U.S. Dollar Falls Amidst High Volatility

Currencies / Forex Trading Feb 04, 2009 - 05:04 AM GMTBy: ForexPros

High volatility was the rule today as the majors advanced sharply against the Greenback as mixed data and stops in thin conditions exaggerated moves. Despite poor earnings from US automakers equities were able to hold onto slight gains into the end of the day helping to hold both EURO and USD/JPY off their lows and in the case of EURO to trade above previous resistance in the 1.3030 area for a high print 1.3037 before trading a full handle lower mid-day.

High volatility was the rule today as the majors advanced sharply against the Greenback as mixed data and stops in thin conditions exaggerated moves. Despite poor earnings from US automakers equities were able to hold onto slight gains into the end of the day helping to hold both EURO and USD/JPY off their lows and in the case of EURO to trade above previous resistance in the 1.3030 area for a high print 1.3037 before trading a full handle lower mid-day.

After the noon hour the EURO advanced again to hold the 1.3000 handle suggesting that late shorts are getting squeezed. Trader’s note that stops under the 1.2800 handle went untouched suggesting also that longs are in near-term control of the market and offers may be over the 1.3080 area into the overnight session.

USD/JPY fell on general USD weakness today trading through stops placed around the 88.80 area for a low print at 88.58 but the rate quickly recovered aided by equities to hold back above the 89.00 handle into the close. Traders note that the USD/JPY is showing good support under the 88.80 area suggesting that more coiling before a potential short-squeeze lifts the rate into large stops likely close-in around the 90.50 area.

USD/CHF dropped as well erasing gains made the past few days dropping to a low print at 1.1400 before rallying almost a full handle but the rate was unable to hold above 1.1480 and retreated to the low 1.1400 area; traders note that stops were in the 1.1550 area as expected with more around 1.1480 suggesting that the longs are hurting into mid-week. Additionally, the rate is looking for a close under the 100 day MA as a clue for further weakness putting the bulls on notice. Aggressive traders can look to add to open shorts in the rate should the 1.1380 area fail. In my view, a return to the 1.1200 handle is in the works so I think you can trade the short side near-term.

USD/CAD also traded lower failing at the 1.2400 handle for a low print at 1.2310 before rallying back. The move was a dead cat bounce and the rate returned to the 1.2320 area into the end of the day suggesting the rate has a lot of longs looking to quit soon. Highs in the rate at 2.2525 were right at technical resistance and if short from there look to add on a bounce back near the 1.2380 area for a test of the 1.2200 handle. In my view, today’s surprise lift in the housing data was enough to encourage some optimism for equities and auto sales were already factored in.

In my experience a large move in the majors on minor news with big news due shortly is often a foreshadowing of more to come. Tomorrow’s ADP private payrolls is likely to show further contraction and today’s USD sell-off may be a sign of more to come mid-week and into Friday’s NFP. Look for more retreat by the Greenback overnight as follow-on selling takes hold in Asia.

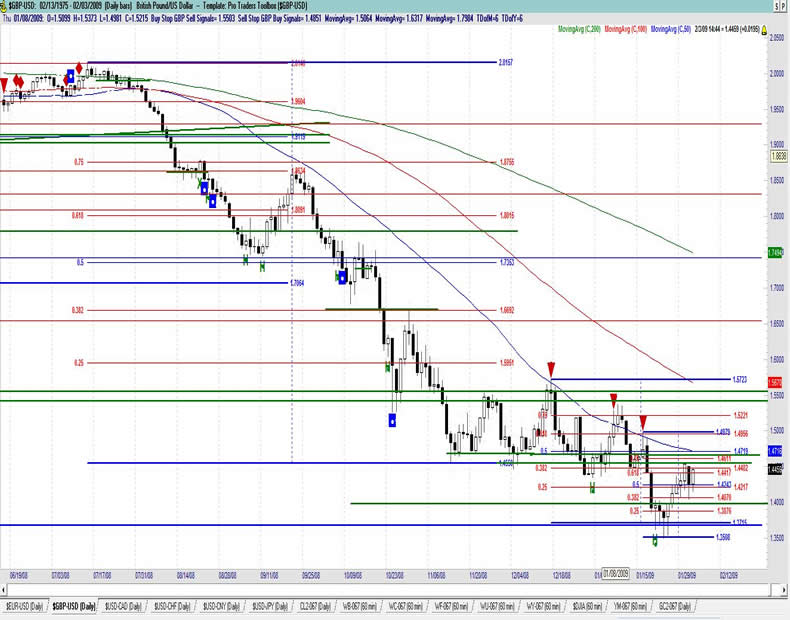

GBP USD Daily

Resistance 3: 1.4620, Resistance 2: 1.4550, Resistance 1: 1.4480

Latest New York: 1.4458, Support 1: 1.4150, Support 2: 1.4080, Support 3: 1.4000/10

Comments

Rate rallies and takes EURO with it; traders note stops and active buying above the 1.4300 area. Any correction a buying opportunity now as the rate begins to squeeze shorts. 23 year lows are very likely to hold on any break. Possibly unwinding of GBP crosses pressuring the rate back to and above the 1.4300 handle near-term. Light stops seen on the move under 1.4200 with likely active selling dropping into lows overnight but the rate recovers New York suggesting the bulls are in control. Two-way action continues suggesting that shorts are aggressively adding and longs are trying to find a bottom. Rate trading on technical’s now. Spillover from EURO likely but modest. A short-covering rally is increasingly likely now. Late sellers likely in or hurting.

Data due Wednesday: All times EASTERN (-5 GMT)

4th-6th GBP Halifax HPI m/m

4:30am GBP Services PMI

5:30am GBP BRC Shop Price Index y/y

EUR USD Daily

Resistance 3: 1.320/30, Resistance 2: 1.3150, Resistance 1: 1.3080

Latest New York: 1.3036, Support 1: 1.2700/10, Support 2: 1.2650, Support 3: 1.2620

Comments

Rate blasts through the 1.3030 key S/R area; likely on the way to the recent 1.3300 area top. Follows GBP in two-way action today then rebounds, cross-spreaders likely pressure as crosses are unwound during the day. Two-way action overnight in light volume as stops get triggered under 1.2850 area and below but sellers run out on support at the 1.2800 handle. Close back above 1.3030 argues for another test of the 1.3300 area weekly highs. Downside bias likely running out as rate held solid support numbers around the 1.2700/20 area. Bulls are still attempting to find a bottom. 50 bar MA failed now likely to offer resistance and a close above suggests the bottom will be in. Technical levels around the 1.3300 area now likely to offer resistance so expect two-way action and consolidation. Aggressive traders can look to buy the next dip.

Data due Wednesday: All times EASTERN (-5 GMT)

4:00am EUR Final Services PMI

5:00am EUR Retail Sales m/m

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.