Gold Stocks Fortune-Making Anomaly is Starting to Close

Commodities / Gold & Silver Stocks Apr 06, 2010 - 03:52 PM GMTBy: Q1_Publishing

There’s a bull market building in small subsector of gold stocks.

There’s a bull market building in small subsector of gold stocks.

Those who pay close attention now will be set to make an absolute fortune. Here’s why.

A few months ago when new records were being set in gold prices, the herd was watching closely and falling all over themselves to buy gold.

From hedge fund manager John Paulson’s multi-billion dollar bet to ad blitzes from bullion dealers, everyone was buying gold.

Gold was the “hot” investment. Some of the best gold stocks were soaring. But everyone knew there would be corrections along the way.

The correction came over the last few months. But an extremely profitable trend has been emerging in a small sub-sector of gold stocks.

A Profitable New Trend in Gold Stocks

The chart below tracks the performance of gold prices, gold stocks (Market Vectors Gold Miners ETF - GDX), and junior gold stocks (Market Vectors Junior Gold Miners - GXDJ) since gold was more than $1200 an ounce last December:

As you can see, the correction has pretty much played out as should be expected.

At the bottom of the correction in early February, the price of gold fell more than 10%. The major gold miners fell about 25%. And junior gold miners fell more than 30%.

The full course of the correction, however, shows an anomaly is starting to emerge.

Junior gold stocks are outpacing the entire sector.

Since the top, gold prices are off 8%, junior gold miners are down 12%, and the big miners have fallen 20%.

The divergence where junior gold stocks outperform is set to continue into the future whichever gold prices go for one very simple reason.

Gold Stocks: Great, Greater, Greatest

The reason junior gold stocks will do exceptionally well is because despite the run-up in gold prices and renewed interest in gold stocks, they’re still so very cheap.

As we noted last November Geithner Signals Gold Stocks Going Much Higher:

The other gold sector which just got a lot more attractive in the past week has been junior gold stocks.

Since November 2007 when the McEwen Junior Gold Index was hitting all-time highs, gold prices have climbed 30% and the junior gold index is down 60%.

That’s just half the story though. Their outlook gets even brighter when you look at the big gold stocks. The Philly Gold/Silver Index (XAU), which tracks the major gold and silver miners, is down only 15% from its November 2007 highs.

This is a really simple one. Gold is up 30%, major gold stocks are down 15%, and junior gold stocks are down 60%. Which one would you like to buy now?

Since then, gold prices have gone nowhere and junior gold stocks have climbed.

The chart below compares gold prices, major gold miners, and the McEwen Junior Gold Index:

Junior gold stocks still offer the best value in the market. Gold prices are well above their 2008 highs. Major gold miners are have recovered too. Junior gold stocks meanwhile, continue, to lag far behind. The McEwen Junior Gold Index is actually still more than 20% below its 2008 levels.

No End in Sight for Gold Bull Market

That’s why we continue to foresee the biggest opportunity in junior gold stocks.

The gold bull market is showing no signs of ending anytime soon. And the Federal Reserve’s ongoing policy of near-zero interest rates is going push gold prices even higher.

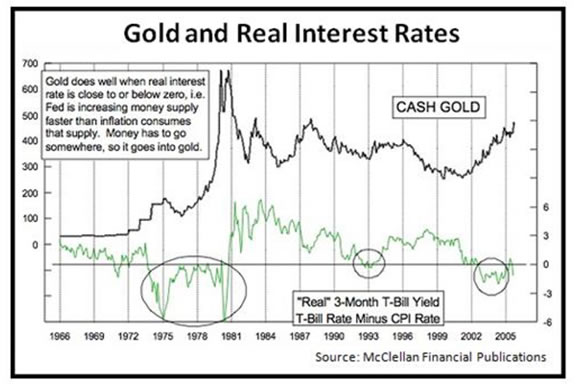

History proves low rates drive gold prices higher:

When rates are lower than inflation (a.k.a. negative real interest rates), gold prices soar.

Right now, with inflation running between 2% and 4%, real interest rates are in the same range as they were in the 1970s when gold prices ran up more 800%.

Now, we realize the Fed is probably a few months away from its first rate hike in years. But when they do increase rates, they’ll likely increase rates by one-quarter or half of a percentage point. Interest rates will still be extremely low and will continue to be for at least the next few years.

That means gold prices are going higher and fortunes will be made by investors who stick to juniors.

To give you an example, just take a look at what happened last year when we identified five significantly undervalued gold stocks in our most recent gold report.

The five gold stocks detailed in them climbed 1646% while the price of gold climbed 13% over six months time last year (follow this link to get your own copy of the report – 100% Free). That’s more than 100 times higher return than gold.

The gold bull market is alive and well. And investors focused on junior gold stocks are going to be walking away with fortunes in the next few years. Buy junior gold stocks now.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2010 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.