U.S. Real Estate Confusion or Lies?

Housing-Market / US Housing Mar 09, 2010 - 02:19 PM GMTBy: Mike_Stathis

Do you ever become confused over daily economic data?

Do you ever become confused over daily economic data?

If not, then you probably aren’t paying close attention.

But that’s not necessarily a bad thing.

If you don’t pay real close attention and spend a good deal of time analyzing what’s really going on, you’re probably better off not paying any attention to the data at all because it is designed to confuse you; to manipulate the truth.

Most often, government officials, Wall Street and industry hacks intentionally lie to you as a way to build confidence.

After all, most of these “analysts, chief economists and investment strategists” you hear about are really in the business of sales and marketing, NOT research.

And the Fed Chairman? Merely another cheerleader/politician, whose purpose is to permit extortion and fraud by the shareholders of the Federal Reserve.

In the best of scenarios, these so-called experts will be late to the party, most likely, drawing upon the research of real experts, who made accurate forecasts long before.

The most recent example of such confusion occurred just before Christmas, on December 22, 2009, when the following headline was blasted all over the newswires...“November Home Sales Soar 7.4%.”

As you can imagine, the moronic financial reporters attributed the day’s gains in the stock market to this bit of news; as if they know what moves the market.

As I’ve discussed previously, these claims of this and that driving the market higher or lower are wrong more often than they are right.

The point is that you had to read the report to know that the data was for home resales, not new home sales.

The article also quoted numbers from the real estate shill organization, the National Association of Realtors. According to this fraudulent organization, about 2 million homebuyers took advantage of the $8000 first-time homebuyers tax credit.

Despite this (unconfirmed) data, according to the article, the inventory of unsold homes on the market fell in November by 1% to 3.5 million. This number is wrong because it does not count homes in the closing process, nor does it count homes in the foreclosure process. As you can imagine, each of these processes typically last 2-4 months.

Furthermore, this number (unsold home inventory) says nothing about the millions of homes that homeowners want to sell but have not put on the market because they are waiting for a better real estate environment.

As mentioned in the past, I have estimated the total number of single-family homes for sale and vacant apartment units to be around 13 million.

Apparently, home builders have finally figured out the reality, as shown by the most recent data on new home starts below (although it took them a very long time to wake up).

Home sales hit a bottom in January of 2009. And it has only been government subsidies and special programs by Fannie and Freddie that have helped sales rebound from this low. However, more than one-half of the homes bought over the past two years have been foreclosures.

Click here to refresh your memory about Fannie and Freddie.

Adding to the confusion, the next day (December 23rd) the newswires reported that November homes sales plunged by 11%.

If you took the time to read both releases, you would have eliminated the confusion.

But very few people take the time to do that. They act impulsively.

This type of behavior can lead to a dangerous day-trading mentality.

The point I’m trying to make is that at best, these news releases are designed to make investors behave impulsively so that you don’t take the time to sit down and examine what’s really going on. At worst, they are designed to create the illusion of a strengthening recovery.

The report was startling considering the fact that the tax credit for first-time homebuyers was extended through April 2010. And a $6000 tax credit was added for homebuyers who relocated.

At the end of November, there were 235,000 new homes for sale; the lowest inventory level in nearly 40 years (since 1971). However, based on previous home sales data, that tiny amount still represents nearly 8 months of supply.

Furthermore, the home resale data was for contracts signed over the summer, while new home sales data was for contracts signed in November.

But who would expect new home sales to rise with millions of homes in foreclosure?

Why pay a premium when you can get a better price in the foreclosure market?

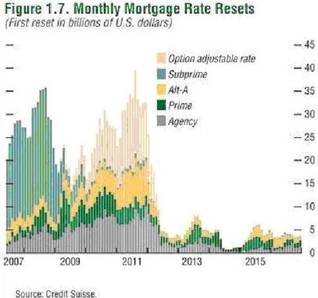

When you look at the big picture, things look a bit different. As mentioned in the last issue (as I have for over a year now), the big foreclosure avalanche begins in 2010 and will last through 2011, as most of the ARM and Alt-A loans reset during that period.

This serves as a fairly good indicator of where interest rates are headed. You shouldn’t expect short-term rates to move appreciably higher until at least Spring of 2010. They may not rise above 1% until after 2010.

As I discussed during the interview published in the December issue, when it comes to real estate driving the economy, that’s the type of argument used by the guys in Washington who specialize in creating a Ponzi scheme economy.

The tail can’t wag the dog. An improving real estate market isn’t the driver of the economy. A healthy economy drives real estate because people have jobs; they have incomes to pay for mortgages.

Thoughts of a bottom in real estate would boost consumer confidence, which would create more buyers. This would boost housing prices, which would further boost consumer confidence. Combined, this would boost the stock market—it’s a chain reaction within an endless loop.

This explains why Washington and Wall Street are trying desperately to generate a recovery picture.

Meanwhile, they continue to contradict their upbeat message by acting in opposition.

For instance, the recent removal of the previous $400 billion funding ceiling for Fannie and Freddie should raise some major concerns. This is a huge deal because it now means that these losers get a blank check.

Furthermore, the U.S. Treasury passed this monumental funding commitment without the approval of the Senate Finance Committee and other members of Congress (not that it would have made much of a difference, other than for these guys to showboat on C-SPAN to gain political points).

Understand that when people speak of a “bottoming” in real estate, they usually don’t specify their definition.

For some, bottoming means a pick up in housing starts; for others it means increased sales.

To me, it means real estate prices.

As such, I stand by my original forecast made three years ago for a median real estate price decline of 35% (upper end).

If I turn out to be correct, we probably reached the bottom in prices a few months ago. However, the bottoming process will take many months, perhaps a year. Thereafter, it will be a slow climb up.

You should also be aware of the fact that with most Americans in the red for their homes, it’s not only difficult to refinance, but it’s also virtually impossible for most that might be out of work to relocate for job opportunities.

You can’t sell your house if you owe more than its worth unless you have the cash to pay the bank the difference.

I would not expect there to be many unemployed homeowners who have the cash to pay off a mortgage deficit.

For several months, Fannie Mae has been offering refis at 125% of value as another desperate attempt to rescue the living dead who are being gouged by crooked banks that issued what I feel should be banned—ARMS and option-ARMS.

Apparently, the idiots in Washington have finally realized what’s in store for real estate in 2010 and 2011, as evidenced by the Federal Reserve’s $1.25 trillion purchase of toxic MBS, the recent removal of the $400 billion ceiling of government funds for Fannie and Freddie, the extension of the first-time homebuyer tax credit and expansion of a $6000 tax credit for homeowners who want to relocate.

In particular, the removal of the U.S. Treasury’s $400 billion loan cap to Fannie and Freddie is very odd because Fannie and Freddie have thus far used only $111 billion.

Moreover, the government has estimated that the losses from the GSEs is not expected to exceed $170 billion over the next ten years!

This estimate, made by the U.S. Treasury is a complete JOKE.

You might note an article I wrote last year stating that the $700 TARP would be lucky to cover the losses from AIG, Fannie and Freddie. I stand firm with that forecast.

I stand firm in my forecast that Fannie and Freddie will cost taxpayers more than $500 billion in losses before this mess has been cleaned up. In fact, this is the low end of my estimates; the absolute best-case scenario.

What is my upper-end estimate? $1.5 trillion.

All of this, and Fannie and Freddie have hired new clowns offering them up to $6 million. This adds another joke to the comical nature of the United States of America; a nation with characteristics of a banana republic.

At best, America is run by crony capitalism.

At worst, it has become a fascist dictatorship, run by a group of elitists.

Call it what you like, but it’s certainly not the nation of the past.

And the future does not look too bright from where I am standing.

Fannie’s new CEO, Michael Williams is just as clueless as his predecessors.

The same can be said of Freddie’s new CEO, Charles Haldeman, former CEO of Putnam investments; a mutual fund company!

Median residential home prices have already declined as low as 33% from the 2006 peak. With the big loan resets approaching, it appears as if my upper limit of 35% might be exceeded.

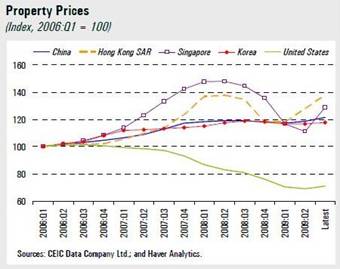

If you live in the U.S., Canada or the UK, when the topic of real estate pops up, it’s likely that all you hear about is how bad the market is.

Whether you are reading about the defaults, foreclosures, the collapse in house prices, or the problems faced by Fannie Mae or Freddie Mac, one would think that the global real estate market is suffering, but that would be an inaccurate assumption.

As you might imagine, with the economies in Asia and Latin America booming, these real estate markets are quite healthy.

As for America, you shouldn’t expect things to improve anytime soon.

Those who read America's Financial Apocalypse (2006) and Cashing in on the Real Estate Bubble (2007) were not only alerted to the catastrophe we see today, but were provided with SPECIFIC ways to profit that have yielded over 100% gains since then. See here for some examples.

I can guarantee you the chapter on the real estate bubble alone (chapter 10) serves as the most detailed and comprehensive analysis presented from any book solely dedicated to this bubble.

If you want access to institutional-level research, analysis and investment guidance, subscribe to the AVA Investment Analytics newsletter today. www.avaresearch.com

By Mike Stathis

www.avaresearch.com

Copyright © 2009. All Rights Reserved. Mike Stathis.

Mike Stathis is the Managing Principal of Apex Venture Advisors , a business and investment intelligence firm serving the needs of venture firms, corporations and hedge funds on a variety of projects. Mike's work in the private markets includes valuation analysis, deal structuring, and business strategy. In the public markets he has assisted hedge funds with investment strategy, valuation analysis, market forecasting, risk management, and distressed securities analysis. Prior to Apex Advisors, Mike worked at UBS and Bear Stearns, focusing on asset management and merchant banking.

The accuracy of his predictions and insights detailed in the 2006 release of America's Financial Apocalypse and Cashing in on the Real Estate Bubble have positioned him as one of America's most insightful and creative financial minds. These books serve as proof that he remains well ahead of the curve, as he continues to position his clients with a unique competitive advantage. His first book, The Startup Company Bible for Entrepreneurs has become required reading for high-tech entrepreneurs, and is used in several business schools as a required text for completion of the MBA program.

Restrictions Against Reproduction: No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the copyright owner and the Publisher. These articles and commentaries cannot be reposted or used in any publications for which there is any revenue generated directly or indirectly. These articles cannot be used to enhance the viewer appeal of any website, including any ad revenue on the website, other than those sites for which specific written permission has been granted. Any such violations are unlawful and violators will be prosecuted in accordance with these laws.

Requests to the Publisher for permission or further information should be sent to info@apexva.com

Books Published

"America's Financial Apocalypse" (Condensed Version) http://www.amazon.com/...

"Cashing in on the Real Estate Bubble" http://www.amazon.com/...

"The Startup Company Bible for Entrepreneurs" http://www.amazon.com...

Disclaimer: All investment commentaries and recommendations herein have been presented for educational purposes, are generic and not meant to serve as individual investment advice, and should not be taken as such. Readers should consult their registered financial representative to determine the suitability of all investment strategies discussed. Without a consideration of each investor's financial profile. The investment strategies herein do not apply to 401(k), IRA or any other tax-deferred retirement accounts due to the limitations of these investment vehicles.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.