U.S. Existing Homes Sales Data Continues to Suggest Soft Conditions in Housing Market

Housing-Market / US Housing Apr 21, 2011 - 02:24 AM GMTBy: Paul_L_Kasriel

Much like housing starts, existing home sales also posted a small gain in March. But, the bottom line is that housing starts and existing home sales are hovering close to cycle lows and sustained gains to push readings noticeably above cycle lows have not occurred, as yet. New home sales numbers for March will be published on April 25, 2011.

Much like housing starts, existing home sales also posted a small gain in March. But, the bottom line is that housing starts and existing home sales are hovering close to cycle lows and sustained gains to push readings noticeably above cycle lows have not occurred, as yet. New home sales numbers for March will be published on April 25, 2011.

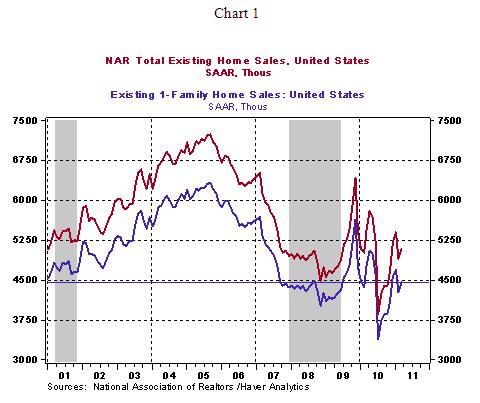

Sales of all existing homes increased 3.7% to an annual rate of 5.1 million units in March. Purchases of existing single-family homes moved up 4.0% to an annual rate of 4.45 million units in March after a nearly 9.0% drop in February. The cycle low for existing single-family home sales is 3.39 million units. The current reading for sales of existing single-family homes indicates a 31% increase from the bottom but still 30% lower than the cycle high of 6.34 million units posted in September 2005.

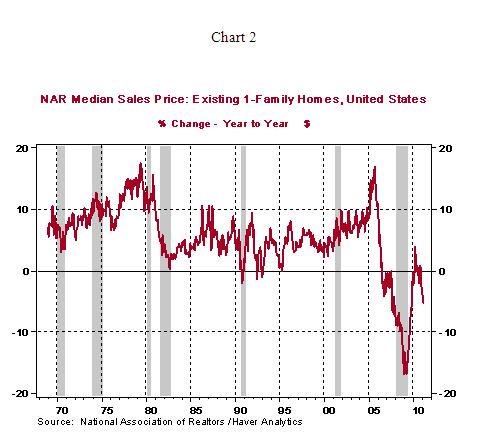

The median price of an existing single-family home at $160,500 is down 5.3% from a year ago. The March 2011 median price of an existing single-family home is nearly 31% below the record high of $230,900 posted in July 2006.

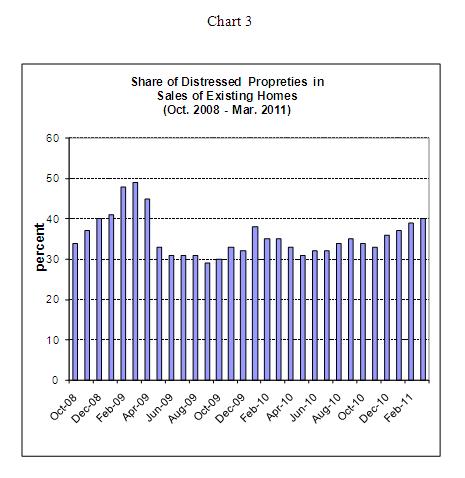

According to the National Association of Realtors, 40% of existing home sales were that of distressed properties during March. All-cash sales made up 35% of sales, up from 33% in February; they accounted for 27% of sales in March 2010. The high percentage of all-cash sales suggests credit availability issues.

Seasonally adjusted, inventories of unsold single-family edged down to an 8.5-month supply from 8.7-months in February. Although inventories have declined, distressed properties continue to hold down prices of existing single-family homes.

The housing market continues to show significant sluggishness even after seven quarters of economic growth and improving employment conditions, which will continue to play role in monetary policy discussions and offer support to doves on the FOMC.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.