Cassandra John Paulson Hedge Fund Manager Makes Billions from the Financial Crisis

Stock-Markets / Recession 2008 - 2010 Jan 30, 2009 - 10:45 AM GMTBy: Oxbury_Research

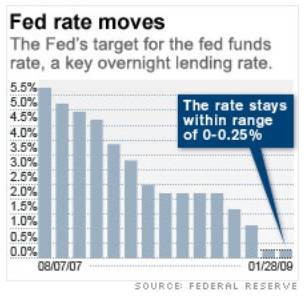

As expected, the Federal Reserve kept its key interest rate near 0% and claimed it stands ready to take additional steps such as purchasing longer-term Treasury bonds if such a move will help get credit flowing once again.

As expected, the Federal Reserve kept its key interest rate near 0% and claimed it stands ready to take additional steps such as purchasing longer-term Treasury bonds if such a move will help get credit flowing once again.

It seems their logic is that lowering the yield on government bonds will spur other lenders to lower their own yields. Hmmm, isn't the mantra of cheaper money everywhere sounding familiar? Why, of course it is.

Cheaper money is exactly what helped inspire the crisis in the first place.

With reasoning like this, we're glad they decided to do nothing, in much the same way as a bull calmly ambling around a china shop causes a lot less damage than one charging up and down the aisles.

But apparently these cheap rates will help fight off deflation, which is much feared by the Fed (and central bankers in general) as those dratted consumers and businesses simply refuse to spend anything if their cash actually appreciates in value.

After all, deflation encourages businesses to cut production and consumers to delay purchases because they anticipate lower prices to come. They'll purchase only what they actually really need while preserving themselves for future opportunities.

That sounds like common sense to us, but in Fed-land such thinking is frowned upon.

Inflation and resulting higher prices for everyone are much better, apparently. And with interest rates like these ones, they'll surely trigger it at some point:

Aside from slashing the lending rate to the lowest possible amount, the Fed has also:

- Increased the amount of money that banks and Wall Street firms can borrow directly from the Fed.

- Lent directly to major corporations through the purchase of commercial paper, used by companies to fund their day-to-day operations.

- Bought mortgage-backed securities to drive down mortgage rates, and

- Will shortly make more credit available to consumers and small businesses through additional loans to banks

The main recipients of all this largesse are the banks, which are still being run by the same fools who took their BKX-Index companies over the financial cliff in the first place:

Being A Banker Means Never Having To Say You're Sorry

After all, the banking executives currently "managing" billions in taxpayer money are the same ones who oversaw the near collapse of the entire industry:

According to an Associated Press analysis of regulatory and company documents, almost 90% of the of the most senior banking executives from 2006 have been retained.

It must be nice to get a free pass and try again (this time with even more borrowed money) with no apparent personal repercussions. The absurdity of the situation is highlighted by the fact that these guys get to keep their jobs, and yet there have been massive bank employee layoffs since 2006 as bank stocks have plummeted and credit evaporated.

Maybe the banking executives should be fired and people should start listening to the people who got it right the first time.

The Cassandra Canaries In The Coal Mine

Peter Schiff is one of them. The author of Crash Proof: How to Profit From the Coming Economic Collapse, foresaw quite some time ago that the U.S. economy had become dangerously and unsustainably dependent on consumption thanks to trillions of dollars borrowed from Japan and China .

Schiff was highly critical of American borrow and spend policies as excessive partying sure to inflict a heavy punishment in the future. And now he's predicting a multi-year recession marked by rampant inflation, a weakening dollar, soaring commodities prices, slumping stock indexes, and falling wages.

To get over the post-party hangover as quickly as possible, he's recommending smaller government, cancelling all the recent bailout programs and letting the free market do what it does best, which is reward efficiency and clean out poor investments and strategies doomed to fail. It sounds a lot more sensible than the current fiasco, which involves nothing more than keeping terminally ill patients on life support for no benefit to anyone except their executives and board members.

But as clever as Schiff's predictions have been (are and likely to continue to be), he's no John Paulson.

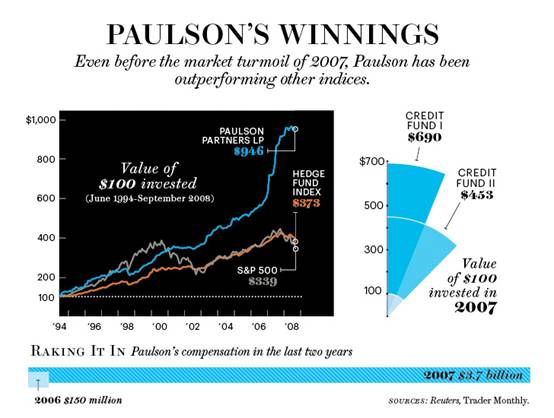

Mr. Paulson (no relation to the much-maligned ex-Treasury Secretary Henry Paulson) saw his investment funds ($36 billion under management and growing by the day) rise $15 billion in 2007. One fund gained 590% and another one 353% to generate $3.7 billion in personal profits for himself as well as countless billions for his clients. Even George Soros didn't make that much with his famous currency trades in the 1990's.

Like Schiff, Paulson also predicts that the recession will last for several years, that unemployment will rise and that things will look bad (if not even worse) for quite awhile yet. When he can make money like this, who can argue with him? (Graphic from portfolio.com)

So how did he do it? Paulson bet against subprime securities while everyone else continued buying them. He also foresaw that Lehman Brothers, Washington Mutual and Wachovia would experience severe difficulties due to their mortgage security practices.

If he could see it (and there were several other hedge fund managers who did the same), why couldn't the so-called Fed and Treasury gurus handing out bailout packages and/or still running the banks?

A Sign Of Times To Come

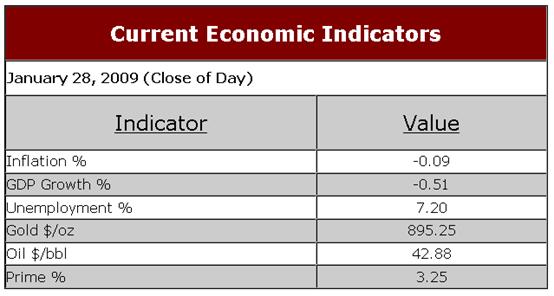

You might want to take a good look at this snapshot from The Financial Forecast Center because it's likely to be a good while before the numbers look significantly better:

Don't believe us (or Schiff, or Paulson)? Consider this small data point amid the whirlpool of data flowing around the market commentaries right now:

Due to current financial turmoil, the NYSE is "temporarily" easing its market capitalization minimum for companies to be listed. Starting April 22, the minimum capitalization over a consecutive 30-day trading period will become 15 million dollars (down from 25 million dollars). That's a 40% drop in requirements.

"This temporary lowering of the 30 trading-day average market capitalization requirement will enable companies of suitable size and quality to remain listed during current difficult market conditions," said Richard Ketchum, chief executive of NYSE Regulation.

This is primarily because the number of companies failing to make the $25 million cutoff is now "significantly higher than the historical norm". Since the NYSE's history can be traced to May 17, 1792, that's rather significant, don't you think?

If even the grand-daddy of world stock exchanges has to lower the requirements to keep its members in the club, times are going to be hard everywhere.

Good investing,

Nick Thomas

Analyst, Oxbury Research

Nick Thomas is a seasoned veteran of technical analysis and has mastered all intra-day trading in stocks, options, futures and forex. He prefers to scout investments as one asset class of many and shapes his investment strategies accordingly. He writes extensively about offshore banking and offshore tax havens and is active in the career development field of independent investment research.

Oxbury Research originally formed as an underground investment club, Oxbury Publishing is comprised of a wide variety of Wall Street professionals - from equity analysts to futures floor traders – all independent thinkers and all capital market veterans.

© 2009 Copyright Oxbury Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Oxbury Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.