Silver Stocks - Hecla Mining: Buy

Commodities / Gold & Silver Stocks Aug 03, 2007 - 08:18 AM GMTBy: Bob_Kirtley

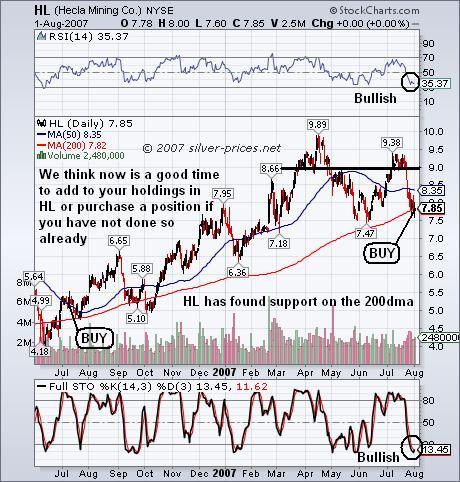

We are giving a BUY signal on Hecla Mining. It is has been marked as a BUY for a long time in our silver portfolio , but we are issuing an additional BUY signal as we think at this point one should add to any holdings in Hecla that one may have and if one has not yet established a position in this stock, now is the time to build that position.

Considering that the RSI and STO are looking bullish, as well as the fact that Hecla has gone through a significant pullback, we think now is a good time to buy some more Hecla. Hecla has broken its support level at around $9.00 and therefore has taken a sharp fall back to around $7.85.

The last BUY signal we have was on our gold website, www.gold-prices.biz , where we signalled a BUY on Kinross Gold , which went on to go on a great run , as we saw Kinross rising over 22% in the 22 days following our BUY signal.

From its recent high of $9.38, Hecla has fallen over 16% in just a few trading sessions, sparked mainly by the recent drop in silver prices. The slip in silver prices has halted at around $12.65 and now looks to consolidate in preparation for the next leg up. If silver prices can hold this level, it will be a significant technical signal as it represents the first higher low that silver has made in a number of months. If this higher low is followed by a rise significantly above $13.59, a higher high would have been made and so a new short term up trend in silver would be confirmed.

Higher silver prices should make for a higher Hecla share price and as we are predicting a major rally in silver at the end of the summer, this correction appears to be a good opportunity to buy Hecla.

Hecla certainly has been benefiting from higher silver price. In the first quarter of this year, their gross profit was US $16.42 million, US $1.91 million higher than the total profit for the whole year in 2006 where Hecla made a gross profit of US $14.51 million. In 2006, Hecla made an annual gross profit of US $73.42 million, their GP increased over 405% on the year before, helped by higher silver prices. However it is not just profits that are rising, we are also seeing Hecla's Net Profit Margin increasing as well, being 31.79% last year up from 16.84%. When our target of $20/ounce for silver is realised, we will see Hecla's profits going through the roof and the same thing will happen with the stock. With a market capitalisation of US $944.07 million, Hecla is large enough to offer us sufficient liquidity, but at the same time the company is not so large that it will respond sluggishly to rising silver prices.

Other silver stocks are also approaching entry points, but we are waiting for technical confirmation that their run down is coming to an end. We will keep our readers fully informed of any opportunities that we see in the silver market and silver stocks.

Hecla Mining trades as HL on the NYSE.

For ideas on which silver stocks to invest in, subscribe to the Silver Prices newsletter at www.silver-prices.net completely free of charge.

By Bob Kirtley

www.silver-prices.net

Bob Kirtley spent many years working on Oil projects including some in Alberta, such as the tar sands installations in Fort McMurray. He lived and worked in many different countries, as that is the nature of the construction business. Planning and cost control are key to a projects success and he tries to apply those disciplines on a daily basis when dealing with investments. His training in such areas as SWOT and Risk analysis can be applied from time to time. His qualifications include being chartered in the United Kingdom, which is similar to that of a Professional Engineer in Canada, along with a Masters Degree in Project Management from South Bank University, London, England.

He has been working for a number of years on a full time basis representing a group of investors in England.

DISCLAIMER : Silver Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.