Concern Over Falling U.S. Housing Market Existing Home Sales

Housing-Market / US Housing Mar 22, 2011 - 08:41 AM GMTBy: Asha_Bangalore

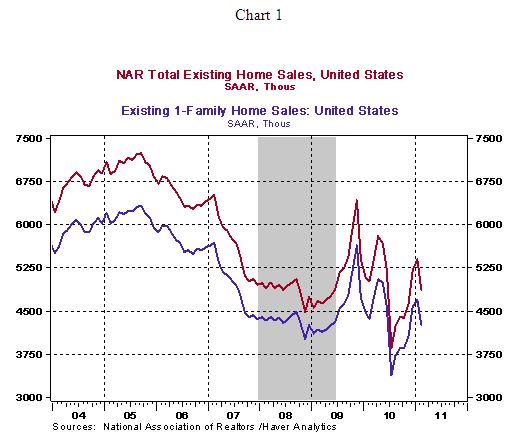

Sales of all existing homes fell 9.6% to an annual rate of 4.88 million units in February, after three consecutive monthly gains, while that of single-family units also declined 9.6% to an annual rate of 4.25 million units. Sales of existing homes declined in all regions of the economy, with the Midwest (-12.2%) recording the largest drop.

Sales of all existing homes fell 9.6% to an annual rate of 4.88 million units in February, after three consecutive monthly gains, while that of single-family units also declined 9.6% to an annual rate of 4.25 million units. Sales of existing homes declined in all regions of the economy, with the Midwest (-12.2%) recording the largest drop.

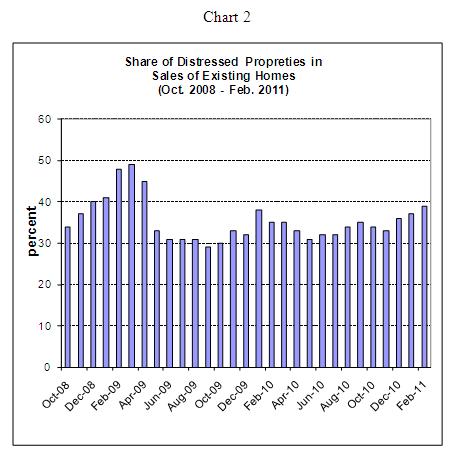

According to the National Association of Realtors, distressed properties made of 39% of existing home sales in February up from 37% in January and 35% from February 2010. A significant volume of distressed properties and a large inventory of unsold homes have led a persistent downward trend of home prices.

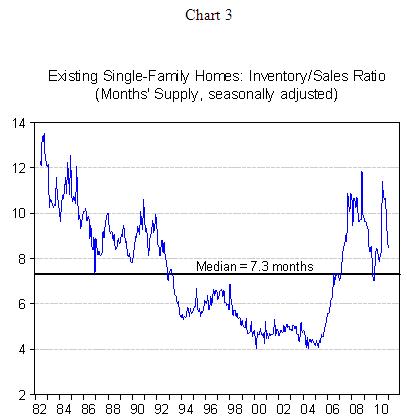

The inventory of unsold single-family homes rose slightly to 8.6-month supply from 8.5-month mark in January.

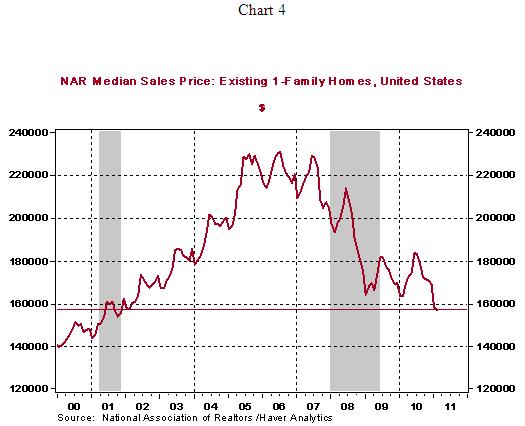

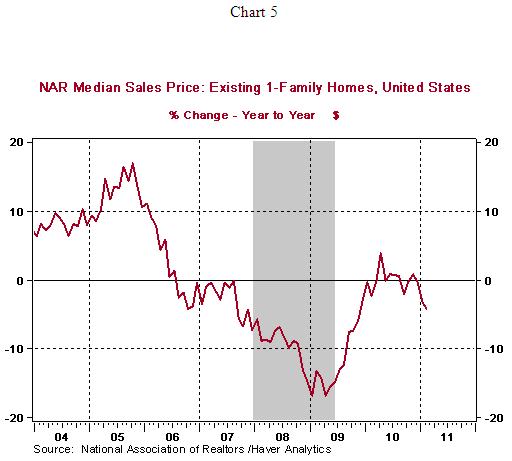

The median price of an existing single-family home in February fell 1.0% to $157,000 from the prior month. The median price of a new single-family home stands at the lowest level since October 2001(see Chart 4). From a year ago, the median price has dropped 4.2%, the largest decline since October 2009 (see Chart 5). The depressed state of the housing market, despite attractive prices of homes, is a source of major concern for policymakers. The housing sector has failed to post a recovery despite seven quarters of economic recovery. As noted in several earlier commentaries, a strong pace of hiring will be necessary to bring about stability in the housing market.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.