragile state of the housing sector, it will take at least five to seven years to move to a longer term structure of housing finance. It offered in the white paper—but did not discuss in detail—three options, which no doubt will be hotly debated going into the 2012 elections.

The first is a privatized system with Fannie and Freddie eliminated. Their $1.5 trillion combined mortgage portfolio, out of the $10 trillion mortgage market, is already set to fall 10% per year. Government financial support would be confined to FHA and VA loans, which accounted for 23% of mortgages last year, targeted to help narrow borrower groups. Private lenders would originate and securitize mortgages without government guarantees. Interestingly, small banks oppose this option because they believe it would concentrate the business in the hands of large lenders, much to their detriment.

The second option would create a mostly private mortgage market as well as FHA/VA involvement, with a government “backstop mechanism to insure access to credit during a housing crisis.” Option three involves a privatized market as well as FHA-VA participation. New, privately-owned companies would buy mortgages from lenders and securitize them. Those securities would be guaranteed by the government as long as they met standards. These new private entities would essentially replace Fannie and Freddie.

Regardless of how government legislation and regulation unfold, the nation’s zeal for homeownership may be weakening outside as well as inside Washington. Homeowners have learned the hard way that for the first time since 1930s, house prices nationwide can and do fall. Zeal for a sound home financing system involves measures that discourage homeownership. And the likely leap in the percentage of renters and falling portion who own their abodes will reduce the power of homeownership advocates.

More Renters

Homeownership is falling, as the earlier boom and quick route to riches in a loose-lending environment has been replaced with collapsing prices, tight underwriting requirements, more regulation and horror stories of huge homeowner equity losses. As homeownership slides, the flip side, the renter population grows. Of course, many former and current homeowners are really renters with an option on their house's price appreciation. They put little if anything down and planned to refinance with cash-out before their mortgage rates reset upward or, in some cases, even before they skipped enough monthly payments to be foreclosed.

Homeownership bulls, naturally, argue that owning a house has never been cheaper. In calculating this index, the NAR assumes that a family with median income buys a median-priced single-family house with 20% down and financed at the current 30-year fixed mortgage rate. The collapse in house prices and decline in mortgage rates in recent years have more than offset the weakness in median family income that, according to the NAR, dropped from $63,366 in 2008 to $61,313 in 2010.

Nevertheless, comparisons between the current attractiveness of buying a home and that in the 1990s and early 2000s is like comparing an octopus to an ant. Back then, incomes were growing; now they’re weak. Unemployment rates were lower; now they’re high. House prices were rising as they had been since the 1930s; now they’re falling and even the stabilization last year has given way to renewed declines. Financing a mortgage was easy with little or nothing down and spotty credit; now it takes 20% or more in downpayments and sterling credit scores. Back then, the prospects of huge house price declines and massive foreclosures weren’t even the subject of horror films; now they’re the real, everyday reality.

Rents Still Cheaper

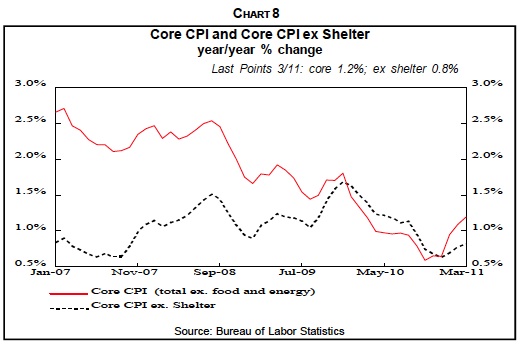

Despite the collapse in house prices, they are still expensive relative to rentals, even as apartment rental rates rise and vacancies decline. Those rent rises are having an interesting effect on the CPI. In the total index, 32% is weighted for shelter including 5.9% for the rental of primary residences. But an additional 24.9% is “owners’ equivalent rent of residences.” The idea is that homeowners rent their abodes from themselves at market rental rates. Of course they don’t, but this creates an odd situation where house prices are falling, but owners’equivalent rent is rising.

This, in effect, overstates the recent rise in the CPI. Chart 8 shows the year-over-year change in the core CPI, which excludes the volatile food and energy components, and the core excluding the shelter component, which is dominated by owners’ equivalent rent. That component is 32.3% of the core index and total shelter is 41.5%.

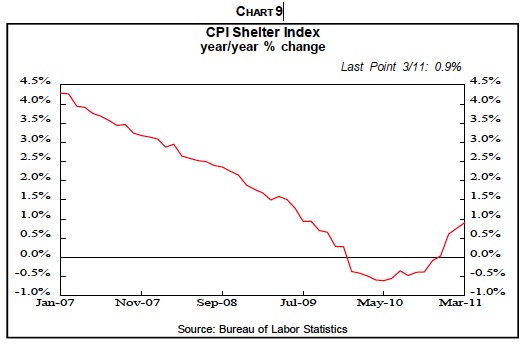

Notice that without shelter, the year-over-year core index rose 0.8%, or 0.4 percentage points less than the 1.2% rise in the total core. Back in 2007 and early 2008 before housing collapsed, owners’ equivalent rent was rising considerably faster than other prices in the core index, as shown by the gap in Chart 8 and in Chart 9. The fall in rent rates in 2008-2009 pushed the year-over-year change in shelter costs into negative territory.

The price index for personal consumption expenditures, which we and the Fed prefer to the CPI, also uses homeowners' equivalent rent, but only weights it at 15% of the total index and 17.5% of the core. Partly as a result of this lower weighting, the core index in March rose 0.9% from a year earlier compared to 1.2% for the core CPI.

Homeownership Downtrend

The fall in the homeownership rate has been swift, but probably understated. The overall rate in the first quarter, 66.4%, was down from the 69.2% peak in the fourth quarter of 2009 and was the same as in the fourth quarter of 1998. But Tom Lawler wrote on April 27 that “if the Q1/2011 homeownership rate by age group were‘correct,’ but the age distribution of households had been the same last quarter as it was in 1998, then the homeownership rate last quarter would have been 65.1%, or 1.4 percentage points lower than in 1998!”

In any event, continuing the rate of fall since its peak will bring the total homeownership rate back to its earlier base level of 64% in the fourth quarter of 2016 from 66.4% in the first quarter of this year. That's a return to trend. And we are strong believers in reversion to trend. Continuing the average annual growth in households over the last decade of 888.5 thousand increases the total number of households by 5.1 million from the first quarter to the fourth quarter of 2016. This is enough to increase the number of new homeowners by 608 thousand even with the drop in the homeownership rate to 64%.

But it also means the addition of 4.5 million new renters, or 782.7 thousand at annual rates. That’s a lot, but we’re not alone in this forecast. Greenstreet Advisors believes that a drop to 65% homeownership in the next five years will produce 4.5 million new rental households. Some of those people will no doubt rent cheap single-family houses, but most will probably be in rental apartments. In the longer run, only about 300 thousand multi-family units have been produced per year, or less than half our projected increase in renters. Apartment construction may again boom after the absorption of current vacancies pushes rental rates up enough to justify new building.

Our Theme

As we hope you’re well aware, we’ve been advocates of rental apartments as an investment theme for some time. It’s one of our long-term “buy” themes in The Age of Deleveraging. We also listed it as an investment strategy for 2011 in our Jan. 2011 Insight. In addition to all the reasons covered in his report, we noted in our January issue that rental apartments will benefit from the separation that Americans are beginning to make between their abodes and their investments. The two used to be combined in owner-occupied houses back when owners believed house prices never fall. So they bought the biggest homes they could finance. The collapse in house prices has shown them otherwise. Further weakness in the prices of singlefamily houses and condos due to the depressing effects of excess inventories (Chart 4) will add fat to the fire.

Contrary to general belief, a single-family house, excluding the effects of increasing size and general inflation, has been a flat investment for over a century (Chart 6). It does provide a place to live, but that value is offset, at least in part, by maintenance, taxes, utilities, real estate commissions and other costs. Furthermore, even with the tax deductibility of mortgage interest, renting a single-family house or apartment is cheaper than home ownership, absent price appreciation. Our repeated analyses over the years have shown this to be true, and even more so in the period of deflation we foresee when nominal house prices will probably fall on average.

Over time, houses have sold for about 15 times rental income. But that’s in the post–World War II years when owners of rental properties expected inflation to enhance their 6.7% return—before the costs of income tax–deductible maintenance and property taxes. When we were young and house price appreciation was not expected in the aftermath of the 1930s, the norm for rentals was 10% of the house’s value. If we’re right about our outlook for slow economic growth and falling house prices, houses and apartments may sell for closer to 10 times rentals than 15 times, much less the 20 times rental income in the housing boom days.

The separation of abodes from investments should work to the advantage of rentals in future years. We’re not suggesting that Americans will give up on single-family owneroccupied housing. The idea of a singlefamily home of your own is just too deeply embedded in the American culture. But many who have no pride of home ownership and who would vastly prefer to yell for the “super” (New York-ese for the building superintendent) than to apply a wrench to a leaky pipe have bought houses and apartments in past decades only to participate in capital appreciation.

The Old And The Young

They’ll be more inclined in future years to occupy rental apartments. This might be especially true of empty-nesters who don’t like to mow their lawns and who decide to unload their suburban money pits—especially because these homes are no longer appreciating rapidly but rather falling in price. At the front end of the life cycle, young couples may decide that because houses are no longer a great investment, there’s no reason to strain their financial, physical, and emotional resources to buy big, expensive houses as soon as possible. So they’ll stay in rental apartments a bit longer and wait until their kids are of the age that a single-family house makes sense.

Reinforcing our earlier analysis of the future demand for rentals is the surprisingly small shift in housing patterns it will take to make a big difference in the demand for and construction of rental apartments. Today, there are 131 million housing units in the U.S., including vacancies, of which 42 million are rentals. If only 1% of the total 112 million households decided to move to rentals, the demand for apartments would increase by over one million, most of which would need to be newly built after current vacancies are absorbed. This is a big number compared to new apartment starts of about 300,000 on average in the past. Rental apartments will also appeal to the growing number of postwar babies as they retire, downsize, and want less responsibility and more leisure time.

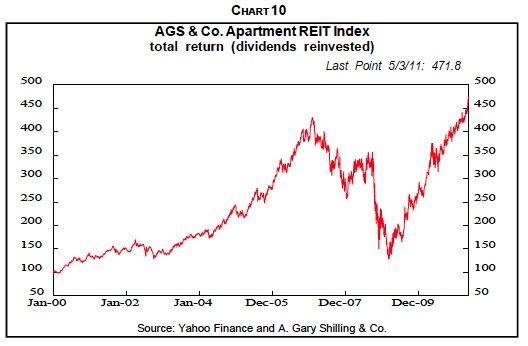

Like other REITs, apartment REITs rose rapidly last year (Chart 10) and may have over-anticipated the performance of the underlying investments in coming quarters. Direct ownership and other forms of investment in rental apartments may be more rewarding in the near future.

Rental apartments are not without their problems for investors. Prices haven’t risen dramatically lately compared to office and industrial buildings, but capitalization rates are relatively low, indicating that prices are high. Also, multi-family mortgage delinquencies and foreclosures are a problem, especially for Fannie, which with Freddie bought apartment loans in 2007 and 2008 as private lenders withdrew. Their share of multi-family loan purchases jumped to 85% in 2009 from 29% two years earlier. They own or guarantee 40% of the $325 billion multi-family mortgage market. Nevertheless, rental apartments are likely to be an attractive investment area for years as the joys and profitability of homeownership continue to fade.

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2011 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.