Buyers Disappear From US Housing Market Fearing Further Falls in House Prices

Housing-Market / US Housing Nov 18, 2007 - 01:29 AM GMTBy: Tim_Iacono

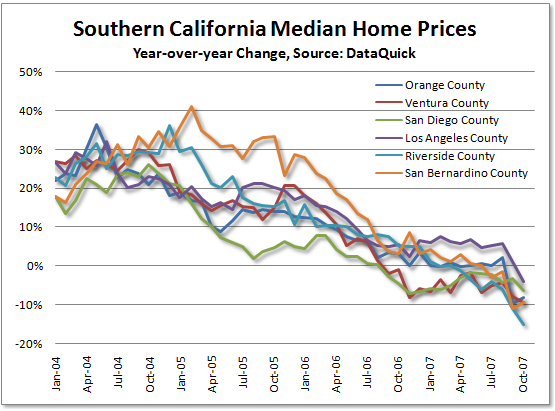

Yesterday, DataQuick released the Southern California real estate sales data for the month of October. For the first time since probably the mid-1990s all six counties show year-over-year declines in the median price led by Riverside County at -15 percent.

Yesterday, DataQuick released the Southern California real estate sales data for the month of October. For the first time since probably the mid-1990s all six counties show year-over-year declines in the median price led by Riverside County at -15 percent.

Marshall " almost all if not all of those gains are here to stay " Prentice, President of DataQuick, had these comments:

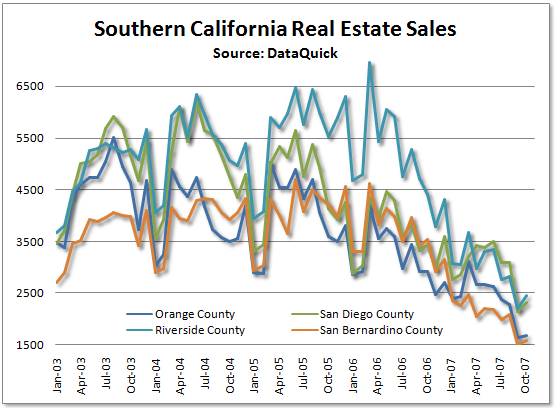

A lot of potential buyers seem to be waiting this one out. It's hard to buy a home when you think it might lose value, especially when you have to borrow money to do it. We can expect the issues with jumbo financing to slowly resolve themselves. Meanwhile, demand is accumulating and when the market does level off, there will be a catch-up period.

Don't hold your breath.

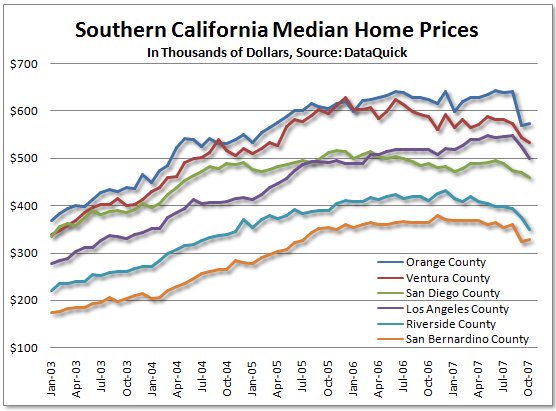

Last month it was Orange County with the biggest price plunge, this month LA County led the way down as the median sale price fell from $525,000 to just $500,000.

Just $500,000?

That still sounds like way too much money for a typical home - it's still almost ten times the median household income.

Volume did pick up a little bit from September when things came to a virtual stand-still. Don't look for volume to decline too much further as it is already at 20-year lows, which, when adjusted for population growth would seem to have nowhere to go but up.

Probably.

That's good news for those in the business of selling real estate, but now that the word is out on real estate prices, don't look for any rebound in prices.

The DataQuick story noted that prices have gone back to spring 2005 levels - don't be surprised if they go back to 2003 levels before they start going back up again.

By Tim Iacono

Email : mailto:tim@iaconoresearch.com

http://www.iaconoresearch.com

http://themessthatgreenspanmade.blogspot.com/

Tim Iacano is an engineer by profession, with a keen understanding of human nature, his study of economics and financial markets began in earnest in the late 1990s - this is where it has led. he is self taught and self sufficient - analyst, writer, webmaster, marketer, bill-collector, and bill-payer. This is intended to be a long-term operation where the only items that will ever be offered for sale to the public are subscriptions to his service and books that he plans to write in the years ahead.

Tim Iacono Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.