When Gold Climbs Silver Soars, Silver Stocks Where Cheaper is Better

Commodities / Gold & Silver Stocks Jun 15, 2009 - 03:47 PM GMTBy: Q1_Publishing

Two weeks ago precious metals were as hot as ever. Gold prices were climbing. Gold stocks were doing even better. And silver prices were leading the way.

Two weeks ago precious metals were as hot as ever. Gold prices were climbing. Gold stocks were doing even better. And silver prices were leading the way.

The old adage, “when gold climbs, silver soars” was playing out perfectly. Gold booked its biggest monthly gain since November. Silver, however, climbed past $15 per ounce and had its biggest monthly climb in 22 years according to MarketWatch.

The old adage, “when gold climbs, silver soars” was playing out perfectly. Gold booked its biggest monthly gain since November. Silver, however, climbed past $15 per ounce and had its biggest monthly climb in 22 years according to MarketWatch.

Silver was showing its value as a dual-purpose commodity.

As an industrial metal, silver’s uses in healthcare, photography, and as a chemical catalyst (just to name a few) has made it more attractive as the economy shows signs of recovery.

As a precious metal, silver has been getting a lot of attention as the U.S. dollar shows continued weakness. Also, when the big money rotated around into gold and John Paulson’s big bet on gold were making headlines, gold was the hot sector. Silver was getting a lot more attention as an undervalued corollary.

Of course, sectors fall in and out of favor. Momentum traders have proven their willingness to quickly move onto something new. But if you’re looking for a long-term investment in silver, aside from silver ETF’s like the iShares Silver Trust (NYSE:SLV), silver mining stocks are the way to go.

The Cheaper the Better

As with all mining stocks, each of the major silver mining stocks offer many different qualities. Some of the higher cost producers offer greater leverage. Others offer greater value and a bit more downside protection. Still others offer very large silver reserves compared to the others.

The key factor we look at first at the Prosperity Dispatch though when comparing sector specific mining stocks is costs. With my investment research I’m looking for value and limited downside risk. In mining stocks that means low costs. Low cost operators provide downside protection because if commodity prices fall, they’re the last ones to close down. Depending on their costs, the other mix of metals produced, the low-cost producers can usually survive extended downturns.

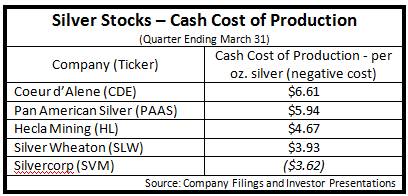

Below is a chart of the cash costs of silver produced. The cash costs are calculated by subtracting the revenues generated from the sale of byproducts like copper, zinc, and other base metals. In one case, after the base metal revenues are added into the mix, the costs are actually negative. (note: Silver Standard – SSRI – is not shown because not enough data exists because its production is much more recent)

As you can see, the cash costs for all the most actively traded silver miners vary widely. This is a result of different types of deposits and mixes of byproduct metal production. In this case, Silvercorp (NYSE:SVM) is the only one with a negative cash cost. In a way it gets paid to mine silver.

The costs will contribute directly to earnings, margins, and impact of any increases in production. So when it comes to valuation time, the costs will go a long way to determining premium valuations.

Lower isn’t necessarily better though. When it comes to safety, the lower the cost the better. When it comes to leverage, the higher costs the better. The basic rationale goes if something is barely or not profitable, it is worthless now. But if silver prices rise, it will be valuable. So it might not be as valuable, the jump from next to nothing to something is very big.

It’s not just costs though, we also have to look at relative performance to see how well these stocks have done during the last time silver prices went on a decent run.

Good Things Come to Those Who Wait

That’s why I’ve broken down where these silver mining stocks were trading when silver started to make its first big run past $15 per ounce back in late 2007.

The date I took for comparison purposes was November 7, 2007. This is the first real breakout above $15 for silver and eventually led to a relatively long and stable period when silver was trading for more than $15 an ounce. The chart below shows what the major silver companies were trading for then, now, and the decline they’ve all experienced.

As you can see, silver stocks have been hit pretty hard over the past year and a half. There are plenty of explanations for the decline.

First, very few sectors have defied the overall market decline. As leading investment manager David Burrows pointed out a few months ago when we sat down with him:

Burrows’ research concludes which stocks you invest in only account for 20% of the total return earned. Meanwhile, the overall market accounts for 50% and which sector you invest in accounts for 30% of returns.

Also, market volatility has been heavily impacted by sector rotations. Over the last year or so, the impact on individual sectors has been extreme. You have a sector go for a good run for a few months, watch a lot of new money bidding up the stocks in the entire sector, and a few months later the entire sector falls right back to where it was. A few recent examples we’ve covered have been shares of education, auto parts suppliers, and stem cell firms.

Finally, there is a general sense that this time around isn’t “the big one” for precious metals. Although there are plenty of reasons to be buying precious metals stocks now and holding for the long-term, it’s not likely the last buying opportunity in precious metals stocks.

Silver Set to Soar

Despite it all, everything is still in place for silver and silver stocks to do exceptionally well in the months and years ahead.

Whether the economy recovers and pushes precious metal safe havens down even lower in price or this is the time precious metals run much higher. History provides all the evidence.

The most important historical silver investment valuation method is the gold/silver ratio. The gold/silver ratio is the measure of how many ounces of silver can be bought for an ounce of gold. For instance, today gold/silver ratio sits at a relatively high at just over 63 (Gold -$939.4/Silver - $14.86).

When we look at how silver prices “slingshot” past gold prices, we identified how far away from normal the gold/silver ratio has gotten:

Right now, the gold/silver ratio is at an extreme. It’s slowly working its way back to historical norms which are much lower.

Over the long term, the gold/silver ratio has averaged about 30. That means one ounce of gold would buy about 30 ounces of silver. The gold/silver ratio hung around 50 for most of 2008.

Today, with silver at $14.60 an ounce and gold at $953, the gold/silver ratio is 65. In other words, an ounce of gold would buy 65 ounces of silver. That’s more than twice the long-run average.

Right now, silver is in great position to do well over the short-term and long-term. It has all the attributes to perform in any type of economic environment. Whether we face deflation (and the inflationary money printing to offset it), inflation, or hyperinflation, silver (and therefore silver stocks) is set to go much higher.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2009 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Q1 Publishing Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.