Return of Inflation, Commodities and Resource Stocks Itching to Takeoff

Commodities / Resources Investing Feb 06, 2009 - 09:06 AM GMTBy: Oxbury_Research

Government, Know Thyself - “Why Can't 'Common Sense' Be Applied to Bailouts?”

Government, Know Thyself - “Why Can't 'Common Sense' Be Applied to Bailouts?”

We welcome President Obama's “basic common sense” announcement of a $500k salary cap for top executives at companies receiving substantial bailout funds. It's a bit of welcome good news.

And the President's definitely right on the money when he states that the average person isn't at all pleased when executives apply for public money “hat in hand ... even as they paid themselves customary lavish bonuses.” In fact, these “executives being rewarded for failure” is the theme we harped upon last week.

We had to laugh at this apparent government revelation, though: the authorities are finally realizing that there's a consensus among ordinary Americans. According to commentators, seems Joe Average believes he's bearing a greater financial burden from the disaster than the guys who helped create the mess in the first place.

Well, who would have guessed? It must have taken a genius to figure that one out.

Could it have anything to do with the mega-bailout funds being lobbed into the laps of these executives and their companies? Even as ordinary folk lose their jobs and watch their mortgage payments go into arrears?

After all, Obama's pet stimulus plan is going to cost another $800 billion (perhaps even $1 trillion) -- all of which will go to companies who basically doused themselves in oil while wandering around in the dark … and then lit a match to see what was going on.

Obama also stated that: “A failure to act, and act now, will turn crisis into catastrophe and guarantee a longer recession, a less robust recovery and a more uncertain future.” Hmm, that's an interesting (if very popular with executives) viewpoint.

But funnily enough, most Austrian economists – these would be the guys that accurately foresaw the current disaster, if you were wondering – they have just the opposite view. They feel that excessive government intervention will only prolong the necessary wringing-out process needed to purge incompetence and mal-investments from the system. They're probably right, given their historical track record.

We'd venture to suggest that limiting executive compensation is like re-arranging the deck chairs on the Titanic. Sure, the seating arrangement appears to be nicer, but that doesn't do a whole lot about the gaping hole in the hull and the flood of ice water rushing inside.

The Empire Strikes Back: Return of Inflation

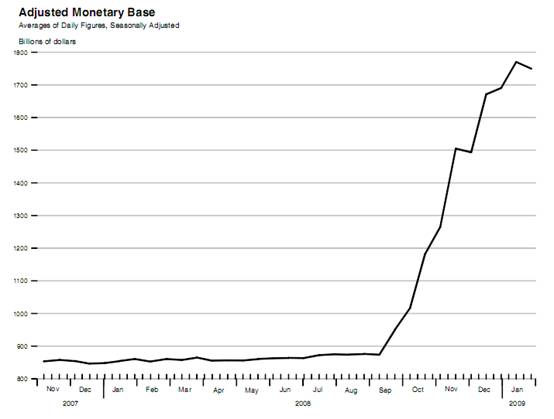

After all, can you really have faith in the sort of imperious management that's done this to the financial system? ((The Adjusted Monetary Base is the sum of currency in circulation outside Federal Reserve Banks and the U.S. Treasury. Graph courtesy of the St. Louis Fed)

With an explosion in free floating dollars like this (and a shrinking supply of goods and services as companies cut back on their operations) what do you think is going to happen to the costs of daily living?

Here's a hint: it will probably something like the graph above. It's just a matter of time. And the propaganda is already preparing the sheep for the inevitable shearing of their savings.

Crispin Odey in the Financial Times : “In a world of debt and deflation, inflation is our friend.”

Martin Wolf in the Financial Times : “If central banks and governments are aggressive enough, they can generate inflation which will lower the debt burden ... But they will imperil – if not terminate the experiment with un-backed fiat (or man-made) money that started in 1971.”

It seems like inflation is coming back into style, and it will look about as good on your bank account as a string bikini on a bag of lard.

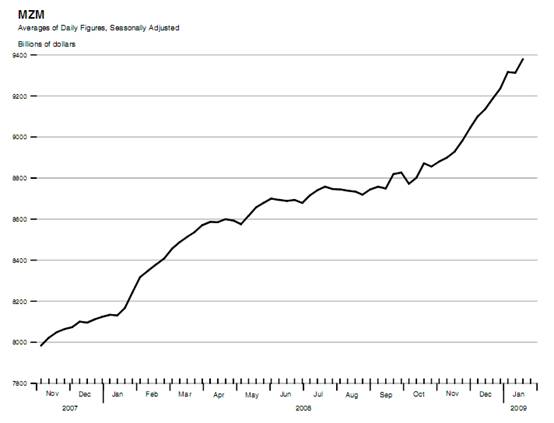

Of course, we could be wrong. Price inflation in day-to-day goods and services might look like the following graph instead: (Money of zero maturity (MZM) is a measure of the most liquid part of the money supply, e.g. financial assets redeemable at par on demand. Graph courtesy of the St. Louis Fed)

That graph doesn't look very comforting either. But don't worry. The mainstream media (and governments, and central banks) say it's good for you.

A Golden Future

Could this be why UBS has just upgraded five North American gold producers, including the world's largest gold miner Barrick Gold? Upgrades (honest ones, anyway) are as rare as hen's teeth in a world of crashing earnings and investor expectations.

UBS is optimistic that the 2009 gold price should hit $1,000 per ounce (a dramatic reversal of its prior view of $700 per ounce). And so it's given the thumbs up to Agnico Eagle Mines (AEM), Barrick Gold (ABX), Eldorado Gold Corp (ELD / EGO), Newmont Mining (NEM) and Goldcorp Inc (GG / G).

This is not surprising, considering that gold has been one of the best-performing assets of late and that demand for gold as a safe store of value has recently surged. Check out our other commentary on gold here [link to the most recent B&B article on gold HERE .

There aren't many other investments showing an upward trend lately, are there?

Base Metals In The Basement

But that doesn't mean that all miners are doing well. BHP Billiton, the world's largest mining company, reported a first-half profit 57% less than the same period a year ago. This was a larger drop than expected after the company booked one-time charges totaling $2.7 billion to close mines and plants in response to falling metals prices.

BHP is not alone: Xstrata Plc and Rio Tinto Group are also closing mines, cutting output and slashing jobs as the worldwide recession curbs demand for metals other than gold. Freeport-McMoRan Copper & Gold has also posted recent net losses.

But is the bottom in? Given that BHP has a recent history of bottoming with volume spikes, that may be the case and we may see a near term upsurge in the share price.

However, that could very well be a false dawn and BHP could remain down for awhile yet. Right now the only bullish game in town is gold.

Having said that, we also believe there will be other commodities making big gains this year, but let's discuss them next week.

Good investing,

Disclosure: no positions

Nick Thomas

Analyst, Oxbury Research

Nick Thomas is a seasoned veteran of technical analysis and has mastered all intra-day trading in stocks, options, futures and forex. He prefers to scout investments as one asset class of many and shapes his investment strategies accordingly. He writes extensively about offshore banking and offshore tax havens and is active in the career development field of independent investment research.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.