Gold Miners Versus the S&P Index, Gimme A Break!

Commodities / Gold & Silver Stocks Nov 03, 2009 - 10:21 AM GMTBy: Adam_Brochert

Ratio charts help keep things in perspective for me. Until my "great awakening" regarding long term investment cycles, I thought everyone just bought and held stocks and then woke up 40 years later with enough money to retire. BWAHAHAHAHA! The paperbugs are a little bizarre due to their religious intensity beliefs in the power of Wall Street, for-profit central bankstas and government. I used to actually care about federal reserve interest rate announcements until I learned that they don't have the power to set interest rates at all - the market does that and the fed simply follows. If you believe otherwise, you might be a paperbug yourself.

Ratio charts help keep things in perspective for me. Until my "great awakening" regarding long term investment cycles, I thought everyone just bought and held stocks and then woke up 40 years later with enough money to retire. BWAHAHAHAHA! The paperbugs are a little bizarre due to their religious intensity beliefs in the power of Wall Street, for-profit central bankstas and government. I used to actually care about federal reserve interest rate announcements until I learned that they don't have the power to set interest rates at all - the market does that and the fed simply follows. If you believe otherwise, you might be a paperbug yourself.

We are in the middle of a nasty secular bear market that promises to be one for the ages. Why? Because this secular bear market must correct the excesses of the previous secular bull market. That is the job of a bear market. And anyone who looks at even the last century of history knows that the U.S. stock and real estate bubbles (not that they were the only ones around the globe, of course) that need to be corrected were in line with some of the greatest bull markets in history. Thus, the current bust/bear market ain't over by a long shot.

This isn't rocket science or some magical secret, but it does require a little digging to uncover the truth. It's not like CNBC is going to tell you to do anything besides stop worrying, be happy, and buy the S&P 500. Actually, I take that back. They will tell you to sell at panic bottoms and tell you to buy risky assets more dangerous than the S&P 500 at tops. Once you realize you're on your own, it is a little scary. I believe the Dow to Gold ratio uncovers some of the mystery behind markets. This beautifully simple ratio is what finally got me off my butt to start writing about markets.

The current Dow to Gold ratio is in a strong downtrend that is not close to being over. This is a multi-year trend that will continue until the ratio gets to 2, and quite likely to 1 or less this cycle due to the size of the previous bull market bubble in all things paper. It is not doom and gloom, you don't have to eat your Gold, you don't have to buy a log cabin (though they are nice if you like the woods), you don't even have to use the word "fiat" if you don't want to, but this cycle will play out as such cycles have throughout history.

Gold becomes a go to asset in this part of the cycle, also known as a Kondratieff Winter, because debt must be purged from the system. Debt purging means lots of debt defaults, which is bad for the paper aristocracy who makes the loans. So the paper aristocracy panics, changes the rules, dumps bad debt on taxpayers, prints more money/debt on the government tab and struggles to maintain its standard of living at any cost. This ain't the first time it's happened in history and it won't be the last. If you think the fed didn't pump up the money supply in the 1930s to unheard of/insane levels and that the government buying up crops and farm animals and destroying them to "support" prices isn't the equivalent of what's going on now, you've been reading too much revisionist/Keynesian history.

Anyway, when such things happen and the economy is tanking, there are few places to hide as an investor. The currency becomes a little scary because the paperbugs do everything in their power to destroy its value and re-start the boom. The deflationists say the paperbugs will not succeed and the inflationists say that they will. I say: "buy Gold and don't worry who is right because Gold will come out on top either way at least until the Dow to Gold ratio gets to 2." Pretty easy, huh?

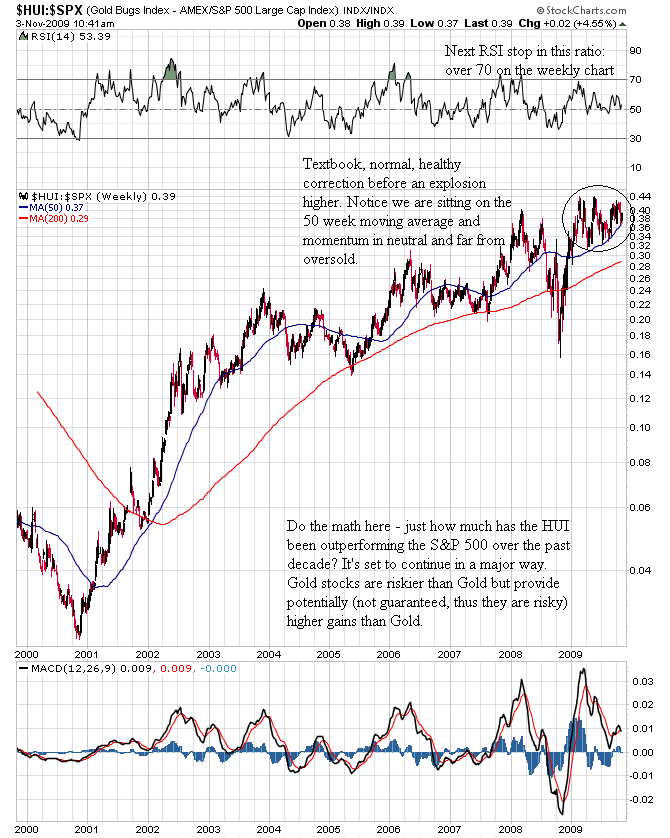

If Gold is the go to asset and best form of cash to hold during this cycle, those companies that dig cash out of the ground will be rewarded. This has been true in spades over the past decade and this trend is set to continue. Below is a gorgeous (that is, if you're not a paperbug) weekly ratio chart of the Gold Bugs Mining Index ($HUI) divided by the S&P 500 Index ($SPX) over the past 10 years:

This ratio is about to explode higher, as Gold stocks continue to outperform the S&P 500. The 15-16 fold higher return of the $HUI relative to the S&P 500 over the past 10 years is not the end. We still have the mania phase to go in the Gold stocks and the price of Gold. November thru January is a powerfully bullish seasonal time of year for the Gold sector and this year will be no different.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.