Thursday, January 10, 2019

Jaguar Land Rover Car Crash 6000 Jobs Cut! / Companies / Auto Sector

By: Nadeem_Walayat

Today Jaguar Land Rover announced 4,500 job losses most of which will take place in the UK that comes on the back of last years announcement to cut 1500 jobs as the car manufacturer puts the blame on a China slowdown, a slump in demand for diesel vehicles as the trend towards electric cars gathers pace and of course BrExit uncertainty.

Read full article... Read full article...

Thursday, January 10, 2019

America's New Africa Strategy / Politics / GeoPolitics

By: Dan_Steinbock

Recently, the White House released its new U.S. Africa strategy, which seeks militarization and portrays China as a threat. Both are misguided. Africa can greatly benefit from Chinese and U.S. economic development.

Recently, the White House released its new U.S. Africa strategy, which seeks militarization and portrays China as a threat. Both are misguided. Africa can greatly benefit from Chinese and U.S. economic development.

On December 13, 2018, U.S. National Security Adviser John Bolton gave a speech in the conservative Heritage Foundation about the Trump administration’s new “Africa strategy,” based on Trump’s ‘America First’ foreign policy doctrine.

In the United States, the media focus was on Bolton’s attack against U.S. adversaries and American aid. Specifically, Boston accused Russia and China of “predatory practices” in Africa.

Thursday, January 10, 2019

Will Powell’s Put Support Gold? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

Fed signals more patience with its monetary tightening, despite strong economy. Why? And what does it mean for the gold market?

Fed signals more patience with its monetary tightening, despite strong economy. Why? And what does it mean for the gold market?

Minutes from December FOMC Meeting and Gold

As everybody knows, in December the FOMC voted unanimously to raise interest rates for the fourth time in 2018. We have analyzed the implications of that hike for gold in two editions of the Gold News Monitor (here and here).

However, yesterday, the Fed published the minutes of its latest monetary policy meeting. The document shows that despite the apparent unanimity, the tensions were growing, as a “few” officials were actually arguing for the central bank to pause:

Read full article... Read full article...

Thursday, January 10, 2019

Stock Market Simple Day Trades – Gap Windows and Price Spikes / InvestorEducation / Stock Index Trading

By: Chris_Vermeulen

Every short-term trader wishes they had a strategy they could rely on for 1-5 trades a week. Well, two of my favorite intraday trade setups I discovered during my 23 years of trading everything from stocks, ETF’s, options, currencies, and futures 24 hours a day I am going to be sharing to subscribers of the Wealth Building Newsletter where these strategies and charts update live throughout the trading day for them to follow and trade the signals that are generated.

Thursday, January 10, 2019

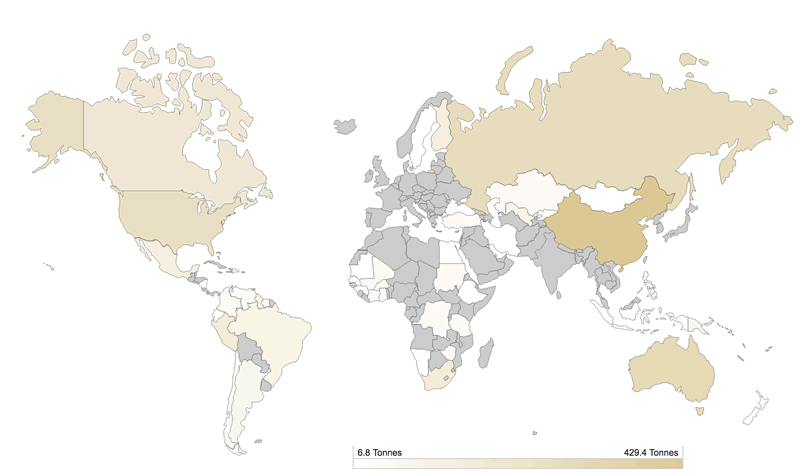

Gold Mine Production by Country / Commodities / Gold & Silver 2019

By: Michael_J_Kosares

Gold mine production by country Divergent paths among the major global producers tell an important tale

Read full article... Read full article...

Sources: MetalsFocus and the World Gold Council with permission.

Thursday, January 10, 2019

Gold, Stocks and the Flattening Yield Curve / Stock-Markets / Financial Markets 2019

By: Gary_Tanashian

The 3 Amigos were a blogger’s way of not boring himself to death while fleshing out important macro indicators month after month.

The 3 Amigos were a blogger’s way of not boring himself to death while fleshing out important macro indicators month after month.

Amigo #1 (SPX/Gold ratio) got home and dropped from target. What’s more, it has taken back the ratio’s equivalent of the entire Trump rally and that is an eventuality we are very open to on nominal SPX as well.

The gaps are interesting and among several possibilities for 2019 we could see fear, loathing and a fill of the lower gap (a greed gap of sorts) prior to a filling of the upper gap, which could blow out the stock bull in manic fashion one day. Relax, it’s just one of several possible road maps. For now, we simply state that SPX/Gold reached a very viable target and dutifully dropped with the market stress.

Read full article... Read full article...

Thursday, January 10, 2019

Silver Price Trend Forecast Target for 2019 / Commodities / Gold & Silver 2019

By: Nadeem_Walayat

My long standing approach to Silver is one of buying when cheap to invest and forget, for it only tends to come alive towards the end of precious metals bull runs as illustrated the last time I took a look at Silver on the 8th of May 2018 -

My long standing approach to Silver is one of buying when cheap to invest and forget, for it only tends to come alive towards the end of precious metals bull runs as illustrated the last time I took a look at Silver on the 8th of May 2018 -

Silver Forecast 2018 and Beyond, Investing for the $35+ Price Spike!

In terms of a Silver market position then as is currently the case the silver market can usually be expected to be a dead market with the tendency to flat line not just for many months but even years as it tends to play second fiddle to Gold in terms of tradable swings, usually only really coming alive towards the latter stages of precious metal bull markets.

Read full article... Read full article...

Wednesday, January 09, 2019

Warning: This Stock Market Rig is Going to End Terribly / Stock-Markets / Stock Markets 2019

By: Graham_Summers

This is getting old.

This is getting old.

The PPT is now juicing Oil higher, because doing so relieves stress in the junk bond market (a large percentage of junk bond issuers are shale companies that require higher Oil prices to be profitable).

This, in turn, is sending a “all clear” signal to stocks, inducing algos to buy indiscriminately.

Read full article... Read full article...

Wednesday, January 09, 2019

How Waymo Will Destroy Uber / Companies / Self Driving Cars

By: Stephen_McBride

Google’s Waymo has officially launched the world’s first self-driving, ride-sharing service! Residents in four Phoenix suburbs can now ride around in its robo-taxis for a small fee.

Google’s Waymo has officially launched the world’s first self-driving, ride-sharing service! Residents in four Phoenix suburbs can now ride around in its robo-taxis for a small fee.It’s one of the biggest disruptive forces in America.

In RiskHedge, I recently explained why self-driving cars are going to gut the auto industry like a fish. And Phoenix is only the first step in Waymo’s domination of American roads.

Read full article... Read full article...

Wednesday, January 09, 2019

Are Changing Prices to San Francisco Starter Homes Enough? / Housing-Market / US Housing

By: Harry_Dent

Bubbles ultimately die of their own extremes, although it always helps to have a trigger like the subprime crisis in 2006.

Bubbles ultimately die of their own extremes, although it always helps to have a trigger like the subprime crisis in 2006.But the San Francisco area takes the cake when it come to the U.S. real-estate bubbles! (That Canadian honor goes to Vancouver and in Australia it’s Sydney and Melbourne.)

And prices have started to fall, albeit slowly, despite no slowdown in the economy and only modestly rising interest rates thus far.

Why?

Because of the insanity of home prices there! They’re massively overpriced, especially in the large and critical starter-home market.

Read full article... Read full article...

Wednesday, January 09, 2019

Silver Price Trend Forecast 2019 / Commodities / Global Debt Crisis 2019

By: Nadeem_Walayat

This is the 4th and final article in this series that concludes in a trend forecast for the Silver price 2019.

- Silver Price Trend Forecast 2018 Review

- Gold - Silver Ratio

- Silver Price Trend Analysis 2019

- Silver Price Trend Forecast Conclusion for 2019

The whole of this analysis has first been made available to Patrons who support my work.

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Read full article... Read full article...

Wednesday, January 09, 2019

Good News for Land Rover as US Sales Soar to New Record, But Facing China Headwinds 2019 / Companies / Auto Sector

By: N_Walayat

Finally some good news for Jaguar Land Rover as it's US sales soared by 24% during December 2018 to a total of 14,080 cars, ending a great year for JLR in the US seeing sales surge to nearly 123,000, up from the 114,300 for 2017, with the US now accounting for approximately 28% of total sales.

Read full article... Read full article...

Wednesday, January 09, 2019

There Goes Tesla’s Tax Break / Companies / US Auto's

By: Rodney_Johnson

As I’ve written before, Tesla (Nasdaq: TSLA) has many problems, including quality control (it now ranks 27th out of 29 vehicle makes, according to Consumer Reports) and a quick burn rate.

As I’ve written before, Tesla (Nasdaq: TSLA) has many problems, including quality control (it now ranks 27th out of 29 vehicle makes, according to Consumer Reports) and a quick burn rate.But one issue hit harder on New Year’s Day than all the others.

Because the car company reached the milestone of selling 200,000 electric vehicles in the second quarter of 2018, the tax credit associated with buying a Tesla was cut in half on January 1, from $7,500 to $3,750, and will decline again before disappearing completely in early 2020.

Read full article... Read full article...

Tuesday, January 08, 2019

An Investment Lesson from Puerto Rico / Stock-Markets / Investing 2019

By: Rodney_Johnson

It takes two and a half hours to fly from Miami to San Juan, Puerto Rico, but the island might as well be on the other side of the planet.

It takes two and a half hours to fly from Miami to San Juan, Puerto Rico, but the island might as well be on the other side of the planet.Even though it’s a U.S. territory and it’s a shorter flight from Miami to San Juan than to L.A. or even Washington, the place is the epitome of out-of-sight, out-of-mind.

When’s the last time you considered the tough conditions on the island?

Hurricane Maria flattened the place more than a year ago, and quickened the pace of migration from the island to Florida, leaving behind the vulnerable population.

Read full article... Read full article...

Tuesday, January 08, 2019

Wall Street Drools over Fishy Jobs Report / Stock-Markets / Economic Statistics

By: MoneyMetals

The Bureau of Labor Statistics delivered a blowout jobs report on Friday. Headline chasing algorithms and investors responded by snapping up stocks. They also sold some gold and silver futures, driving prices lower on the day.

The Bureau of Labor Statistics delivered a blowout jobs report on Friday. Headline chasing algorithms and investors responded by snapping up stocks. They also sold some gold and silver futures, driving prices lower on the day.

To Wall Street cheerleaders, it looked like the stock market correction might be over and precious metals would be headed out of fashion, once again.

It looked like something else to anyone who read past the headlines. What a Potemkin Village the markets have become!

Tuesday, January 08, 2019

Did Strong December Payrolls Push Gold Prices Up? / Commodities / Gold & Silver 2019

By: Arkadiusz_Sieron

December payrolls were strong – but gold prices rose. What happened?

December payrolls were strong – but gold prices rose. What happened?

Job Creation Surprises Positively

U.S. nonfarm payrolls accelerated in December, beating expectations. The economy added 312,000 jobs last month, following a rise of 176,000 in November (after an upward revision) and significantly above 182,000 forecasted by the economists. The number was the biggest increase since February 2018. On an annual basis, the pace of job creation increased slightly last month to 1.8 percent.

What is important is that the gains were widespread, but the most impressive expansion occurred in education and health services (+82,000), leisure and hospitality (+55,000) and professional and business services (+43,000).

Read full article... Read full article...

Tuesday, January 08, 2019

Here’s Why Trump Could Soon Turn on Europe / Politics / GeoPolitics

By: John_Mauldin

2018’s Buenos Aires G20 summit was a chance for world leaders to forge common ground on important global issues.

2018’s Buenos Aires G20 summit was a chance for world leaders to forge common ground on important global issues.

That’s not exactly what happened. But President Trump’s trade discussion with Chinese president Xi Jinping looked initially like a bright spot.

They agreed to stop making things worse for a few months, at least. Markets were more skeptical after digesting the news. And rightly so.

Tuesday, January 08, 2019

How to Spot A Tradable Stock Market Top? / Stock-Markets / Stock Markets 2019

By: Chris_Vermeulen

If you are a long-term investor, swing trader, or day trader, then you could find one or all of the charts below interesting. What I am going to briefly cover and show you could make you think twice about how you are investing and trading your money.

If you are a long-term investor, swing trader, or day trader, then you could find one or all of the charts below interesting. What I am going to briefly cover and show you could make you think twice about how you are investing and trading your money.

I will be the first to admit you should not, and cannot, always pick market tops or bottoms, but there are certain times when it’s worth betting on one.

Below I have shared three charts, each with a different time frame using daily, 30 minutes, and a 10-minute chart. Each chart also has a different technical analysis technique and strategy applied.

Read full article... Read full article...

Tuesday, January 08, 2019

Why 90% of Traders Lose / InvestorEducation / Learn to Trade

By: Nadeem_Walayat

The failure rate for financial market and commodity traders has remained at a consistently high 90% for many decades, this despite all of the advances in information technology, flood of new learning materials that is churned out annually, therefore why is it that 90% of traders still end up losing?

In my opinion, a high 90% of traders are destined to lose because they are in fact listening to those 90% of failed traders who proceeded them that went on to comprise what is trading markets sales industry, perpetually churning out a never ending stream of materials, methods and signal services of how to trade, that invariably don't pan out in reality.

In my opinion, a high 90% of traders are destined to lose because they are in fact listening to those 90% of failed traders who proceeded them that went on to comprise what is trading markets sales industry, perpetually churning out a never ending stream of materials, methods and signal services of how to trade, that invariably don't pan out in reality.

Then there is the commentariat, again 90% of which comprises failed traders. Who may have tried to trade but failed so have gone on to become market reporters, mostly providing rear view mirror in hindsight market commentary, or so vague in outlook that all eventualities are covered as they hope to become the next big media stars, appearing on the likes of CNBC so as to turn failure to trade into full time media careers and thus perpetuate a continuous cycle of failing traders guiding new traders towards a similar fate.

Read full article... Read full article...

Tuesday, January 08, 2019

Breadth is Very Strong While Stocks are Surging. What’s Next for Stocks / Stock-Markets / Stock Markets 2019

By: Troy_Bombardia

As the S&P 500 makes a sharp upwards reversal towards its 38.2% fibonacci retracement, the U.S. stock market’s breadth is surging and risk-off assets (USD) are falling.

As the S&P 500 makes a sharp upwards reversal towards its 38.2% fibonacci retracement, the U.S. stock market’s breadth is surging and risk-off assets (USD) are falling.

This combination of extremely strong breadth and a decline in risk-off assets often leads to short term weakness before a bigger medium term rally, but sometimes was a part of V-shaped recoveries. Moral of the story: focus on the medium term instead of the short term. Although V-shaped recoveries are unlikely, there are not impossible.

Go here to understand our fundamentals-driven long term outlook.

Let’s determine the stock market’s most probable medium term direction by objectively quantifying technical analysis. For reference, here’s the random probability of the U.S. stock market going up on any given day.

Read full article... Read full article...