Where is the Value in the Precious Metals Sector?

Commodities / Gold & Silver Stocks Mar 11, 2010 - 11:48 AM GMTBy: Jordan_Roy_Byrne

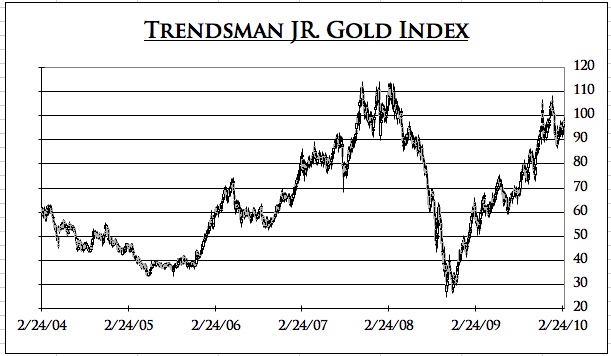

Even despite the tremendous recovery in precious metals shares, I still find value across the entire spectrum. The various indices (HUI, XAU & XGD.to) as well as my proprietary junior index (shown below) all rallied back to or near the 2008 high. Since that point, Gold is about 10% higher. It is more than 10% higher when priced in foreign currencies. Meanwhile, Oil, (which is 25% the cost of mining) is down about 30% (from March 2008). I bet most other cost inputs have declined in price.

Even despite the tremendous recovery in precious metals shares, I still find value across the entire spectrum. The various indices (HUI, XAU & XGD.to) as well as my proprietary junior index (shown below) all rallied back to or near the 2008 high. Since that point, Gold is about 10% higher. It is more than 10% higher when priced in foreign currencies. Meanwhile, Oil, (which is 25% the cost of mining) is down about 30% (from March 2008). I bet most other cost inputs have declined in price.

Assuming other things are held constant, the sector indices should be trading materially higher than their 2008 and 2010 highs. The average gold producer is set to produce excellent cash flow and margins. Simply put, Gold is higher and costs are lower.

Interestingly, the best value is now at the very bottom of the food chain. Some people call these the crap juniors or the garbage juniors. I refer to them as the lower tier juniors. While the seniors and quality juniors have essentially recovered their losses from the crash, the lower tier juniors have barely recovered. Most of these stocks could rise five-fold and still be well below their 2007 or 2008 high.

That being said, these stocks are a huge risk. Most of these companies will never produce an ounce of anything, nor will most define a resource that has a good chance of ever coming out of the ground.

Why am I writing about them?

At this juncture, 95% of the risk has been priced out of these stocks. They fell more than 95% and have barely recovered. Yet, in the same time frame, Gold rose $500 and to a new high. Moreover, gold producers should be seeing record margins in 2010 and 2011 and that would put them in a better position to acquire large and small juniors.

As it is, these stocks (the ones with real prospects) are already significantly undervalued. If these companies can execute and Gold rises to $2000/oz, their share prices could rise ten fold.

Here is an example of one particular company. The stock is in the latter stages of a bottoming formation. The only problem I have with the company is that its fully diluted share count is about 70% more than its current shares, which is typical of lower tier juniors. Nonetheless it has a seasoned management team. The company is a small producer with a plan to increase production and define their resources.

In our premium service we have started to focus a bit of attention on these lower tier juniors, in search of value and quality. We believe that the bulk of one’s gold stock portfolio should be in the quality junior producers. However, now is the time to take a look further down the food chain. These types of stocks have yet to move. Odds are they probably will when Gold makes its next move.

Jordan Roy-Byrne, CMT

http://www.trendsman.com

http://www.thedailygold.com

trendsmanresearch@gmail.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.