Stock Market Continues To Heal

Stock-Markets / Stock Index Trading Feb 15, 2009 - 06:06 AM GMT

Following the market is starting to become a tedious chore. The back and forth action occurring in the stock market may be fertile grounds for the day trader, but not for the position trader. Long or short, trying to trade in this type of environment is tough. Of course, the million dollar question is “when will it be safe to leave the sidelines and enter the market?” No one can answer that. At this time the only real option is to continue to follow the news and observe the market.

Following the market is starting to become a tedious chore. The back and forth action occurring in the stock market may be fertile grounds for the day trader, but not for the position trader. Long or short, trying to trade in this type of environment is tough. Of course, the million dollar question is “when will it be safe to leave the sidelines and enter the market?” No one can answer that. At this time the only real option is to continue to follow the news and observe the market.

The stimulus bill has finally been approved by both houses. The final act is for the president to sign the bill. While news governing the bill has driven the market in the recent past, it is unclear what affect it may this week or in near future. If the package will indeed improve economic conditions, the market should improve before the actual impact is noticed by the economists and the media. As stated in the past, the market will lead the economy.

Like the rest of the indexes, the S&P 500 continues to clash with its 50 day moving average ( dma ). For technicians, the 50 dma (or derivations, such as the 50 ema ) is quite important. While it does not carry the same significance as the 200 dma , it is nonetheless closely followed. Looking at the chart for SPY, the ETF has tested the 50 dma four times, and failed each time. What is significant about these recent tests is that after failing to break through, the average did not go into freefall . This is a good sign. Moreover, the more tests of the average, the more likely a breakthrough will occur. The range on the S&P 500 also continues to tighten.

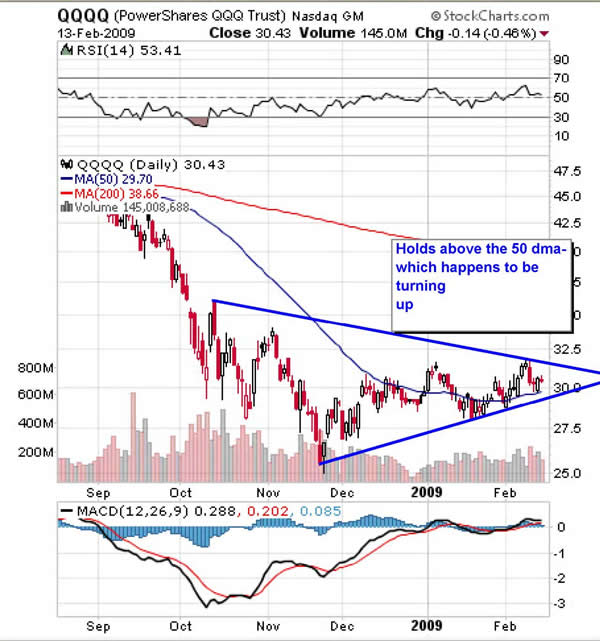

The NASDAQ currently leads the indexes. The QQQQ is actually perched above its 50 dma . If a retest of the 50 dma is successful, a NASDAQ-led rally is possible. Again, similar to SPY, the QQQQ has been trading sideways for some time.

Volatility continues to decrease. Historically, the VIX is well above normal levels. However, little by little, volatility is lessening. The downtrend continues as the 50 dma turns down and provides resistance. The 200 dma will likely be tested in the near future.

The sideways action of the market can make one want to throw up his/her hands and quit. Don't. This part of the stock market's healing process. Despite all the negative news in recent weeks, the market held its ground. The inability to be pushed lower is a sign that the market has been beaten down as low as it can go. This does not mean that if one trades in this environment, he/she should operate without a safety net, but it is a sign that things might be getting better.

Positions: None

By Kingsley Anderson

http://tradethebreakout.blogspot.com

Kingsley Anderson (pseudonym) is a long-time individual trader. When not analyzing stocks, he is an attorney at a large law firm. Prior to entering private practice, he served as a judge advocate in the U.S. Army for five years and continues to serve in the U.S. Army Reserves. Kingsley primarily relies on technical analysis to decipher the markets.

Kingsley's website is Trade The Breakout (http://tradethebreakout.blogspot.com)

Copyright © 2009 Kingsley Anderson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Kingsley Anderson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.