Agnico-Eagle Mines Limited: Record Quarterly Net Income of $121.5 million

Companies / Gold & Silver Stocks Oct 28, 2010 - 04:46 AM GMTBy: Bob_Kirtley

Another record performance by Agnico-Eagle Mines Limited (AEM) on the back of high gold prices along with the completion of a number of quality projects should render the Eagle more than desirable in this sector of the market. And as the trend is to acquire more ounces on Bay Street through merger and acquisition activity, its a surprise to us that this company has not been the target of a take over move by one of the large caps.

Another record performance by Agnico-Eagle Mines Limited (AEM) on the back of high gold prices along with the completion of a number of quality projects should render the Eagle more than desirable in this sector of the market. And as the trend is to acquire more ounces on Bay Street through merger and acquisition activity, its a surprise to us that this company has not been the target of a take over move by one of the large caps.

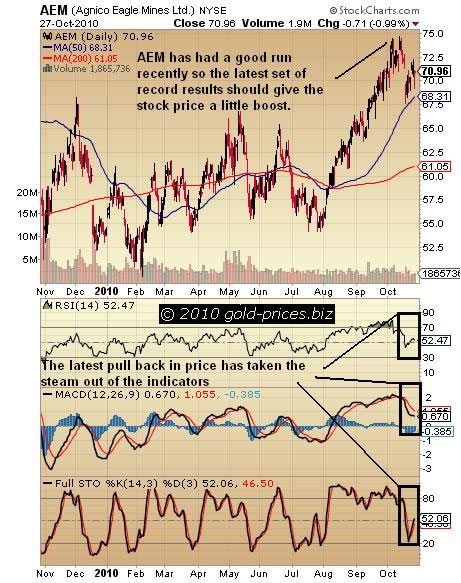

So, we will kick off with a quick look at the above chart where we can see that AEM has had a good run recently, so one imagine that the latest set of record results would give the stock price a little boost. Also note that the pull back in price over the last few weeks which has taken the steam out of the technical indicators, thus allowing the stock price to move higher in tandem with gold prices. At the time of writing we checked into the ‘after hours’ trading session where we can see that the stock was traded up in the after hours session, which is a positive sign.

Today’s results show a record quarterly net income of $121.5 million, or $0.73 per share, for the third quarter of 2010. These improved figures are largely attributable to a 140% increase in gold production, the highlights being as follows:

- Record Gold Production, Record Revenue and Record Net Earnings -

quarterly gold production of 285,178 ounces resulted in revenue of

$398.5 million and net earnings of $121.5 million

- Record Cash Flows - excluding non-cash changes in working capital,

$170.9 million versus the prior quarter’s record of $138.9 million

- Record quarterly gold recovery at Kittila - with the 81% recovery in

the mill at Kittila, the design rate of 83% is on target for year end

2010

- Creston Mascota at Pinos Altos about to Start-Up - crushing plant has

been commissioned and loading of leach pads scheduled to begin in

fourth quarter

It should also be noted that the transformational phase at Agnico-Eagle is over, in terms of mine construction, AEM in now in a phase of optimization and expansion of their newly constructed mining projects.

Sean Boyd, Vice-Chairman and Chief Executive Officer, has mentioned the possibility of increasing the dividend, which is good news for investors who have had a dividend paid to them for the last twenty odd years, though it has been a fairly small one.

At quick look at the total cash costs per ounce gives us a figure of $441. This compares with the total cash costs per ounce of $436 in the third quarter of 2009, although it is disappointing to see it rise slightly.

We will see over the coming days and weeks just how well the market receives these results, as we know the market can be a fickle place and should these results not meet with their expectations some investors will take profits and look to re-enter at a lower share price. We do own this stock as Agnico-Eagle forms part of our core position and we will continue to hold onto it.

To read their news release in full please click here.

Back to our latest venture which was the launch of an Options trading service we are pleased to report that it is going very well so its a big thanks to all those who have signed up for it and the supportive emails that you have sent us.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.