U.S. Mortgage Market Remains Solidly Frozen

Housing-Market / US Housing Jun 11, 2009 - 04:20 AM GMTBy: Mike_Shedlock

On May 28 I wrote Mortgage Market Locks Up. Ten year treasury yields started to soar and 30 year mortgages for good borrowers jumped a full point from 4.5% to 5.5%.

On May 28 I wrote Mortgage Market Locks Up. Ten year treasury yields started to soar and 30 year mortgages for good borrowers jumped a full point from 4.5% to 5.5%.

The question on my mind at the time was whether or not the mortgage action was a brief outlier. It wasn't. Things are now worse.

Two days ago Michael Becker, a Mortgage Consultant at Green Pastures Mortgage & Finance wrote:

Mish, I’ve attached two rate sheets to this e-mail. One shows the rates from May 21st, and the other from today June 5th (after a re-price). You can see on May 21st 4.625% was paying .375 points, and today 5.625% is paying .25 points.

So in a little over 2 weeks rates have jumped 1%. That is a huge jump.

When you add in the effect of the new Home Valuation Code of Conduct (HVCC) appraisal process, many loans originations will never close. This is because it is taking 15-25 days to get an appraisal back, and often those appraisals are coming 10-25% low. So locks expire or appraisals kill the deal, the latter possibly on purpose.

You are going to see the recovery in housing come to a complete halt. Trade up buying is already dead.

Michael BeckerOn Wednesday I called Jeff Bell a Certified Mortgage Planning Specialist at Cobalt Mortgage for his take on the situation.

Jeff commented: "Mortgage rates jumped again to 5.75% and refis are frozen solid. The trade-up market is dead but some new houses are still moving .... for now. "

Fannie Mae 4.5% Mortgage Backed Securities

The current price is 96.66%. Compared to a couple short weeks ago, that is a crash.

Interestingly Jeff Bell also commented on the new Home Valuation Code of Conduct (HVCC), and is not too pleased with it.

One problem is lenders are requiring applicants to put up $500 for appraisals and if the amounts do not come in, even if they miss by a tiny bit, the deal is denied and the applicant is out $500. Jeff had a $1.2 million sale fall through because an appraisal was $20K short.

A couple years back lenders were letting anything slide, now they appear to be looking for excuses to kill any deal, especially with the recent spike in rates. If the appraisal and paperwork is not perfect, goodbye loan and goodbye $500 appraisal fee. Customers are not too happy to say the least.

Two weeks ago when rates were hovering around 5.5% Mark Hanson commented "Mortgage banks that made unhedged commitments at 4.25-4.75% are now in a position to lose substantial sums of money." Today it's an even bigger loss.

Mark thinks that new loan applications will dry up above 5.5%. Michael Becker and Jeff Bell made similar comments.

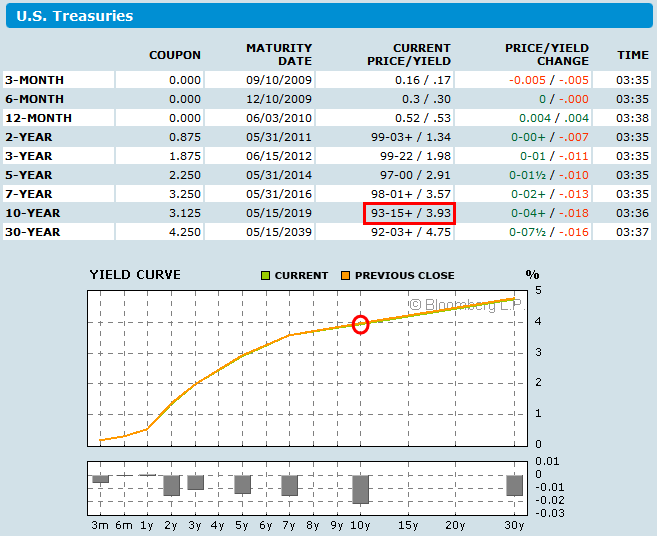

10-Year Treasuries yielded 3.73% on May 28. The yield is 3.93% today.

Treasury Yield Curve 2009-06-11

Interest Rate Buydowns Dead, ARMs Alive

Refis and trades up are not the only things dead. A couple weeks ago when rates started to spike, one could have paid a point or less and bought the rate down to 4.5-4.75%. Now, Jeff Bell informs me that the same buydown today might cost as many a 6 points! Wow!

Obviously no one will be willing to pay that much for a buydown. Instead, ARMs are back in vogue and 4.75% is doable on a 5 year ARM.

Excuse me for asking, but aren't ARMs resets and recasts one of the problems we are currently facing?

Mortgage-Bond Yields Climb to New High Since Fed’s Buying Plan

Please consider Mortgage-Bond Yields Climb to New High Since Fed’s Buying Plan.

Fed Is Out Of ControlYields on Fannie Mae and Freddie Mac mortgage securities rose, setting a new high since the Federal Reserve announced plans to buy the bonds to drive down interest rates on new home loans and further thwarting the effort.

U.S. mortgage applications fell last week to the lowest level since February as a jump in borrowing costs discouraged refinancing and signaled that Fed Chairman Ben S. Bernanke’s bid to cap rates is stalling, according to Mortgage Bankers Association data released today.

The Fed initially said on Nov. 25 that it would buy as much as $500 billion of mortgage securities, before announcing in March that it would expand the program to as much as $1.25 trillion, as well as buy $300 billion of Treasuries.

What now Big Ben? You've already blown over a third of your $1.25 trillion commitment and all you have to show for it is more garbage on your balance sheet and a locked up refi market.

One thing is clear, Ben Bernanke and the Fed have lost control of the mortgage market (not that the Fed was ever in control in the first place). They weren't. It was all an illusion.

For now, the stock market is shrugging this off. If rates stay above 5.5% for long, don't expect that to last. And it may not last anyway.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.