U.S. Housing Market Lags Economic Recovery, Robust Growth in Hiring Key to Revival

Housing-Market / US Housing Dec 07, 2010 - 04:05 AM GMTBy: Asha_Bangalore

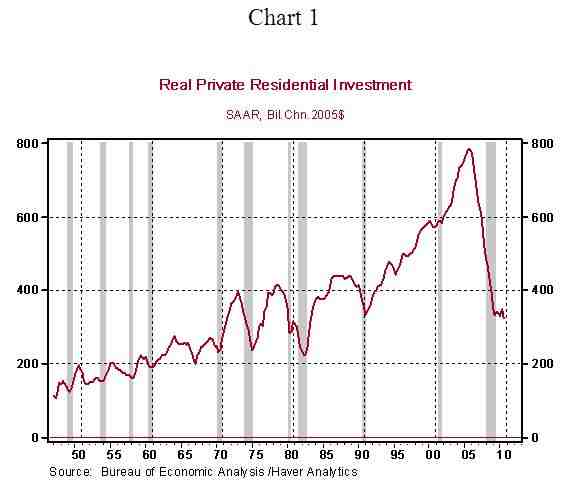

The current recession/recovery phase has many records for history books. Here is another one. In the post-war period, the housing market nearly always led the economic recovery. Housing market troughs, as measured by the trough of real residential investment expenditures, occurred prior to the onset of the overall economic recovery. Chart 1 plots real private residential investment expenditures and the shaded regions denote recessions as identified by the National Bureau of Economic Research.

The current recession/recovery phase has many records for history books. Here is another one. In the post-war period, the housing market nearly always led the economic recovery. Housing market troughs, as measured by the trough of real residential investment expenditures, occurred prior to the onset of the overall economic recovery. Chart 1 plots real private residential investment expenditures and the shaded regions denote recessions as identified by the National Bureau of Economic Research.

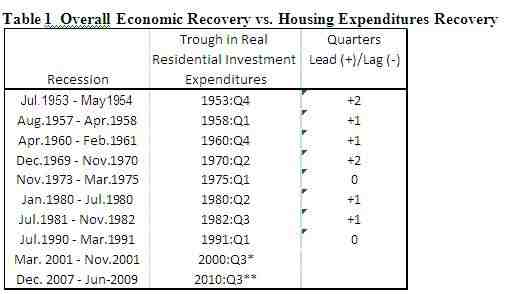

The precise leads/lags of residential investment expenditures vis-à-vis the general economic recovery in the post-war period are listed in Table 1. For example, economic recovery commenced in May 1954 (Q2), while the trough of real residential investment expenditures occurred in the fourth quarter of 1953, which implies a two-quarter lead (+2).

Note: * - A recession in residential investment expenditures did not occur.

** - Although the recession ended in June 2009, residential investment expenditures

are yet to recover.

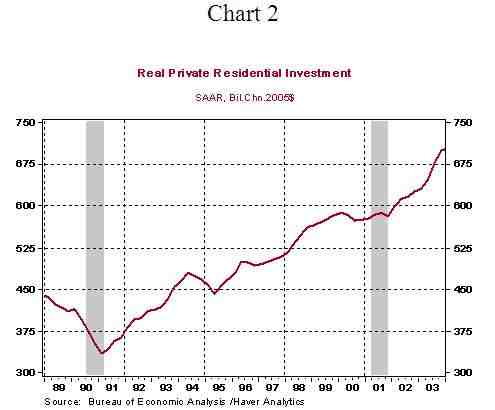

Going down the list, residential investment expenditures have turned around before each post-war recovery, with the exception of 1975 and 1991 when the economic and housing market recoveries occurred simultaneously. The 2001 recession did not experience a "true" recession (see Chart 2), only a small slowing occurred in 2000.

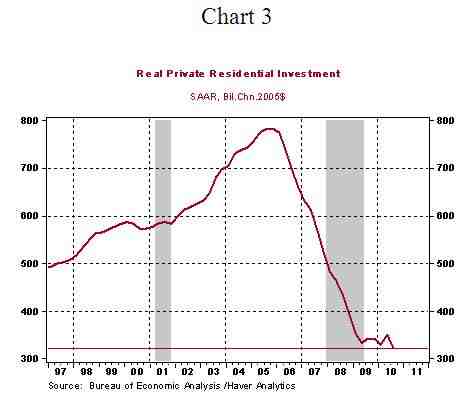

By contrast, although the recent recession ended in June 2009 and the economy has recorded five quarters of economic growth, residential investment expenditures are yet to establish a bottom (see Chart 3). The level of residential investment expenditures in the third quarter of 2010 is the lowest for the current recession/recovery phase. It is entirely conceivable for residential investment expenditures to decline in the fourth quarter of 2010. A robust trend in hiring is the missing element for a housing market recovery, while low mortgage rates and attractive home prices are important but inadequate to lift home construction and sales.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.