Commodities Bouncing Back in 2009

Commodities / Resources Investing Feb 17, 2009 - 09:37 AM GMTBy: Frank_Holmes

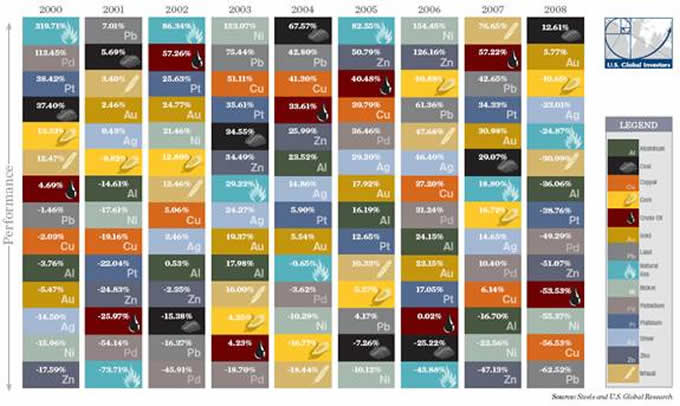

The numbers for 2008 are in, and we can now quantify just how rough the year was for commodity spot markets.

The numbers for 2008 are in, and we can now quantify just how rough the year was for commodity spot markets.

So far in 2009, the results are much better, though that's not the case across the board.

Out of our basket of 14 hard and soft commodities, only coal and gold finished 2008 in positive territory. Coal was up 12.6 percent due to a relatively strong first half of the year, while gold rose nearly 6 percent during the year as many investors concerned about rapidly devaluing assets fled to a safe haven.

Contrast this to the stellar performance of commodities in 2007, when all but three of the 14 finished positive. Wheat led the way with a 77 percent gain, followed by oil's 57 percent increase and lead at 43 percent.

In fact, even though coal was at the top of the heap in 2008, its performance was 16 percentage points worse than in the previous year, and gold's gain last year was 25 percentage points lower than in 2007.

Lead plummeted to the bottom of the chart in 2008, trailed closely by copper, nickel and oil. Of course, for oil, it was a year of extremes – it soared to a peak of $147 per barrel in July before nose-diving to under $45 by year-end.

In bull markets, the old saying goes, a rising tide lifts all boats. In a falling market, those same boats often end up as shipwrecks.

You can see that in the 2008 returns. In none of the previous eight years did so many of the 14 commodities finish underwater – the next worst year was 2001, when nine had negative returns.

2001 was one of the worst years for commodities in recent memory, with natural gas falling 74 percent, oil 26 percent and nearly all of the industrial metals turning in double-digit losses. But even that year pales next to 2008.

The mean return for the 14 commodities in 2008 was -34 percent (-17.4 percent in 2001), and the median was -37.4 percent (-16.1 percent in 2001).

Eleven of the 14 commodities finished with a loss of 20 percent or more in 2008. That is more than the previous eight years combined.

2009 is still young, but two spot commodities are already down more than 20 percent – crude oil (-23.8 percent) and natural gas (-20.2 percent).

It's been a much better six weeks for silver, which is up nearly 19 percent in 2009. Palladium (+15.8 percent) and platinum (+14.9 percent) have also started the year on the right foot. Gold is up about 7 percent.

And lead is once again buoyant – it's risen about 12 percent so far in 2009.

By Frank Holmes, CEO , U.S. Global Investors

Frank Holmes is CEO and chief investment officer at U.S. Global Investors , a Texas-based investment adviser that specializes in natural resources, emerging markets and global infrastructure. The company's 13 mutual funds include the Global Resources Fund (PSPFX) , Gold and Precious Metals Fund (USERX) and Global MegaTrends Fund (MEGAX) .

More timely commentary from Frank Holmes is available in his investment blog, “Frank Talk”: www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.