Connecting the Dots to the U.S. Housing Market Recovery

Housing-Market / US Housing Sep 29, 2009 - 02:12 AM GMTBy: Mark_B_Rasmussen

Dot 1

Dot 1

There is a “shadow market” of 2.7 million homes that are technically in foreclosure but are yet to be reclaimed by the lender, says a Wall Street Journal study today. While it’s no secret banks are kicking the can down the road on finalizing foreclosures (and consequently accepting the mortgage loan as a loss) this is the first guess at the total number of such homes that we’ve heard:

“As of July, mortgage companies hadn't begun the foreclosure process on 1.2 million loans that were at least 90 days past due,” says the study. “An additional 1.5 million seriously delinquent loans were somewhere in the foreclosure process, though the lender hadn't yet acquired the property. The figures don't include home-equity loans and other second mortgages.

“Moreover, there were 217,000 loans in July where the borrower hadn't made a payment in at least a year but the lender hadn't begun the foreclosure process. In other words, 17% of home mortgages that are at least 12 months overdue aren't in foreclosure, up from 8% a year earlier.”

The crash in U.S. home prices will probably resume because about 7 million properties that are likely to be seized by lenders have yet to hit the market, Amherst Securities Group LP analysts said. “The favorable seasonals will disappear over the coming months, and the reality of a 7 million-unit housing overhang is likely to set in,” they said. The amount of pending foreclosed-home supply has been boosted by more borrowers going into default, fewer being able to catch up once they do, and longer time periods to seize properties because of issues such as loan-modification efforts and changes to state laws, the New York-based analysts wrote.

The “huge shadow inventory,” reflecting mortgages already being foreclosed upon or now delinquent and likely to be, compares with 1.27 million in 2005, the analysts led by Laurie Goodman wrote today in a report.

The Census Bureau said that there were 18.8 million vacant homes (4.8 million seasonal/ vacation) in the second quarter of 2009. How many of these are owned by the unemployed, underemployed/marginally attached/discouraged workers 16.8% (U.6) August 2009 or the yield starved and un prepared baby boomers?

Dot 2

The foundation of The Faux Economy was that Americans are “consumers” not producers. The economic paradigm of the past 3 decades (global locust economics) has been spend yourself rich…we think, they sweat; we consume, they produce; we spend, they save; we borrow, they lend. Remember “The Wealth Affect” and “The Ownership Society”? Our Faux Economy was/is mostly composed of financial services (credit/debt growth and engineering, 44% of S&P profits 2 yrs. ago)-CCU, construction (all classes)-CCU, retail-ICU, leisure/hospitality (discretionary spending)-ICU, Automotive- (17 million to >10 million sales)-CCU. If the “consumer” represented 71% of the economy, how can we possibly avert the collapse of the Faux Economy? Where are the jobs going to come from? No jobs, no recovery!! Where’s my bubble? Do unemployed and under employed people purchase homes or make house payments?

ICU = Intensive Care Unit

CCU = Critical Care Unit

Dot 3

Let’s look at the “Baby Boomer” retirement group of apx.78 million Americans retiring over the next 9 years. This is where most of the income and private wealth of this country resides. This decade has marked the lowest savings rate and highest debt growth on record. Two of the largest losses of net worth have occurred over the past 9 years. Defined benefit pensions have declined over the past 20 years and the decline has accelerated. In 1980 38% Americans had defined benefit pensions, today it is <20% with the trend accelerating. Thirty seven percent of working Americans have no retirement savings. Social Security provides an average of 40% of pre retirement income. In 2004 the median retirement savings was $27,000. The only age group that had job growth over the past year was the over 55 category. How many of these “extra” homes are owned by the 78 million “Baby Boomers”? Will any of them sell to supplement their decimated retirements and nearly 0% savings returns (thank you Federal Reserve, you couldn’t have chosen a better time)? How many of these “Baby Boomers” will downsize as they reach retirement age over the next 10 years? This looks like a lot of potential inventory to me.

Today there are 6 workers for every new job. There are 1.3 million unemployed whose unemployment benefits will run out by the end of the year. The Federal government can extend those benefits but, this does not bode well for incomes. Don’t unemployment benefits put additional fiscal pressure on the broke states?

Dot 4

With banks currently unwilling to lend, the new federal triumvirate of the Obama administration, the Treasury and the Fed are trying to inflate the moribund U.S. housing market. This time around, however, the FHA is the weapon of choice. The Federal Reserve has purchased over $850 billion in mortgages over the past year to keep interest rates near a record low. The Federal government has instituted an $8,000 first time homebuyer tax credit. How many first time homeowners are there left? The Federal Government has created Help and Hope for Homeowners and other loan modification programs with dismal results. Federal officials knew they had to keep the mortgage spigot open, especially to suspect borrowers, so they turned to their new “secret weapon” – the FHA.

Some of the players may have changed since the first subprime-mortgage crisis, but the game apparently remains the same. The FHA has quadrupled its insurance guarantees on mortgages in just the last three years, with the bulk of that growth coming in the past two years. Currently, the FHA insures $560 billion of mortgages.

Two weeks ago, Ginnie Mae proudly announced that it had issued a monthly record $43 billion in FHA mortgage-backed securities, and through the end of July held guaranteed securities with a value of $680 billion. It is on track to exceed $1 trillion worth of guaranteed securities by the end of calendar year 2010. Earlier this summer, the U.S. Department of Housing and Urban Development (HUD), which oversees the FHA, raised concerns about FHA practices. On June 18, HUD released an internal inspector general’s report that revealed that the FHA’s default rate exceeded 7% and that more than 13% of its insured loans were delinquent by more than 30 days.

In a “Review and Outlook” piece, The Wall Street Journal reported that the FHA’s reserve fund dropped from 6.4% in 2007 to about 3% today, putting it dangerously close to its mandated 2% minimum. That translates to a “33-to-one leverage ratio, which is into Bear Stearns territory,” the newspaper report stated, referring to the now-failed investment bank that had been a central player in the original subprime mortgage crisis.

Eventually, defaults will overwhelm the FHA. And the hoped-for floor in residential real estate pricing will be pulled out from under us all. The next down-round in real-estate values will expose bank balance sheets for what they really are: Over-leveraged and over-stuffed with junk. Already on the ropes, banks will lose capital and will have to tighten the credit screws on consumer borrowers even more.

Can interest rates stay near record lows forever? What happens if and when they go higher?

Dot 5

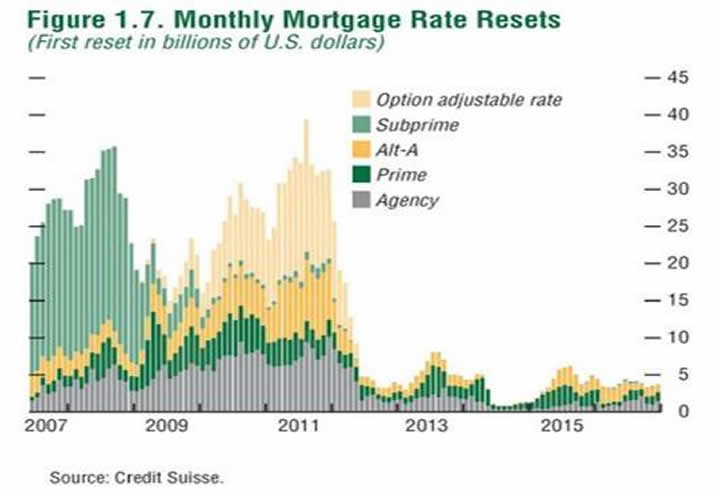

Option ARM’s aka “exploding ARM’s” are (loans where the borrower doesn’t even pay the accrued interest and that is added to the principal balance) adjustments peak 08/11. These are not to be confused with Subprime or Alt-A (liar loans/stated income). These are the loans where payments can double and triple in a month. Expect much higher default rates than sub-prime. Goldman Sachs expects 61% default rates – ever the optimists, Barclays Capital expects 81% default rates (me too), which is consistent with early resets this year. Most of these have growing principal balances with declining values. Refinancing is not an option. Maybe a 200% LTV.

In addition to the up coming Option-ARM/Alt-A debacle, we have a coincident Commercial Real Estate collapse. This should further impair bank balance sheets and lending.

By Mark B. Rasmussen

Mark is a real estate appraiser/broker by profession

Copyright © 2009 Mark B. Rasmussen

Mark B Rasmussen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.