The Crude Oil Deflationary Bear Market

Commodities / Crude Oil Mar 11, 2009 - 01:17 AM GMTBy: Kyle_L_Lucas

Yesterday on the blog I posted an email my sister sent me. ( Click here to read her note .) She asked me about the Oil market and its relation to the real estate market in the town she lives in.

Yesterday on the blog I posted an email my sister sent me. ( Click here to read her note .) She asked me about the Oil market and its relation to the real estate market in the town she lives in.

As long time readers Know, I have been pretty bearish on Oil since last Summer. And now, even with the huge decline in prices I am still not bullish, though I respect the possibility of a good suckers' rally before the next wave of price destruction ensues. I will get into the pricing aspect in a bit.

My sister asks me to explain Oil speculation. Since she is a paying subscriber to the Letter like the rest of you, I'll do my best to spell it out.

• Crude Oil started to go up some years ago because of a structural lack of investment in production. This lack of investment stemmed from an extended period of low prices in the 1990s. That period of low prices stemmed from a previous period (70s and 80s) in which the price of the commodity traded at an elevated level. High prices led to over-production which led to low prices which led to under-production which led to renewed high prices which led to renewed over-production, which led to where we are today. This process is what they call ' Cyclicality '.

• Superimposed on this commodity-specific cyclicality are broad monetary and geopolitical trends. Credit expansions and contractions; wars and peaces. Stuff like that.

• But why did Oil go up to like $150 last year? One word: Speculation . Speculation that under-production of the commodity was somehow a law of nature; speculation that credit expansion was a permanent reality; speculation that this all-purpose-perpetual-war would someday somehow cut off the supply of Oil to the world.

But I am not just talking about the speculation of the Speculator. The dudes like us who buy and sell futures contracts and other securities with the intent to profit from price fluctuations. Included in the ranks of speculators are the producers of the commodity. How adept the Arabians were in their bull operations the last few years! In the first half of this decade a humorous string of pseudoscience started to circulate in environmental and investment cliques. 'Peak Oil'. * So the Arabians thought, why not lead these gullible Westerners to believe there is something valid in their silly science? So they temporarily curtailed production growth, and so grew the Oil bubble. Prices reached a point where they could forward sell production years into the future at ridiculously high prices. And about the same time the Arabians suddenly 'discover' that they can expand production by a good 10 or 20 percent.

Meanwhile production was being expanded everywhere else in the world too. So much Crude Oil was produced the last few years that there developed a shortage of places to store the commodity. So the last several months the market has been trying to work off all this excess inventory. This shortage of storage led to the huge contango on the futures market (meaning forward prices are higher than spot or near-month prices).

So what is the state of the Oil market now? Well, the contango has started to narrow. That's a good sign. But on the other hand production and exploration don't seem to have been curtailed so much yet. How many Oil producers or drillers have you heard go out of business recently? If Oil was indeed a bubble, then you would think there would be some bankruptcies to accompany its deflation. A few minor players have filed for protection the last few months, but no huge multi-multi-billion Dollar concerns.

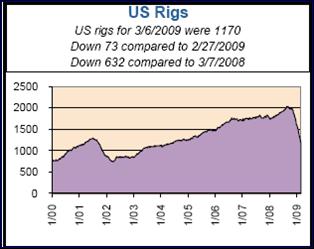

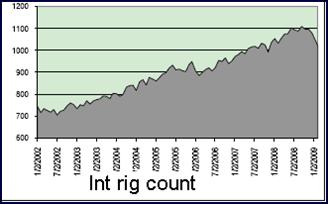

The US rig count has come down sharply from the peak last year, as you can see on the chart below. But those figures are mostly Natural Gas rigs and not Oil, so I'm not sure what the 'right' number should be. The international rig count has decline somewhat too, but I still see it as being pretty elevated. It looks like the growth trend has been broken, but for me to believe that Oil is truly under-

I would like to see a serious decline in that count. Closer to 800 sounds about right.

My sister's husband works in the Oil Services business. When the question about Oil investments have come up in our conversations the last couple years I've told them that 'the time to invest in Oil is when he [sister's husband] loses his job.'

It's a good job he has, so I really hope that doesn't happen. In fact, it is for this reason that I really hope I am wrong about my outlook for the Energy Sector.

I haven't looked at my sister's prospective real estate purchase closely enough to Know how good a deal it is. My hunch is that a house purchase now in that area will work out fine, at least when viewed from a multi-year perspective. With any luck that new housing project she mentions will fall through. With the credit markets the way they are, combined with the uncertainty about Oil and Gas prices, the failure of this proposed ' Black Gold Village ' becomes a distinct possibility. I mean really, can we believe the Über-Bubble has fully deflated when a development with such a silly name is still in the works? Just sayin'....

And now let's take a closer look at the architecture of the Oil market. Below I include a longer-term chart of the December 2009 WTI Nymex contract. From January 2007 to July 2008 the price rose by about $89. We can consider that move the final wave of the bubble. If we combine the dimensions of Time and Price, we might expect the deflationary side of the bubble to at least be of similar 'size'

to the last inflationary portion of the bubble. I'm going to take a wild guess here and say that the ultimate amount of price deflation will be approximately 132.472 percent of the $89 inflation. That would put the December contract down to around $29. But when? What if the total deflation lasts about 75.49 percent as long as the previous 77 week inflationary period? That would place the bottom around the end of August or beginning of September 2009.

That actually fits into my macro-outlook pretty well, though the reader should realise by now that I am better with price projections than I am with timing. Hopefully applying the Theory of Proportion to the dimension of Time will lead to some improvement on that front, but we shall see.

Maybe my sister should wait to buy a house until the end of the Summer then? She has been wanting to buy property for four or five years now and every time she mentioned the idea to me I shot it down. This never made for very fun family conversations, but I think she realises now that while it sounded like I was being an asshole, I was actually just being an economist.

But this time I'm not so anxious to talk her out of it. If this doesn't turn out to be the best time to make such a move, it could still be a 'good enough' time to do it. Waiting till later in the year might be better, but then there is the risk that house won't be around then.

As an aside, I'm looking at this chart of Hess (HES) share prices and it looks fairly questionable at the moment. I see no reason why it couldn't fall back and test last December's low.

With a forward P/E estimate of 15, a hair cut of 1/3 the current rate seems plausible. And that would fit with the price objective in the event that the share price closes below that neckline above 49. And look at that CMF indicator!

Yeah, enough words for today. We'll do it again tomorrow. Have a good morning.

Regards,

* I Know most of my readers actually think there is some truth to 'Peak Oil'. I hope I don't insult anyone too badly. Oh, but if it makes you feel better, I don't believe in 'A.I.D.S.' or 'Global Warming' either.

By Kyle Ledbetter Lucas

http://trendandvalue.blogspot.com/

Lucas is something of a philosopher with a knack for financial markets forecasting. He publishes the Trend & Value weblog and the new Trend & Value Letter, an investment newsletter published five mornings a week. Formerly a Precious Metals Broker, Lucas now lives in Quito, Ecuador.

Copyright © 2009 Kyle Ledbetter Lucas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Lucas

12 Mar 09, 18:45 |

follow up published

my response to a reader's comments: http://trendandvalue.blogspot.com/2009/03/crude-oil-bull-clique-returns.html |