South African Gold Miners, Dollar/Rand Rate and the HUI

Commodities / Gold & Silver Stocks Nov 19, 2010 - 03:59 AM GMTBy: Hubert_Moolman

US dollar/SA exchange rate

US dollar/SA exchange rate

The Dollar/Rand exchange rate is a very important rate for South African gold miners, as well as an important proxy for gold miners in general. Together with some other indicators, this ratio can tell us when gold miners are about to increase in real terms—that is, as compared to all other asset classes (including gold itself). When this happens, you really want to be in gold miners.

I can tell you that by all indication, especially my unique fractal analysis, we are entering such a time. This article is an attempt to illustrate why I think we are entering the time where gold (and silver) miners will be the best performing asset class over the next many years.

Below is a 5-year US dollar/SA rand chart.

On the chart, I have highlighted two fractals (pattern 1 and 2). The period over which each of these patterns formed can also be viewed as a cycle. If my comparison of the two fractals is correct, then we are now at the beginning of a new cycle.

To show the similarity of the two patterns, I have marked similar points (1 to 4) on both patterns. We are now just about after point 4, and this would represent the bottom (5 November 2010). From here I expect the rate to rise, thus giving JSE gold miners leverage on the gold that they are selling.

Remember that a significant part of JSE gold miner’s cost is in Rand or non-USD currency, whereas they get Dollars for the gold that they sell. Of course, this is not the only condition needed for gold miners to prosper. Margin (revenue less cost) is king in any business and no different for gold miners. Their margins are most favourable when the gold price is rising in real terms.

The gold price is currently rising in real terms and should continue to do so for at least the next 5 months. In fact, I believe this increase in real terms will accelerate over the next 5 months due to the deflationary conditions that I expect from now to about April next year.

Expected timing and target for the US dollar/SA rand exchange rate

Below are two charts which zoom into the last part of the two fractals presented on the first chart of this article. (The full analysis continues for subscribers and pay per article clients only.)

JSE Gold Index

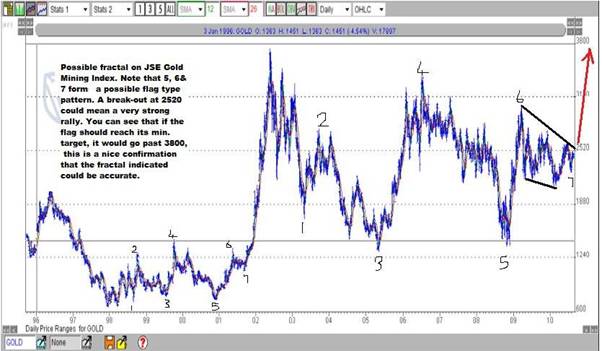

Below is a chart of the JSE Gold index that I did awhile back. I have highlighted two possible matching fractals. The commentary on the chart is self-explanatory. Note that, since then, the index has broken upward out of the flag.

This chart and fractal analysis is consistent with my expectation for gold miners. It also illustrates why I think the rallies in gold miners will be explosive. The expected timing and price targets will be made available to my premium subscribers and pay per article clients.

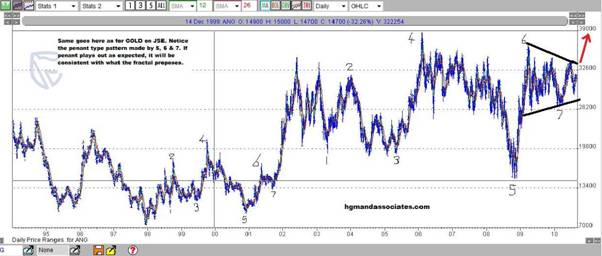

Below, I have done the same analysis for Anglogold (in S. African rand). The note on the chart is also self-explanatory. The reason I have used Anglogold is to illustrate a fractal on the HUI, which you will see on the last chart. Again, the pennant/flag has broken out since then.

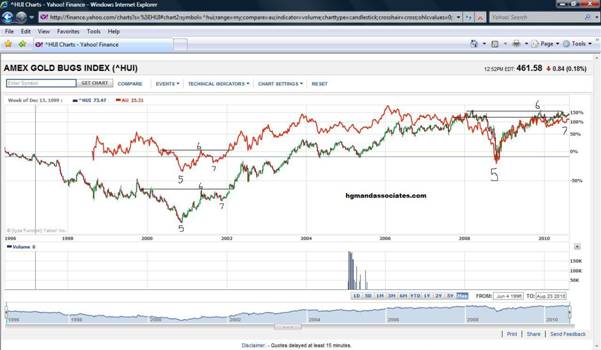

On the last chart, I have the HUI compared to Anglogold (in US dollars). Again, I have highlighted two possible fractals and marked points 5, 6 and 7 on both. For Anglogold, these points also correlate with points 5, 6 and 7 on the Anglogold (in S. African rand) chart. The HUI has of course also broken out of the line drawn since then.

This analysis presents a similar view as to what should be expected for gold miners, as presented under the JSE Gold and US dollar/South African rand analysis. The HUI should increase significantly in value over the next many years. The expected timing and price targets for the HUI will be made available to my subscribers and pay per article clients.

Warm regards and God bless

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

Please visit my blog and website for more of my work and premium service. http://hgmandassociates.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2010 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.