Stock Market On Fast Train Towards Zero

Stock-Markets / Stock Index Trading Mar 02, 2009 - 08:28 PM GMT

On Sunday, I indicated that when the market fails to sell off on bad news, it means the market is finding a floor. When it in fact sells off on bad news, it is certainly not a good sign. This sort of ties into the old market adage, “buy on the rumor, sell on the news,” whereby by the time the news has been published to the world, it has already been discounted by the market.

On Sunday, I indicated that when the market fails to sell off on bad news, it means the market is finding a floor. When it in fact sells off on bad news, it is certainly not a good sign. This sort of ties into the old market adage, “buy on the rumor, sell on the news,” whereby by the time the news has been published to the world, it has already been discounted by the market.

Right now, the investor psyche is so damaged at this point that bad news is resulting in the market digging an even deeper hole for itself. Things are so bad that even Gold, the natural hedge against a bad economy, was down today. Well, the news this time was that the Federal Government was going to give AIG an additional $30 billion. As a consequence, the market went south, ending on its lows of the day. Clearly, the market does not appreciate how the Obama administration is handling the crisis.

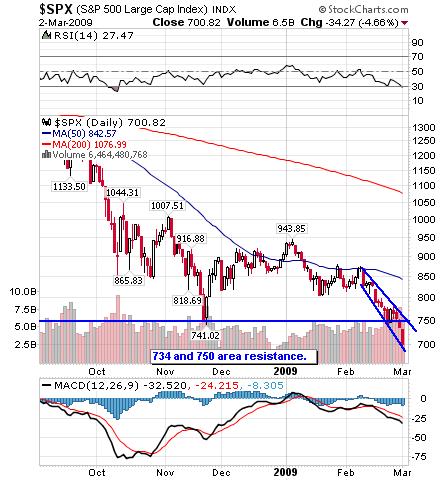

Despite being only seventeen months old, this bear market has caused the S&P 500 to lose over 55% of its value. As a consequence, this is the worst bear market, EVER, for the S&P 500. It only pales in comparison to the 1929 market crash, when the DJIA sunk 89.2% (there was no S&P 500 at the time). Very scary stuff. Unfortunately, I do not have price targets as to when the destruction of value may end. My only strategy is the same as it has been since October 2007- stand aside and let the market prove itself.

The DJIA and S&P 500 are well past their respective November lows. Their resistance points are listed on the charts below. Notice also that RSI is again showing both indexes below 30, and therefore oversold.

Like the English in the Battle of Britain, the NASDAQ refuses to fall. However, it seems its days are numbered. Today, it closed at 1322, only a scant 27 points from the intraday November low. The strength shown by the NASDAQ illustrates a good point. The stocks in the NASDAQ are not in the same precarious position as the financials. However, the tech stocks are the proverbial baby being thrown out with the bath water. In a bear market, there are no safety stocks.

Will we have another “Turnaround Tuesday?” The McClellan Oscillator is currently oversold at 94.26. Whatever happens, my advice is to stand aside; Tuesday will no doubt be a crazy day. There is a lot of talk on television about this being a bottoming process. That may be the case. However, market timing, which is possible, does not involve buying at the absolute low. Never, ever try to catch a falling knife.

By Kingsley Anderson

http://tradethebreakout.blogspot.com

Kingsley Anderson (pseudonym) is a long-time individual trader. When not analyzing stocks, he is an attorney at a large law firm. Prior to entering private practice, he served as a judge advocate in the U.S. Army for five years and continues to serve in the U.S. Army Reserves. Kingsley primarily relies on technical analysis to decipher the markets.

Kingsley's website is Trade The Breakout (http://tradethebreakout.blogspot.com)

Copyright © 2009 Kingsley Anderson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Kingsley Anderson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.