U.S. House Prices, Tip of Iceberg of Housing Market Woes

Housing-Market / US Housing Dec 01, 2010 - 02:18 AM GMTBy: Asha_Bangalore

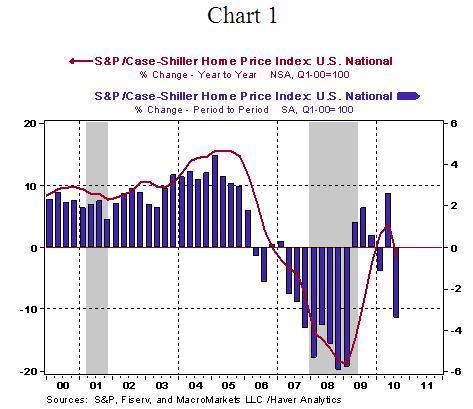

The seasonally adjusted Case-Shiller Price Index fell 0.8% in September after a 0.5% drop in August. In the third quarter, house prices, as measured by the Case-Shiller Price Index have dropped 3.4% after a 2.6% gain in the prior quarter. From a year ago, this price index declined 1.5%. The house price picture is disappointing and worrisome. The brief gain in house prices in the second quarter reflects the impact of the first-time home buyer program much like the situation in 2009 when the program was put in place (see Chart 1).

The seasonally adjusted Case-Shiller Price Index fell 0.8% in September after a 0.5% drop in August. In the third quarter, house prices, as measured by the Case-Shiller Price Index have dropped 3.4% after a 2.6% gain in the prior quarter. From a year ago, this price index declined 1.5%. The house price picture is disappointing and worrisome. The brief gain in house prices in the second quarter reflects the impact of the first-time home buyer program much like the situation in 2009 when the program was put in place (see Chart 1).

As home prices decline, the number of homes that are underwater (outstanding mortgages of these homes exceed the current market value) are likely to increase. According to Core Logic, 23% of all homes with mortgages were underwater in the second quarter of 2010, which is 11 million. There is a high concentration of underwater mortgages in Nevada, Arizona, Florida, Michigan and California. Underwater mortgages present a serious stumbling block for not only a housing market recovery but also overall economic recovery.

Unemployed homeowners are placed in tight positions if they are unable to sell their homes and relocate for jobs if their mortgages are underwater and this situation translates into an increase in foreclosures. Essentially, underwater mortgages set forth a chain of economic challenges that are increasing the severity of the housing market woes and restraining the pace of economic growth.

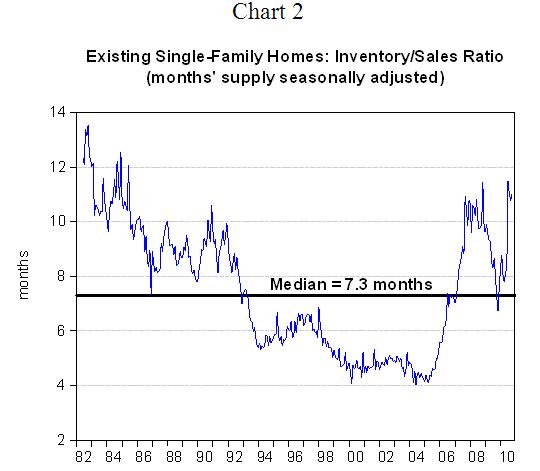

In September, five (Boston, Los Angeles, Washington, San Diego, and San Francisco) out of twenty metro areas, the Case-Shiller house price survey tracks, recorded year-to-year declines. The inventory of unsold existing homes drives home the point that additional price declines are nearly certain (see Chart 2).

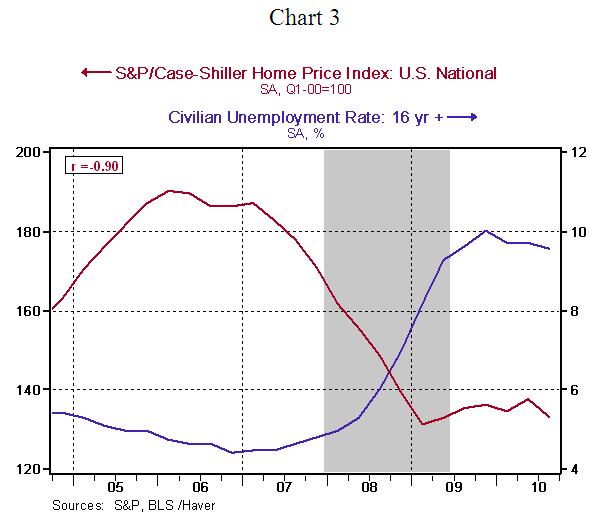

The Case-Shiller price index shows a strong negative correlation with the unemployment rate in the past five years (see Chart 3). The correlation is not significant for the entire period for which the Case-Shiller price index has been published. Recognizing the close knit relationship between these two markets is essential for policy making because irrespective of historically low interest rates and affordable prices of homes, job growth is critical to reverse the worrisome situation of the housing market.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.