The Inside Out World of U.S. Home Mortgages

Housing-Market / US Housing Apr 26, 2011 - 10:58 AM GMTBy: Douglas_French

Nothing perks up the spirits like the coming of spring. Flowers are blooming and the birds are singing. The winter thaw is finally complete for most of the nation. But while yards are starting to bloom, home values are still dormant. The median sales price of a home in the United States has dropped to just over $159,000, the lowest level since 2002.

Nothing perks up the spirits like the coming of spring. Flowers are blooming and the birds are singing. The winter thaw is finally complete for most of the nation. But while yards are starting to bloom, home values are still dormant. The median sales price of a home in the United States has dropped to just over $159,000, the lowest level since 2002.

However, markets propelled upward with the Fed's rocket fuel saw something they liked in the March housing numbers. Slabs were poured and nail guns commenced firing on 549,000 homes (annualized) up more than 7 percent from February, exceeding economists' forecasts.

However, markets propelled upward with the Fed's rocket fuel saw something they liked in the March housing numbers. Slabs were poured and nail guns commenced firing on 549,000 homes (annualized) up more than 7 percent from February, exceeding economists' forecasts.

The number of building permits rose 11 percent to a 594,000 pace, again above the projections of economists who had the number at a 540,000 annual pace.

"The underlying trend is one of stability or modest improvement since we hit our low point a couple of years ago," said economist Richard DeKaser, who is paid by Parthenon Group in Boston to tell Bloomberg nonsense like this.

The housing market is not improving and it is not going to for a long time. Daniel Indiviglio, writing for the Atlantic, points out that multifamily structures accounted for two-thirds of the increase in permits pulled in March. Apartments were a third of the increase in starts.

"The home building market remains weak and clouded with uncertainty," writes Indiviglio. "The upticks in permits and starts in March still leaves them both at very, very low levels from a historical perspective."

Builders around the country are resorting to extreme sales tactics to move their sticks and bricks. Kim Meier's KLM Builders is offering to throw in a new car with each home sale. Selling new homes in a Chicago suburb 50 miles from downtown, Meier told the New York Times "We needed to do something dramatic. The market's been soft."

The boom-time practical wisdom for the home-building industry was that people would stretch their commute to the limit in order be able to afford to buy a home. Suburbia kept expanding until people spent hours on the road each day getting to and from work. What were once small farm hamlets became bedroom communities with farmers selling their fields for more than they ever imagined, and row after row of tract homes were thrown up according to the FHA guidelines.

Homebuyers' desire to live what landscape historian J.B. Jackson describes as the lawn culture sent homebuyers to distant subdivisions that were previously devoted to growing grain in the Midwest, cotton outside of Phoenix, or timber near Seattle or Atlanta. "The culmination of the lawn culture was the country club," writes Robert Fishman in Bourgeois Utopias: The Rise and fall of Suburbia, with its carefully tended golf course. "It represents the suburban equivalent of the urban park."

Country clubs are going broke, and builders like Meier are forced to offer $17,000 toward a new General Motors car because, as David Streitfeld writes,

Builders and analysts say a long-term shift in behavior seems to be under way. Instead of wanting the biggest and the newest, even if it requires a long commute, buyers now demand something smaller, cheaper and, thanks to $4-a-gallon gas, as close to their jobs as possible. That often means buying a home out of foreclosure from a bank.

Sales of new homes in February were down 80 percent from the peak in 2005. "New single-family sales are now lower than at any point since the data was first collected in 1963, when the nation had 120 million fewer residents," Streitfeld writes. An Associated Press story last month pointed out that new-home prices now average 45 percent more than average existing-home-sales prices. Normally the difference is 15 percent.

With such a price difference, it only makes sense that the sales of existing homes have faired much better by comparison, down only 28 percent since '05. However, distressed properties are 40 percent of all sales.

People are bailing from their American dream. Home prices don't always go up after all. And as much as prices have dropped thus far, Robert Schiller thinks there is 15 to 25 percent to go to the downside.

And the distressed market will not be cleared quickly. First it was attempts from Washington with tax incentives for buyers that propped up prices and kept builders from throwing in the towel. Builders also cashed up with tax refunds from taxes paid during their boom years, using the money to buy land, to buy lots, and to start new homes.

But the distressed-market headwind will be in builders' faces for many years. When Taylor Bean CEO Lee Farkas was asked by the Justice Department's Patrick Stokes if he thought his firm's agreement with Colonial Bank allowed Taylor Bean "to sell fraudulent, counterfeit, fictitious loans" to the bank, he replied,

Yeah, I believe it does. It's very common in our business to, to sell — because it's all data, there's really nothing but data — to sell loans that don't exist. It happens all the time.

Yep, nothing but data. Maybe that's how a company of 50 employees can claim to hold title to 60 million mortgage loans in the United States. Mortgage Electronic Registration Systems (MERS) of Reston, Virginia, was created 16 years ago by Fannie Mae, Freddie Mac, and big banks like Bank of America and JPMorgan Chase.

The quaint practice of recording mortgage assignments down at the local courthouse was slowing the mortgage business down during the boom. MERS "cut out the county clerks and became the owner of record, no matter how many times loans were transferred. MERS appears to sell loans to MERS ad infinitum," explain New York Times reporters Michael Powell and Gretchen Morgenson.

Suddenly securitization was set free. Nobody noticed until the housing market cracked. Then the question of who had standing to foreclose on properties came into question. The owner of a loan is whoever must do the foreclosing, not a loan servicer.

The holder of nearly half of all America's mortgages prefers to operate in the shadows. Powell and Morgenson write,

Little about MERS was transparent. Asked as part of a lawsuit against MERS in September 2009 to produce minutes about the formation of the corporation, Mr. Arnold, the former C.E.O., testified that "writing was not one of the characteristics of our meetings."

For those who believe Taylor Bean's practices were an aberration, Alan M. White, a law professor at the Valparaiso University School of Law in Indiana, last year matched MERS's ownership records against those in the public domain and found, "Fewer than 30 percent of the mortgages had an accurate record in MERS."

Powell and Morgenson rightly ask, "If MERS owned nothing, how could it bounce mortgages around for more than a decade? And how could it file millions of foreclosure motions?"

The government-sponsored enterprises (GSEs) and big banks are not allowed to fail, and the ability to foreclose is in question as long as MERS is in the middle of all this. But for those making their payments, how can they actually know who their lender is? They know who they write a check to every month, but what entity actually owns their loan?

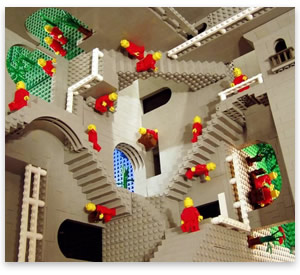

If underwater by thousands of dollars, or hundreds of thousands, what's the incentive to pay? If a borrower wants to work out a compromise in good faith, how can they know if they are negotiating with the right party? The mortgage mess is a house of mirrors.

Proof that strategic default is on the mind of more overindebted homeowners comes from credit analytics firm FICO claiming their team of researchers "have demonstrated the ability to identify borrowers who are over 100 times more likely to default strategically than others."

FICO wants to help mortgage companies get the jump on those who plan to walk away.

Strategic defaulters, as a group; have better FICO scores, display better credit management, spend money more carefully, have owned their property for a shorter period of time, and have more open credit in the last six months.

In other words, the financially savvy are much more likely to strategically default.

However, FICO's chief analytics officer Andrew Jennings argues,

Strategic defaults are bad for lenders and investors, they're bad for the homeowners who elect to default and they're bad for neighborhoods and cities. Preventing them is in the interests of everyone involved.

These arguments are the typical nonsense trumpeted by the mortgage industry and are all addressed in Walk Away: The Rise and Fall of the Home-Ownership Myth.

The idea is that FICO's new tools will help lenders identify borrowers they should negotiate with before these folks walk. FICO is doing its part, but don't look for the bailed-out and the too-big-to-fail to start negotiating. Borrowers don't keep them in business — Washington does.

Douglas French is president of the Mises Institute and author of Early Speculative Bubbles & Increases in the Money Supply. He received his masters degree in economics from the University of Nevada, Las Vegas, under Murray Rothbard with Professor Hans-Hermann Hoppe serving on his thesis committee. See his tribute to Murray Rothbard. Send him mail. See Doug French's article archives. Comment on the blog.![]()

© 2011 Copyright Ludwig von Mises - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.