Financial Markets Crash 2.0 Countdown

Stock-Markets / Financial Crash Mar 09, 2009 - 02:39 AM GMTBy: Stefan_Pernar

Subprime Tsunami to be followed by Option Arm / Alt A Asteroid - May you live in interesting times . Just as we thought we could stop holding our collective breath as the subprime tsunami starts to recedes, new specters appear on the horizon and you probably have not heard of them - yet. Meet subprime mortgage 's ugly cousins: Option ARM and Alt A mortgages .

Subprime Tsunami to be followed by Option Arm / Alt A Asteroid - May you live in interesting times . Just as we thought we could stop holding our collective breath as the subprime tsunami starts to recedes, new specters appear on the horizon and you probably have not heard of them - yet. Meet subprime mortgage 's ugly cousins: Option ARM and Alt A mortgages .

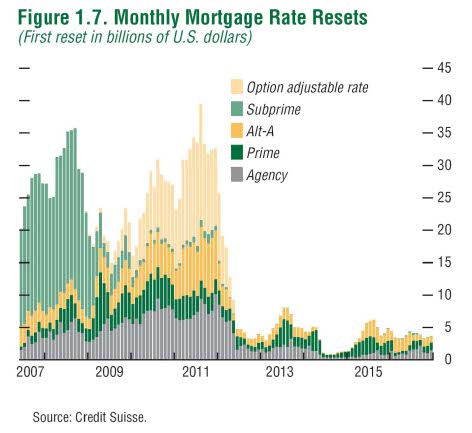

ARM stands for Adjustable Rate Mortgage and guess what: the rates are not about to go down. As Whitney Tilson explains on 60 minutes using data collected by Credit Swiss, this will cause default rates to sky rocket as even the relatively low teaser rates are already too much for cash strapped home owners.

As far back in September 2006 Business Week called the Option ARMs nightmare mortgages and elaborated as following:

The option adjustable rate mortgage (ARM) might be the riskiest and most complicated home loan product ever created. With its temptingly low minimum payments, the option ARM brought a whole new group of buyers into the housing market, extending the boom longer than it could have otherwise lasted, especially in the hottest markets. Suddenly, almost anyone could afford a home — or so they thought. The option ARM's low payments are only temporary. And the less a borrower chooses to pay now, the more is tacked onto the balance. […] The option ARM is “like the neutron bomb,” says George McCarthy, a housing economist at New York's Ford Foundation. “It's going to kill all the people but leave the houses standing.”

Two years later to the day Bloomberg picked up on the Alt-A menace :

Homeowners lured by low introductory rates to Alt-A mortgages, which typically require little or no proof of a borrower's income, may fuel the next wave of foreclosures and further delay a recovery from the worst housing decline since the 1930s. Almost 16 percent of securitized Alt-A loans issued since January 2006 are at least 60 days late, data compiled by Bloomberg show. Defaults will accelerate next year and continue through 2011 as these loans hit their three- and five-year reset periods, according to RealtyTrac Inc., an Irvine, California-based foreclosure data provider.

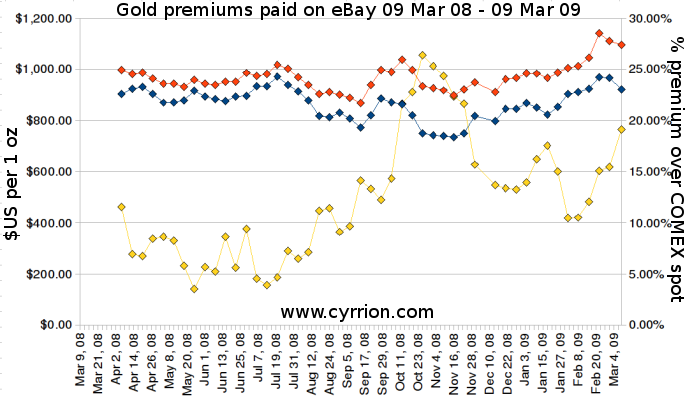

In other news: eBay premiums of American Gold Eagles and American Buffalo 1 ounce gold coins continue to rise and now stand at just under 20% over spot as of last week. This comes as little surprise since worried investors increasingly prefer to hold gold in hand and gold coin shortages show no signs of abating . Throw in the $23 Trillion of troubled assets in eastern Europe and you have a formula for disaster .

Personally I am starting to get really worried when hedge funds are picking up on gold and Warren Buffet's Berkshire Hathaway is assessed with a 13% chance of going bankrupt in the next 5 years . Interesting times these are indeed.

(yellow = percent premium paid on eBay, blue = COMEX spot price weekly average, red = eBay price weekly average)

By Stefan Pernar

© 2009 Copyright Stefan Pernar - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.