Obama's Stocks Bear Market Takes A Breather

Stock-Markets / Stocks Bear Market Mar 08, 2009 - 09:58 AM GMT

The meltdown that began in February is nothing short of spectacular. Like a tornado, its ferocity and destruction is frightening, yet fascinating to watch. On Thursday, the S&P 500 had lost 20% since inauguration day, resulting in some calling this recent leg down “Obama's Bear Market.” To be fair, we have been in a bear market since October 2007. Whether this recent downtrend is the fault of the current administration is “above my pay grade.” What is not above my pay grade (or at least I think it's not) is analyzing the recent price action of the indexes.

The meltdown that began in February is nothing short of spectacular. Like a tornado, its ferocity and destruction is frightening, yet fascinating to watch. On Thursday, the S&P 500 had lost 20% since inauguration day, resulting in some calling this recent leg down “Obama's Bear Market.” To be fair, we have been in a bear market since October 2007. Whether this recent downtrend is the fault of the current administration is “above my pay grade.” What is not above my pay grade (or at least I think it's not) is analyzing the recent price action of the indexes.

The market initially rallied after the Jobs Report was released, indicating an unemployment rate of 8.1%. That rally soon fizzled and the market sunk lower. Within the last hour of trading, however, the market rallied back to post some minimal gains.

The DJIA continues to lead the way down. As you can see by the chart below, it has been moving downward in a well-organized channel. The few moves to the upside have failed to make any significant gains. A break in the channel may signal a move to the upside. Resistance is still located in the 7000 and 7550 areas.

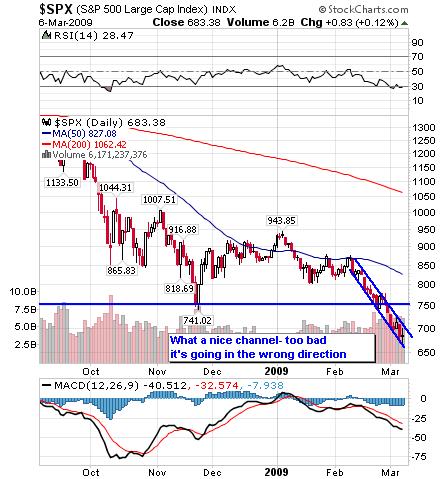

The S&P 500 is also moving in a tidy channel. Resistance is located in the 750 area.

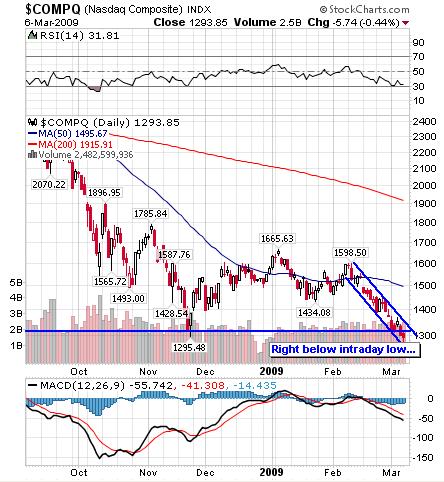

It was only a matter of time before the rest of the market pulled the Nasdaq down below its November low. Clearly, the Nasdaq was the strongest of the three indexes. With no financials to drag it down, the Nasdaq hung tough. However, the pull of the other indexes was too strong to continue resisting. In a bear market, even the quality stocks (and staple stocks) get pummeled. They might withstand the direction of the overall market at first, but eventually almost all stocks succumb to the pressure. The Nasdaq actually lost almost a half percent on Friday, but it did rebound significantly from the intraday low. Currently, the Nasdaq is less than a point below intraday low of November.

Somewhat surprisingly, the VIX has not spiked up or made any large moves this past week. It currently sits at 49.33. Is this an indicator that investors are just indifferent to the market's movements? Investor apathy is an ingredient required for bottoms. People grow weary of the stock market and just stop caring. Of course, this is an inexact timing mechanism that shouldn't be used to solely to base decisions.

Does Friday's tape action provide any clues for next week? Not really. While it was constructive for the indexes to bounce back at the end of the day, a lot more than a feeble one-day reversal is required to demonstrate the market has found its footing. Keep in mind also, that while the indexes did reverse, they could not make headway in the morning. Moreover, while the market is oversold, it can stay oversold for an extended period of time. Therefore, trying to pick a bottom is a dangerous game.

By Kingsley Anderson

http://tradethebreakout.blogspot.com

Kingsley Anderson (pseudonym) is a long-time individual trader. When not analyzing stocks, he is an attorney at a large law firm. Prior to entering private practice, he served as a judge advocate in the U.S. Army for five years and continues to serve in the U.S. Army Reserves. Kingsley primarily relies on technical analysis to decipher the markets.

Kingsley's website is Trade The Breakout (http://tradethebreakout.blogspot.com)

Copyright © 2009 Kingsley Anderson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Kingsley Anderson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.