Category: Stock Market 2021

The analysis published under this category are as follows.Monday, March 15, 2021

Resting Stock Bulls and Gold Question Mark / Stock-Markets / Stock Market 2021

By: Monica_Kingsley

Stock bulls went right for all time highs yesterday, clearing the 3,900 threshold in this correction – one that is in its very late innings indeed. But the preceding upswing has been sharp, and not all the internals support such a swift recovery, which is why I am still looking for consolidation to strike at any moment.

We might be actually experiencing such a daily one right now, as today‘s premarket session has sent S&P 500 futures a few dozen points down. The big picture is though one of of the stock market getting used to rising rates, which are rising in reflection of the economic growth. But what about the snapback short-term rally in long-term Treasuries?

It‘s not materializing as the instrument went down again yesterday – unconvincingly bobbing above recent lows. The defensive sectors such as consumer staples and utilities, reversed yesterday (at a time when technology rose), sending a warning that we‘re about to see higher rates again. Probably not happening as fast as through Feb, but still. Let‘s bring up my recent perspective on high rates, what they are exactly:

(…) the „high rates“ we‘re experiencing currently, do not compare to the early 1980s, which underscores the fragility of the current monetary order. The Fed knows that, and it has been evident in the long preparatory period and baby steps in the prior rate raising and balance sheet shrinking cycle.

The market will see through this, and the central bank would be forced to move to bring long-term rates down through yield curve control or a twist program, which would break the dollar, drive emerging markets, and not exactly control inflation – real rates would drop like a stone in such a scenario, turning around gold profoundly.

But the market knows the Fed isn‘t getting ready to really do anything more than it does right now. Gold rebounded on Tuesday, and the rally took it above $1,730 but the daily reversal is concerning. As I wrote yesterday in the title, the gold bulls can‘t rest – but they are resting, and prices are back at the lower end of the $1,720 volume profile.

Read full article... Read full article...

Sunday, March 14, 2021

What Stock Market Lessons Can We Learn From Yoda - The Jedi Master? / Stock-Markets / Stock Market 2021

By: Avi_Gilburt

Over the last 9 years since we opened Elliottwavetrader, I have had the privilege of training thousands of investors, traders and money managers regarding how to appropriately view the stock market from an honest and objective standpoint. And, during that time, I have just about seen it all when it comes to the wide array of perspectives with which people approach the market.

So, in this article, I am going to tap into some of the brilliance presented in the teachings of the Jedi Master - Yoda, and will apply it to my experience in training thousands of investors, traders and money managers. I will also be bolstering these lessons with what our members have actually said about these truths regarding the market.

YODA: “Ready are you? What know you of ready? For eight hundred years have I trained Jedi. My own counsel will I keep on who is to be trained. A Jedi must have the deepest commitment, the most serious mind.”

Read full article... Read full article...

Saturday, March 13, 2021

Dow Stock Market Elliott Wave Analysis / Stock-Markets / Stock Market 2021

By: Nadeem_Walayat

My commonsense interpretation of EWT continues to resolve in accurate outcomes as the chart of my last analysis implied to expect a strong 5 wave impulse advance into 2021 that has come to pass.

Read full article... Read full article...

Thursday, March 11, 2021

Dow Stock Market Long-term Trend Analysis / Stock-Markets / Stock Market 2021

By: Nadeem_Walayat

The Dow has broken out to new all time highs above 29,600 which successfully held as support during the January correction.

Read full article... Read full article...

Thursday, March 11, 2021

Stock Market Pullback that’s largely driven by Tech and Growth Stocks / Stock-Markets / Stock Market 2021

By: Troy_Bombardia

Last week saw a wide divergence in the stock market. Sectors that exploded higher after March 2020 (e.g. tech, IPOs, growth stocks) saw sharp drawdowns while sectors that lagged significantly (e.g. energy & finance) are catching up. In this Market Report I will highlight a few indicators that matter right now. But more importantly, I’ll discuss how we’re investing & trading in this environment because at the end of the day, the only thing that matters is how you’re positioned. Everything else is just noise.

Read full article... Read full article...

Thursday, March 11, 2021

Yet Another Bubble And Stock Market Crash Article / Stock-Markets / Stock Market 2021

By: Avi_Gilburt

If I see another article calling this market a bubble, or that the crash is coming, or claiming that “the party is over,” I am seriously going to scream. But, I guess we should thank all these article writers as they are adding bricks to the wall of worry that we will climb in 2021.

I mean, have you ever seen a crash when everyone, and their mother, grandmother, uncle, aunt, and aunt’s cat knew it was coming? In fact, I got calls from many of my relatives asking me whether they should get out of the market since all they are hearing is that we are going to get a repeat of the March 2020 crash.

As an individual investor, you are undoubtedly bombarded by information throughout the internet. While some of it is bullish and most are normally bearish (as bearishness seems to sell better), it is quite a challenge to be able to distinguish the wheat from the chaff. Unfortunately, the great majority of the information resides within the chaff, and often causes investors to focus upon their fear more so than profitable information.

Read full article... Read full article...

Tuesday, March 09, 2021

This Isn’t Your Father’s Overvalued Stock Market / Stock-Markets / Stock Market 2021

By: John_Mauldin

Many analysts contend that current stock valuations resemble the dot-com era. You can see it visually at CurrentMarketValuation.com. Some highlights…

The classic “Buffett Indicator” certainly seems to be in nosebleed territory. Notice that the valuations in 1966, the beginning of a long-term bear market, were also high.

Read full article... Read full article...

Tuesday, March 09, 2021

Stock Market Great ADP Figures But Things Can Still Turn Nasty / Stock-Markets / Stock Market 2021

By: Submissions

Powell gave a wait-and-see answer to my yesterday‘s rhetorical question about the bears just starting out, indeed. The S&P 500 plunged, breaking far outside the Bollinger Bands confines, illustrating the extraordinary nature of the move. Rebound would be perfectly natural here (and we‘re getting one as we speak) – but will it be more than a dead cat bounce?

Stocks partially recovered from last Friday‘s intraday plunge, and good news about the stimulus clearing House followed after the market close – stock bulls took the opportunity, and Monday‘s session gave signs that the worst is over. Tuesday‘s move partially negated that, but even after Wednesday, the short-term case was undecided (even as tech kept acting relatively weak).

Yesterday‘s session though gives the short-term advantage to the bears, and that‘s because of the weak performance I see in other stock market indices and bonds. The Russell 2000 got under pressure, negating what by yesterday still looked like a shallow correction there. So did the emerging markets and their bonds. More downside can materialize either suddenly or slowly over the coming say 1-2 weeks. It depends on the tech and its heavyweight names, where these find support.

Read full article... Read full article...

Tuesday, March 09, 2021

U.S. Stocks: Here's a Big Sign That "Sentiment Cannot Get Much More Extreme" / Stock-Markets / Stock Market 2021

By: EWI

The stock exposure of the most bearish active investment managers is revealing

Relatively few investors want to bet against the stock market rally.

As a Feb. 18 financial article says (CNBC):

Short interest in the market has fallen to near-record lows.

Indeed, bullish sentiment is so extreme that even the most bearish among a group of professionals are behaving bullishly.

Read full article... Read full article...

Monday, March 08, 2021

It is Time for Stock Market Investor Caution? / Stock-Markets / Stock Market 2021

By: Andre_Gratian

Current Position of the Market

SPX Long-term trend: There is some evidence that we are still in the bull market which started in 2009 and which could continue into the first half of 2021 before coming to an end.

SPX Intermediate trend: SPX is not likely to end its intermediate trend until it reaches about 4150.

Analysis of the short-term trend is done daily with the help of hourly charts. They are important adjuncts to the analysis of daily and weekly charts which determine longer market trends.

Read full article... Read full article...

Sunday, March 07, 2021

US Treasury Yields Rally May Trigger Stock Market Crazy Ivan Event / Stock-Markets / Stock Market 2021

By: Chris_Vermeulen

In the first part of this research series, published yesterday, we explored the rising Yields and how my team and I expect markets to react to the new level of fear that may begin to enter the global credit markets. Rising Yields suggest investors believe the future risks to the global economy don’t support lower Yield rates. The talk that investors expect a super-heated global economy may have some truth to it, but we feel the rise in Yields is related more to global credit risks than any type of super-heated global economy.

Today we will explore the potential for a Crazy Ivan event in the global markets. This would be represented as a price revaluation event, causing the global markets to suddenly attempt to revalue price levels based on new levels of fear and more data.

Read full article... Read full article...

Saturday, March 06, 2021

Dow Short-term Stock Market Trend Analysis / Stock-Markets / Stock Market 2021

By: Nadeem_Walayat

The stock market has fully recovered from the Chinese Coronavirus catastrophe. Remember the Dow traded down to a low of just 18,213 on 23rd of March 2020 and then over the next 10 months recovered to trade at a series of new all time highs into 2021, all whilst the virus has continued to rage on, delivering the US and UK WORSE second peaks in terms of infections and deaths.

Read full article... Read full article...

Friday, March 05, 2021

FED Balance Sheet Current State / Stock-Markets / Stock Market 2021

By: Nadeem_Walayat

Not to forget the inflation mega-trend courtesy of rampant central bank money printing to monetize government debt coupled with the fake inflation indices. So you really think US inflation is just 1%? it's more like 6%! Anyway the money printing binge now totals $7.4 trillion, up from $4 trillion at the start of 2020.

Read full article... Read full article...

Friday, March 05, 2021

US Treasury Yields Rally May Trigger A Crazy Ivan Event (Again) In Stock Market / Stock-Markets / Stock Market 2021

By: Chris_Vermeulen

Since shortly after the US November elections, my research team and I have been clear about our research and our belief that the bullish rally in the markets would continue to drive the strongest sectors higher and higher. In December 2020, we shared an article suggesting our proprietary Fibonacci Price Amplitude Arcs and GANN theory indicated a major price peak could set up in early April 2021. On February 3, 2021, we also published an early warning that Treasure Yields were set up to prompt a big topping pattern sometime over the next 6+ months . We followed that up with a February 21, 2021 article suggesting future Gold and Silver price trends may be tied to the moves in Treasury Yields and the resulting stock market trends.

Now that the Treasury Yields have completed what we suggested would be required to start a “revaluation event” in the stock market, we believe that a “Crazy Ivan” event may soon setup in the global markets. Many months back (August 28, 2019), we published an article about precious metals were about to pull a Crazy Ivan price event (https://www.thetechnicaltraders.com/precious-metals-crazy-ivan-followup/). This prediction came true in 2020 and 2021. Now, we are suggesting the global markets may pull a new type of Crazy Ivan event – a price revaluation event prompted by the rise in Treasury Yields.

Read full article... Read full article...

Wednesday, March 03, 2021

Stock Market Bull Trend in Jeopardy / Stock-Markets / Stock Market 2021

By: Troy_Bombardia

What a week it has been! Various markets saw noticeable declines on news of rising yields. The strong upward trend for stocks is finally taking a long-overdue breather and so is extreme sentiment.

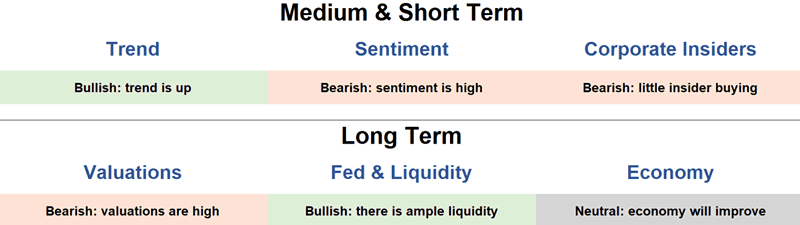

Let’s look at some bullish and bearish factors to give us a better idea of what the markets are doing.

Read full article... Read full article...

Friday, February 26, 2021

Congress May Increase The Moral Hazard Building In The Stock Market / Stock-Markets / Stock Market 2021

By: Avi_Gilburt

A few weeks ago, I wrote about the moral hazard being created by the Pavlovian buy-the-dip perspective in the market. As I expect the market to top out in the next few years and enter into a prolonged bear market, the nature of the market rallies over the last 10 years have thoroughly trained investors that all you have to do is buy-the-dip, as the market always comes back.

In fact, this past week, I saw these two comments in my articles, which only reinforces my perspective:

“I love a good press on an author from a paid subscriber but I’ve been making money hand over fist by trading and pouncing on pullbacks on a few stocks I closely watch. You have to have the time and you have to know the stocks well. Making much more money this way than I ever was buying/holding/speculating.”

Read full article... Read full article...

Thursday, February 25, 2021

The Everything Stock Market Rally Continues / Stock-Markets / Stock Market 2021

By: Troy_Bombardia

The market’s strong uptrend remains intact despite some lingering concerns about high valuations, extreme sentiment, and other overbought signals. Investors continue to pour into all markets (stocks, commodities, crypto etc.) with ever increasing liquidity.

Read full article... Read full article...

Wednesday, February 24, 2021

Is More Stock Market Correction Needed? / Stock-Markets / Stock Market 2021

By: Andre_Gratian

Current Position of the Market

SPX Long-term trend: There is some good evidence that we are still in the bull market which started in 2009 and which could continue into the first half of 2021 before coming to an end.

SPX Intermediate trend: May continue until SPX reaches ~4050-4150 (March 2021).

Analysis of the short-term trend is done daily with the help of hourly charts. They are important adjuncts to the analysis of daily and weekly charts which determine longer market trends.

Read full article... Read full article...

Tuesday, February 23, 2021

For Stocks, has the “Rational Bubble” Popped? / Stock-Markets / Stock Market 2021

By: Paul_Rejczak

Matthew Levy writes: In keeping with last week’s theme, the market has mainly traded sideways this week. However, that correction I’ve been calling for weeks? We have potentially started.

While I don’t foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of Q1 could happen.

Bank of America also echoed this statement and said last week that “We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply, and as good as it gets’ earnings revisions.”

Yes, the sentiment is still positive. That won’t change overnight. Vaccines seem more effective than we thought, especially against other variants of the virus. All that extra stimulus money and record low-interest rates could keep pushing stocks to more records and stimulate pent-up consumer spending. It’s not like the Fed is going to switch this policy up anytime soon, either.

Read full article... Read full article...

Monday, February 22, 2021

Stock Markets Discounting Post Covid Economic Boom / Stock-Markets / Stock Market 2021

By: Nadeem_Walayat

The stock market has continued to confound all of the doom merchants out there who blindly continue to point to the worst economic contraction since the great depression if not in history for most western economies. All whilst the Dow pushed its way to a new all time high into the end of 2020 and has continued to march ever higher during 2021 in response to which most investors have faced a barrage of that messages that the bubble is always about to burst, whilst my Patrons have received an unequivocal consistent message that this bull market has a long ways to go and that investors should not look a gift horse in the mouth when all of the stocks on my AI list were typically marked down by over 1/3rd against their Pre pandemic trading levels during March 2020.

Read full article... Read full article...