U.S. Housing Market Developments Suggest Persistent Unease

Housing-Market / US Housing Mar 10, 2011 - 03:02 AM GMTBy: Asha_Bangalore

The Mortgage Bankers Association's Mortgage Purchase Index moved up 12.5% to 194.4 during the week ended March 4. On a monthly basis, the Mortgage Purchase Index has declined 3.3% in February following a nearly 8.0% drop in January. Of late, the link between mortgage applications for purchases of homes and actual sales appears to be weak (see Chart 1). Combined sales of homes rose slightly in January [Sales of existing homes advanced in January (+2.7%), while sales of new homes plunged (-12.6%)].

The Mortgage Bankers Association's Mortgage Purchase Index moved up 12.5% to 194.4 during the week ended March 4. On a monthly basis, the Mortgage Purchase Index has declined 3.3% in February following a nearly 8.0% drop in January. Of late, the link between mortgage applications for purchases of homes and actual sales appears to be weak (see Chart 1). Combined sales of homes rose slightly in January [Sales of existing homes advanced in January (+2.7%), while sales of new homes plunged (-12.6%)].

Mortgage rates have increased after the Fed has commenced the second round of quantitative easing in November 2010. The 30-year fixed rate mortgage was last quoted at 4.87%, up 70 bps from the recent low of 4.17% on November 5 (see Chart 2).

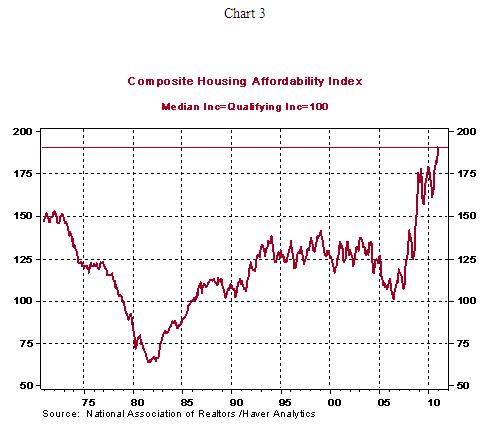

Housing affordability hit a record high mark of 191.0 in January 2011 (see Chart 3). The attractive home price and mortgage rate situation has not resulted in the typical improvement of housing market conditions largely due to a worrisome employment situation. The gains in hiring recorded in February raise expectations of a near term improvement in the housing market. But, other reports from the housing market raise the level of concern. According to CoreLogic, 11.1 million homes or 23.1% of residential mortgages outstanding had negative equity in the fourth quarter of 2010, up slightly from the third quarter. This problematic situation combined with the existence of numerous foreclosed residential properties make a strong case for the Fed to maintain the current easy monetary policy stance in the months ahead.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.