The Russian Bear, Chinease Dragon, and US Dollar

Currencies / US Dollar May 10, 2007 - 02:07 PM GMTBy: Jim_Willie_CB

Russia and China have become a major problem. Everywhere one turns, there is Russia & China at odds with the United States . We have the Great Bear in a conflict over energy, Iran , military installations, and central bank policy. We have the Great Dragon in a conflict over currency reform, banking reform, copyright enforcement, trade matters, human rights, and central bank policy.

Armed with a combined account of almost $1600 billion, these two giants are in a Battle of Titans with the United States for geopolitical control. With the financial shift to developing nations comes a natural push toward geopolitical control. The USEconomy and USDollar have never been in a weaker position. The bear and dragon know it well, and have taken steps to wrest more power and influence.

USDOLLAR BOUNCE SHOULD BE FEEBLE

The bounce in the USDollar has begun. Let's see if it can manage to move from the position flat on its back to even a kneeling position, where it can beg for leniency. The FOREX market is notoriously unforgiving, the adversary being the major central banks. In the last few months, it has become clear to those with eyesight that the G7 Finance Ministers have a plan to permit a lower USDollar exchange rate. A new lunatic notion might be at work. That the United States might desire a lower US$ in order to ‘teach China a lesson' on floating currencys. A higher Chinese yuan currency will matter remarkably little in reducing the US-China bilateral trade deficit. The same crowd of clueless economists and financial titans expected free trade with China to buttress the cost structure of the USEconomy with NO CONSEQUENCES. The same misguided crowd expected in 2003 that a lower USDollar would resolve the trade deficit.

The same compromised crowd designed tax advantages to large corporations for moving operations to foreign lands. The same inept crowd regarded the nightmare MOUNTAIN OF US $ DEBT overseas not to matter, since owned by trade partners. The Russian Bear & Chinese Dragon are proving not to be very cooperative. Why should they? They each want a seat at the inner circle big banker finance minister meetings. They each want to rebuild their militaries, one tattered, the other in renaissance. They are each frustrated and angry with the abused US power. They want their day in the sun, their years at the helm. Hegemony creates adversaries. Aggression invites response.

It is clear that foreign currencys have been breaking out on the upside. A little profit taking has begun, now that the Bank of England has hiked interest rates as expected. To be more precise, the euro, pound sterling, and the Aussie Dollar have broken out to new multi-year highs. The Canadian Dollar has approached highs set in 2006, where a new ‘hands off' policy seems to be in effect. The euro is taking some limelight from the USDollar, sharing in a sense its reserve status in an unofficial capacity. Resource backed currencys are doing well, such as the Canadian Dollar. The Aussie$ and Kiwi$ were each well anticipated beneficiaries of higher govt bond yields versus the piddling yield Japanese Govt Bonds offer, following the Japanese Repatriation ended March 31st. A near-term decline in the Japanese yen from regional investment in higher Aussie/Kiwi bond yields was anticipated. That was a forecast stated to Hat Trick Letter subscribers in February. The mix of currencys has become the central vortex in the global financial system which has grown in power to form a veritable hurricane. We are deep into the Competing Currency era warned by Von Mises. Modern capitalism has been quite the messy maelstrom, complete with carnival barkers, irreconcilable differences, constant wars, and hidden wars.

By the way, on a lighter note, one can hear the shrill Larry Kudlow on CNBC actually say “Flea markets and capitalism are the best paths to prosperity.” Does he really say that? Imagine how it sounds when played backwards!

HIGH COST OF FOREIGN-HELD US DEBT

My father once told me during my inquisitive youth, that the federal debt was relatively harmless since Americans owe it to themselves. That was the first potent denial of a lethal debt burden. My college years were racked by the Saudi-led OPEC embargo against the United States in 1973. The aftermath included a quadrupled crude oil price, a new PetroDollar defacto standard to support the USDollar as world reserve currency. The federal debt had grown large from the Vietnam War. The trade gap had grown large from the new chronic increases in oil imports amidst gradual declines in domestic oil production, which the US invented. (In Pennsylvania , I finally met a fellow who came from Oil City PA, a co-worker in 2001). We were told that the federal debt was not a threat, since the Saudis were our friends. That was the second potent denial of a lethal debt burden. My early career working years were subjected to the Great Offshore movement for US manufacturing, at a time when Intel was almost killed. How many remember that crucial event? The US mfg base in technology and electronics migrated to Asia along the Pacific Rim to give rise to the PacRim Tigers. The federal debt had grown from the Reagan years and the lunatic monumental defense buildup.

The Soviet Union might have been rubbed out and removed, but the Pyrrhic Victory went to the United States , whose federal debt exploded, leaving the national finances crippled. From that point onward, an extra $trillion seemed not so imposing. The mfg offshore movement sent the trade gap to exorbitant heights. We were told that the federal debt was not a problem, although certainly large, since Japan and Saudis owned most of that debt. They were our friends and allies, for yet another denial of a lethal debt burden.. My concern rose to alarm that as foreigners own more debt, a new credit master class was growing overseas. In the process US sovereign control of its own system would slowly erode. We were becoming beholden to foreigners, and would be coerced to compromise our own priorities. Let me go on record in saying that US sovereignty has been irreparably compromised. The lost US mfg base stands as the singlemost important structural defect, a gaping hole which permits an incalculable weakness from debt export.

NEW KIDS ON THE FOREX RESERVES BLOCK

In 2000, all changed. Russia and China hit the scene. The ill-fated decision during the Clinton Administration to grant Most Favored Nation status to China opened the door to a labor arbitrage. The result was over three million US manufacturing jobs sent to China . US corporations justify their abandonment of US workers, shedding fringe benefit costs at the same time, by claiming the low-cost solutions benefit both their financial structure and the USEconomy. The trade gap would next grow even while the USDollar would be devalued by 25% to 30% in the next few years. This was PRECISELY my forecast in stated in 2003, turned true, complete with mocking emails sent to me worthy of laughter then and now. China captured a large slice of that exported US-based inflation. Moronic economists actually claimed that the USEconomy was exploiting the Asian lower labor costs, as we sold them our high-grade debt. China began to accumulate its MOUNTAIN OF US $-BASED DEBT in its FOREX account. Foreign reserves held in the land of the Great Dragon enjoyed a head start, measured at $160 billion in the year 2000, having grown to $1202 billion by early 2007. Now the sleep walkers running US policy regard the Chinese yuan and gigantic FOREX mountainous reserves account as a problem.

Russia had to recover from its failed 80-year experiment in communism. Heck, the United States might soon have to recover from its failed 36-year experiment in counterfeit money! An argument can be made that the US Congress no longer represents the people. The Yeltsin and Putin years have brought with them a tremendous renaissance in Russia, which has paid off its Paris Accord foreign debt. Russia has made a transition, still nowhere near complete, away from the communist inefficiencies hampering its national oil business, toward a more market-based organized economical development of its staggering energy deposits. Once upon a time when the proletariat was duped and the red bourgeois ran the roost, the Russian oil business was rewarded according to meters drilled, not barrels produced. Those days are gone. Russia began to accumulate its MOUNTAIN OF US $-BASED DEBT in its FOREX account. Foreign reserves held in the land of the Great Bear rode the energy wave, having grown to over $320 billion early in the year 2007.

HOSTILE CHANGE IN WIND

Something deadly and different can be identified. The horseback ride enjoyed by Putin and Bush just a few years ago seems like from a vastly different era. The naivete of USGovt leaders has been exposed, when dealing on the geopolitical chessboard. Our guys might not be all too skilled at checkers. The hostility has become palpable between the United States and Russia , evident in dealings on World Trade Org issues, on European energy pipeline supply issues, on US Military base concerns on the Russian borders, on Iran nuclear processing equipment issues, on matters with finance ministers to manage the USDollar. The US butts heads with Russia in every conceivable arena nowadays, in a HOSTILE fashion.

Something deadly and different can be identified. The cooperation identified by constructive contracts between US corporations to build Chinese factories took a respite in 2002 and 2003, but clearly resumed to surpass $15 billion annually in 2004 and 2005 each year. If one needs to point fingers at the new problems with China, look no further than US corporate executives who plowed tens of billion$ into China, killed off US jobs, and have fed the dragon. However, the end of the rigid yuan currency regime was removed in July 2005 with little progress to show in a yuan upward revaluation. A relatively small 7% rise in the yuan since then pales by comparison to the 55% rise in the euro currency (versus US$) since 2001, and 15% rise in the euro in roughly the same time frame as the yuan has been relaxed, but not freed. The ineptitude of USGovt leaders has been exposed, when dealing on the economic and financial chessboard with patient and crafty Beijing leaders.

Our guys might not be all too blessed with a good hand in this poker game, since we dealt twice as many card to the Chinese side of the table. The friction was not missed by alert observers last summer between the United States and China , during a state visit by their prime minister. The rank amateurs running the US Administration played the Taiwanese national anthem, then permitted some elderly woman to rant & rave without interruption about some sensitive Chinese domestic topic. Imagine an American middle aged jobless man rant & rave outside a Beijing meeting with heads of state, where the poor guy yells for five minutes about his job outsourced, his pension depleted, his savings vanished in the 2000 stock bust! That would not happen in Beijing , but the incident did occur in Washington DC .

The hostility is growing between the US and China, perhaps initiated when Los Alamos weapons schematic designs were lifted off a pathetically insecure US data base, made public early in this new decade. The hostility has been evident in dealings on open market reform issues (especially banking), on currency reform issues, on copyright piracy issues, on tariff retaliatory issues, on matters with finance ministers to manage the USDollar, on human rights issues. The last item is ironic, since the rights of US citizens have been eroding on a yearly basis, as syndicate shadows extend from government to borders to military to media. The Bill of Rights sits on a table under the weight of the Patriot Act. The US butts heads with China in an increasing number of arenas nowadays, with HOSTILE levels rising.

So first, the US owes federal debts to itself. Then the US owes federal debts to friends. Now we are told the US owes federal debts to our so-called trade partners who have mutual interests. Translate that to the US owes federal debts to our nations which with each passing year can be identified as enemies, or at least progressively more hostile.

The Asians are no longer recycling their vast trade surpluses. They had been engaged deeply in ‘Vendor Financing' to the USEconomy. Without the financing, one must wonder if they regard their customers in the US as critically important now as before. Asian regional growth and development is on the grand march. Furthermore, a MOUNTAIN OF US$-BASED DEBT in its FOREX mountain on corrosive USTBonds is their reward, acting like a tailing pit of pure acid . A little mining terminology there. The oil producing MidEast nations have made up the difference from Asian halted flows, and picked up the slack. Russia serves as an exception among oil producers, as they stand hostile to USTBond support.

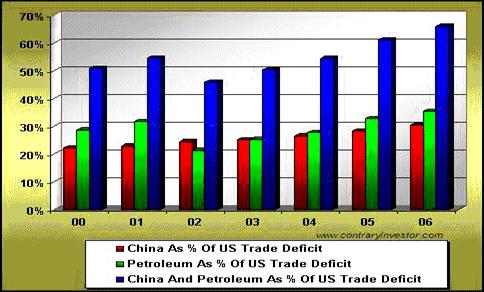

Max Wolff points out that four leading finished product exporters (China, Japan, Germany, Singapore) supply 37.0% of the world's capital, and that six leading oil exporters (Russia, Saudis, Kuwait, UAE, Algeria, Venezuela) supplied 29.3% of the world's capital in 2006, while the United States imported 64% of that capital in 2006. This end result is a grotesque perversion of anything either John Maynard Keynes or his ilk ever imagined. Such is the bitter fruit of managing a fiat currency. The reality is that Russia dominates in energy supply, grabbing geopolitical power as it uses energy as a weapon. The reality is that China dominates in manufacturing, grabbing geopolitical powers as it exploits its universal (not specialized) labor cost advantage. The United States is acutely vulnerable to foreign dependence upon foreign-made finished products, and foreign energy supplies. Together, China and Petroleum imports account for 65% of the US trade deficit.

FOREX DATA ON RUSSIA & CHINA

Russia and China must be monitored nowadays. Their FOREX reserves are growing rapidly, managed with fixed ratio targets. This permits substantial swings in euro purchases to maintain those ratios. Russia has gold and FOREX reserves totaling $321.7 billion, as of March 16. From the beginning of 2007, Russian reserves have catapulted by $70 billion to reach $370B. They maintain an even US $/Euro ratio with small pound sterling dose. So one can conclude Russia purchased at least $25 billion in euros to balance in 1Q2007. They maintain their ratios.

Chinese FOREX reserves catapulted by $130 billion to reach $1202 billion in the first quarter. They maintain a 2/1 model favoring US$/Euro with a minor pound sterling sprinkle. So one can conclude China purchased perhaps as much as $30 billion in euros to balance in 1Q2007. Not so simple, since currency exchange rates are in a fluid state. Also, actions taken to enforce a target ratio might not be enforced in the same manner by the Kremlin and Beijing leaders. Russia is openly hostile to the USDollar, calling it a grossly mismanaged currency unworthy of world reserve status. China seems more cooperative, but is legitimately concerned about hefty losses from a falling USDollar.

The bankers in Moscow and Beijing might differ in their zeal and willingness to deliver a severe punch to the USDollar. The Kremlin leaders might enjoy the opportunity to give a ‘Russian smile' (lips move, rest of face does not, [thanks, JZ]) by balancing immediately and giving a lift to the euro. The bankers in Beijing play a game with those bankers in New York and WashDC. They are cutting deals with Wall Street bankers. Few Americans realize how much of Chinese wealth is cornered by Communist ruling members, their family and friends. Wall Street firms salivate at a continuation of the initial public stock offerings, lucrative to the investment bankers, like the ICBC Bank last autumn which netted well beyond $1 billion in Goldman Sachs profits.

The Chinese FOREX account might not have balanced as much as desired. China holds an impractically outsized amount of USDollars to sell, soaked from its exporters. They have a bigger challenge and a narrower political path to walk, in order to keep to their ratios.

Maintaining FOREX balanced targets, motives, and more, are matters discussed in the May Hat Trick Letter report. If balanced ratios are not at desired levels, the Bear & Dragon might kill any minor USDollar bounce rally here. They each desire euros. They each have rapidly rising FOREX reserves, one from energy export, the other from industrial output export.

This new trend of rapidly accumulating FOREX reserves by Russia & China is not going to change anytime soon. The pressure on the USDollar will be a constant feature to the entire financial and investment world. The bear & dragon will keep a ceiling on the USDollar, will keep a bid under both the euro currency and gold. No end is in sight on this important change, which will progressively be seen as hostile to US interests by aggressive but weakened USGovt leaders. Russia and China each have their problems and challenges, but they each have resources beyond a printing press and military.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“I think you bring the most refreshing voice to our hard asset community that I have experienced in a long time. Your unique blend of erudition and irreverence have kept me most engaged. Your newsletter is remarkable in its scope about all things worldwide that effect our financial well-being. I think you are totally brilliant, the new Doug Casey on the scene.” (Lori B in Washington )

“As an old time subscriber, congratulations on your newsletter. It stands outside of the crowd like the Dow Theory Letter from the famous Richard Russell. Keep up your excellent work which is worth a thousand times the subscription price.” (Peter O in Austria )

“I have spent some time lately reading the special reports. Your work is brilliant, the depth of what you are doing is titanic. It is an incredibly complex and dense world that we live in. You are penetrating the fog, the lies, the misconceptions, and the poppycock. It is going to be amazing to watch it all unfold, and your commentary along the way will be the sizzle on the steak.” (Gregg F in Illinois )

“I am currently subscribed to over 60 paid newsletters. Your analysis is by far the most accurate every time. The most impressive characteristic of your thought processes is your ability to think in multi-factorial terms. You are one of the few remaining intellectuals with such capacity intact.” (Gabriel R in Mexico )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.