Stock Market Flash Crash, Fat Finger or "Sell in May and Go Away"?

Stock-Markets / Seasonal Trends May 09, 2010 - 08:21 PM GMTBy: Dian_L_Chu

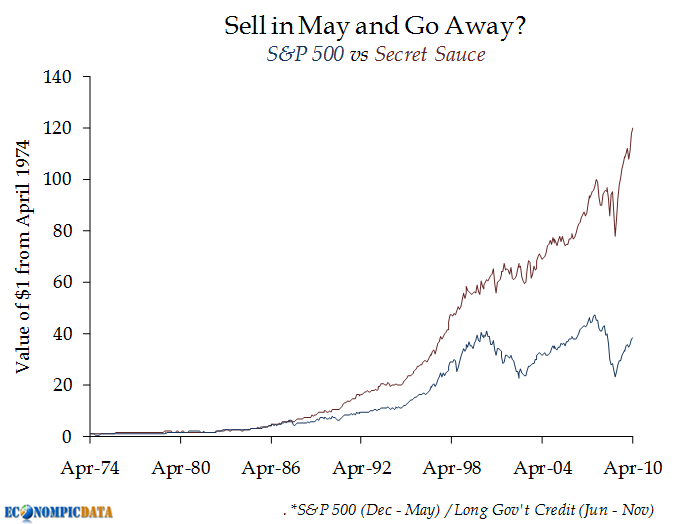

A seasonal stocks timing strategy--“Sell in May and Go Away”--holds that if you shift your holdings out of stocks into bonds and return to the market in November every year, you'll come out way ahead.

In such strategies, stocks are sold at the start of May and the proceeds held in bonds or a deposit account; stocks are bought again in the autumn, typically around Halloween.

Econompic recently compared the strategy--sell S&P 500 in May and then invest in the long government / credit bond index, versus a buy and hold S&P 500 strategy (note that these returns include reinvestment of dividends), and here are the results from 1974 to present:

The strategy seems to work, which defies the efficient-market hypothesis. Basically it works because of seasonal factors. End-of-the year bonuses, the Santa Claus rally, and first-quarter reports typically help lift stocks from November to April. May through October tend to be sketchy, and generally brings a period of portfolio housekeeping.

Coincidentally, Econompic posted this finding on May 4, 2010, two days prior to the "flash crash" on May 6, when Dow dropped 1,000 points and sparked a $1 trillion decline in stock values around the world.

Early on, according to stories circulating around the trading floor, Dow’s a thousand points of fright is the result of a "fat finger" trade that entered a sell order for billions when it was supposed to be for millions.

However,according to the preliminary federal investigation of trade data, the flash crash apparently involved "a series of high volume trades" in S&P futures originated on the Chicago Exchange, which seems to suggest "fat finger" is an unlikely catalyst.

More plausible, it was some big fat cats cashing in amid rising risks from Greek debt contagion, coupled with structural problems in the trading mechinism, rather than fat finger that caused the six minutes of terror on that fateful day at Wall Street?

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.