U.S. Housing Market Shortage Coming, Now in the Best to to Buy, Inane Thoughts?

Housing-Market / US Housing Jun 25, 2010 - 10:43 AM GMTBy: Mike_Shedlock

Housing bulls are coming out of the woodwork just as housing is about to collapse for the second time.

Housing bulls are coming out of the woodwork just as housing is about to collapse for the second time.

New Home Sales at Record Low

Housing sales, housing starts, and mortgage refinancings have all collapsed along with the expiration of home-buyer tax credits.

Yesterday the Census Bureau report on New Residential Sales in May 2010 showed sales of new single-family houses in May 2010 collapsed to a seasonally adjusted annual rate of 300,000.

Roof Collapses on Housing Market

Rosenberg has some interesting comments on housing in Thursday's Breakfast With Dave.

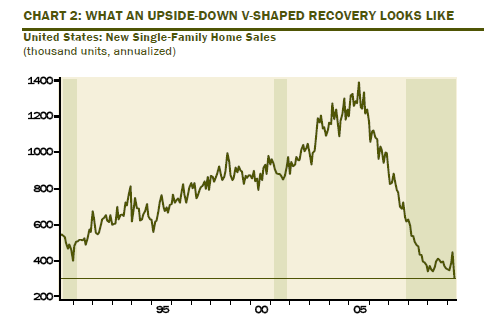

New home sales cratered a record 33% in May, to a record low of 300,000 units at an annual rate. This breaks the prior all-time low of 341,000 set back in April 2009 when the economy was knee deep (more like six feet under) in recession.

There must have been a wave of cancellations too because April was revised down to 446,000 from 504,000 and March to 389,000 from 439,000. The only other time when new home sales made a new low 11 months after the end of a recession was during the double dip of the early 1980s – assuming that the pundits are correct on this assessment of when the economy bottomed out.

The inventory backlog, which had taken a dive in April as the tax credits were about to expire, soared from 5.8 months to an 11-month high of 8.5 months. And, this excess supply is exerting more downward pressure on pricing – the median price of a new home fell 1% MoM in May to $200,900 and is now down nearly 10% for the year (was $222,600 in December). Home prices have not been this low since December 2003 and are light years away from the $257,000 peak established in mid-2006.

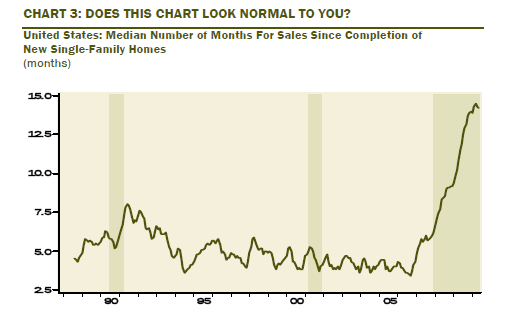

Despite all the stimulus aimed at the housing market, it took builders a record median 14.2 months to find a buyer for a completed home in May. This sector is broken. People don’t want to buy an asset they see will depreciate in value. And people don’t want to pursue the dream of homeownership if it means taking out a mortgage – the scars from the credit collapse are obviously lingering if not accelerating.

Housing's Upside Down V-Shaped Recovery

Median Months To Sell New Single-Family Homes

Lennar Home Sales Down 25%

Bloomberg reports Lennar Home Sales Down as Much as 25% in June as Tax Credit Ends, CEO Says

Lennar Corp.’s home sales are down 20 percent to 25 percent this month compared with a year earlier as the expiration of a government tax credit for buyers saps demand, Chief Executive Officer Stuart Miller said.

The end of the tax credit may hold back a recovery in the U.S. housing market, which has been hurt by weak demand and increasing foreclosures during the recession. New home sales plunged 33 percent in May from April to a record low pace, the Commerce Department reported yesterday. To qualify for the credits -- worth as much as $8,000 -- purchasers must have signed contracts by April 30 and must close the sale by June 30.Housing Tax Credits Added To Housing Problems

Notice the absurd spin that the "end of the tax credit may hold back a recovery in the U.S. housing market".

The reality is there was an oversupply of houses, there still is a huge oversupply of houses, and it was outright idiotic to stimulate more homebuilding in such conditions.

Demand was pushed forward, and now what? Now we are still stuck with huge inventory and fewer buyers. There is also an enormous amount shadow inventory of bank owned real estate and more foreclosures in the pipeline.

Housing Signals Double-Dip

Rosenberg notes "The only other time when new home sales made a new low 11 months after the end of a recession was during the double dip of the early 1980s"

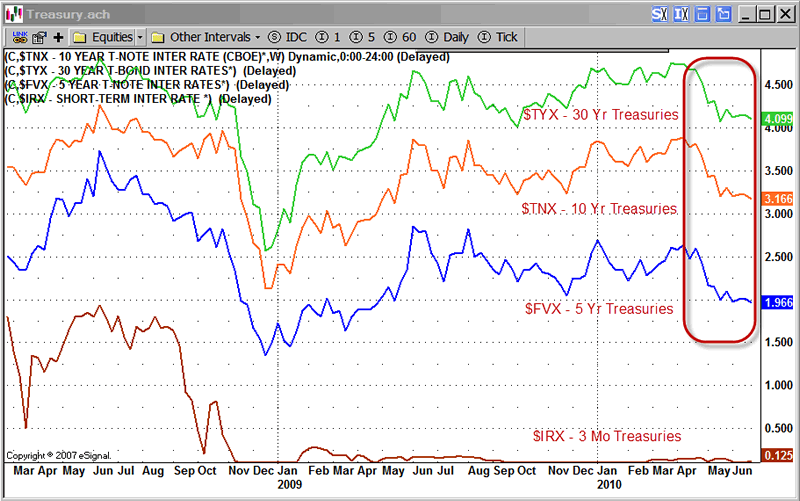

Housing and the Yield Curve both signal a double-dip.

Yield Curve as of 2010-06-22

The above chart shows Weekly Closing Yields.

The chart does not reflect inflation, inflation expectations, reflation, or an improving economy. It does reflect what one would see after a reflation effort that has failed.

Mortgage rates at lowest point since at least 1971

Inquiring minds note that Mortgage rates at lowest point since at least 1971.

Mortgage rates fell this week to the lowest level on records dating to 1971, giving consumers added incentive to lock in low payments for home purchases and refinanced loans. The average rate for 30-year fixed loans sank to 4.69 percent, from 4.75 percent last week, mortgage company Freddie Mac said Thursday.

That's the lowest point since Freddie Mac began tracking rates in April 1971. The previous record of 4.71 percent was set in December. Rates for 15-year and five-year mortgages also hit lows.

Yet the falling rates have yet to spark a home-buying boom -- or energize the economy. New-home sales collapsed in May after homebuying tax credits expired. The economy also remains under pressure from high unemployment. And many people don't qualify under tightened lending rules.

Many Americans owe more on their mortgages than their homes are worth -- often called "under water" -- and can't refinance. The Obama administration has launched programs to help borrowers refinance if they owe up to 25 percent more than their home's value and have loans owned or guaranteed by mortgage giants Freddie Mac or Fannie Mae.

About 291,000 homeowners have participated as of March. Yet that's a small fraction of the nearly 15 million homeowners who are under water, according to Moody's Economy.com, and cannot refinance. In hard-hit areas in Nevada and Florida, for example, home prices have fallen 50 percent or more from their highs. Record-low rates can't rescue those homeowners.Is a housing shortage coming?

CNNMoney is asking the ridiculous question Is a housing shortage coming?

As the nation struggles to shrug off the worst housing crash since the Great Depression, it may be hard to believe a housing shortage could be on its way.

The nation is simply not building enough homes to keep up with potential demand. Just 672,000 new homes were started in April, an annualized rate and less than half the long-term run rate needed to meet the nation's natural population growth.

"It is ironic, but there is a growing consensus that there may be a new housing shortage coming," said James Gaines, a real estate economist with Texas A&M.

So far, the shortfall has been masked by a weak economy that has put a damper on home buying. Once the job market rebounds, however, people will look to have their own homes again. This pent-up demand could get unleashed on unprepared markets, causing shortages and rising local prices.Growing Consensus a Housing Shortage is Coming?!

That is one of the most absurd claims I have ever heard. There is enough housing inventory to last for years if you factor in shadow inventory.

On October 25, 2007 - I was asked the question When Will Housing Bottom?

Those looking for a housing bottom anytime soon are likely to be disappointed. Let's see why from three different angles:

- Mortgage Rate Resets in Conjunction With a Consumer Led Recession

- Historical New Home Sales

- Historical Housing Starts

On the basis of mortgage rate resets and a consumer led recession I mentioned a possible bottom in the 2011-2012 timeframe.

See Housing - The Worst Is Yet To Come for more details. ...

Cycle Excesses Greatest In History

The excesses of the current cycle have never been greater in history. The odds are strong that we have seen secular as opposed to cyclical peaks in housing starts and new single family home construction. With that in mind it is highly unlikely we merely return to the trend. If history repeats, and there is every reason it will, we are going to undercut those long term trendlines.

There will be additional pressures a few years down the road when empty nesters and retired boomers start looking to downsize. Who will be buying those McMansions? Immigration also comes into play. If immigration policies and protectionism get excessively restrictive, that can also lengthen the decline.

Finally, note that the current boom has lasted well over twice as long as any other. If the bust lasts twice as long as any other, 2012 just might be a rather optimistic target for a bottom.In contrast, Bernanke said There's No Housing Bubble to Go Bust

Coldwell Banker CEO Sings a Familiar Tune

Inquiring minds are hearing that old classic tune from Coldwell Banker's CEO Now's the "Absolute Best Time" to Buy a Home

The housing market weakened again in May. New-home sales plummeted 33% to a record low, and existing-home sales fell 2.2%.Although this is not the worst time to buy a home, 2005-2006 was, this is hardly the "best" time. Arguably 1998-2000 with an exit in 2005 would have been perfect.

That's certainly bad news for home sellers, but it's not the case for home buyers, says Jim Gillespie, CEO of Coldwell Banker. "This the absolute best time that I've ever seen to purchase a home," he tells Aaron.

Gillespie says it's such a strong buyer's market for three reasons:

- Low Rates. Interest rates on 30-year fixed mortgages remain near historic lows, around 4.75%.

- Inventories are high. Buyers can expect plenty of supply to meet their demands. The government estimates it will take more than eight months to burn off the excess inventory, up from about six month in April. Six months is considered the norm.

- Prices. "Prices have finally stabilized in most of the country," says Gillespie. The median U.S. home price is near an eight-year low and down 29% from the peak in July 2006. Though every market is local, Gillespie believes any further drop in prices will be skewed by distressed sales.

Jim Gillespie, CEO of Coldwell Banker and James Gaines, a real estate economist with Texas A&M simply do not understand the fundamentals.

Housing Fundamentals

- Boomers looking to downsize will add to housing supply.

- Foreclosures will continue to add to supply for several more years.

- Shadow housing inventory is massive.

- Global growth is slowing. This will affect exports and jobs.

- Bank balance sheets are tremendously weak. Don't expect lending to pick up or businesses to go on hiring sprees anytime soon.

- Unemployment is 10% and going to stay high for a decade.

- The economy is poised for a double-dip recession, assuming you believe the economy exited the last recession.

- Kids are graduating college hundreds of thousands of dollars in debt with no way to pay it back. They cannot afford houses and are delaying family formation.

- Nearly anyone who wants a house and can afford a house already has a house.

- Debt deflation will be in play for a decade.

- Attitudes towards housing have changed. A few years ago people thought of housing as an ATM as well as a retirement plan. Most people now realize a house is a place to live and a mortgage is a liability not an asset.

- Attitudes toward debt have changed. Kids have seen their parents argue and worry about mortgage payments, credit card payments, and jobs. They will not want to get in trouble like their parents did.

- 15 million homeowners are underwater on their mortgage according to Moody's Economy.com. Those 15 million homeowners are literally trapped in their home unable to sell and unable to move.

In 2007 I wrote "2012 just might be a rather optimistic target for a bottom." That projection is looking reasonably accurate. At the time I made it, most thought I was off my rocker.

Even if by some miracle housing bottoms in the next year or so, the headwinds mentioned above will put a damper on home price appreciation for a decade.

There is absolutely no reason to rush to buy homes now and the idea that a housing shortage is coming soon or now is the best time ever to buy a home are both absurd.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.