U.S. Dollar Attracts New President Obama HoneyMoon Euphoria Buying

Currencies / Forex Trading Jan 20, 2009 - 12:41 PM GMTBy: ForexPros

After a three-day weekend that saw the USD advance against the majors on Monday, the Greenback is extending its rally against most major pairs again this morning; the big mover overnight is the GBP as the rate falls to a new multi-year low. Traders report thin conditions but lot’s of two-way action as Cable falls through the 1.4100 handle for a low print at 1.3912 in early New York. Starting overnight as GBP crosses remained under pressure the drop in Cable was pressured by Russian sales of GBP and EURO as the Russians attempt to support their currency. Traders estimate around 10B the last 24 hours was spent by the Russians most of it in GBP but some in EURO and USD.

After a three-day weekend that saw the USD advance against the majors on Monday, the Greenback is extending its rally against most major pairs again this morning; the big mover overnight is the GBP as the rate falls to a new multi-year low. Traders report thin conditions but lot’s of two-way action as Cable falls through the 1.4100 handle for a low print at 1.3912 in early New York. Starting overnight as GBP crosses remained under pressure the drop in Cable was pressured by Russian sales of GBP and EURO as the Russians attempt to support their currency. Traders estimate around 10B the last 24 hours was spent by the Russians most of it in GBP but some in EURO and USD.

Combined with EURO-Sterling sales and GBP/JPY sales the GBP fell to its lowest level since July 2001 making a mess of balance sheets as longs scrambled to get out and shorts pressed their advantage. Analysts project a test of the 1.3600 area if Cable cannot hold 1.3850 on further weakness.

EURO also fell on sympathy pressure but traders also report solid two-way interest with large names on the bid as the rate fell through 1.3020 area with rumors of semi-official names on the offer.

Despite large drops in both pairs buying interest was evident suggesting that buyers are still interested in dips; high prints in EURO at 1.3104 overnight with lows in early New York at 1.2920. Some stops seen as technical levels fell but the main interest was rebalancing suggesting active selling in both EURO and GBP despite the net cross-selling in the non-USD pairs.

USD/JPY was on the quiet side overnight holding the 90.00 handle as interest was in the European pairs took center stage; trader note interest on the dips for a low print at 90.07 with highs at 90.99 after the recent try to hold 91.00 handle. The rate now looks poised for a short-squeeze and sell interest is rumored to be waiting at the 92.00 area and above. Traders note volumes remained lower as the markets appear to be watching the US Presidential Inauguration for clues to the USD’s next move.

USD/CHF is holding firm at the 1.1400 handle erasing offers around the 1.1380 area the past 24 hours; low prints at 1.1315 with highs at 1.1482. Traders note solid offers above the 1.1450 area suggesting that the USD may be overextended a bit. USD/CAD rallied as well for a high print at 1.2661 in early New York; lows at 1.2528 were above the 1.2480 area suggesting late longs may be making for a high around the 1.2700 area or above but volumes are thin. In my view, the USD is benefiting from aggressive overseas intervention more so than economic reality.

Today’s euphoria over the new US President will probably encourage a lot of USD firmness as the “honeymoon” period attracts USD buyers but the reality of the situation is far worse than current pricing suggests. The only way out of this situation is to devalue the USD and I think that makes for some attractive buys across the board. Look for the USD to remain two-way and consolidate the next few days.

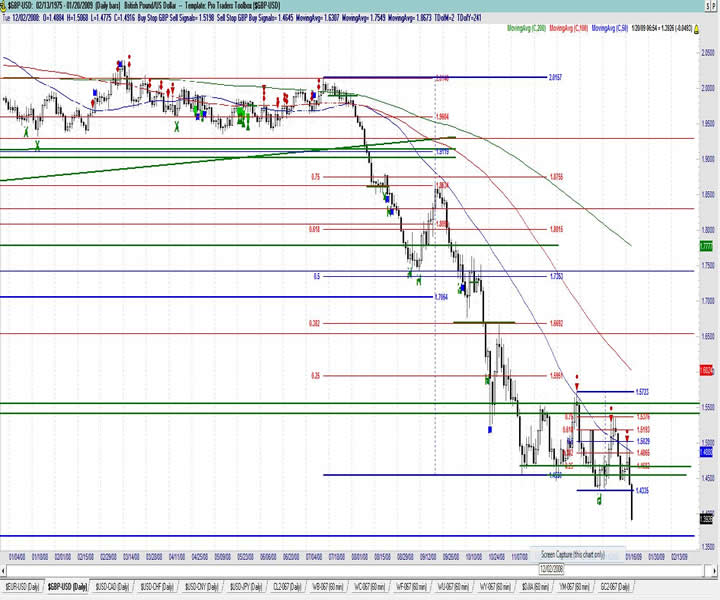

GBP USD Daily

Resistance 3: 1.4600 , Resistance 2: 1.4520/30, Resistance 1: 1.4450, Latest New York: 1.3923

Support 1: 1.3850, Support 2: 1.3800/10, Support 3: 1.3760

Comments

Rate falls hard as cross-spreaders sell GBP across the board. Overnight economic news seen as neutral; some rumor of UK bank downgrades adding pressure. Sell-signal from toolbox validated suggesting a test of the next major support area around the 1.3850 to 1.3780 area. Signs of the bottom after holding the 1.4500 handle last week negated near-term with offers likely back at the sell zone around 1.4450 area now. Cross-spreaders continue to sell GBP across the board. Volumes continue light on this break. Spillover from EURO likely. Look for two-way action into this bottom. A short-covering rally is increasingly likely now; looking for signs of late sellers.

Data due Wednesday: All times EASTERN (-5 GMT)

4:30am GBP MPC Meeting Minutes

4:30am GBP Average Earnings Index 3m/y

4:30am GBP Prelim M4 Money Supply m/m

4:30am GBP Public Sector Net Borrowing

4:30am GBP Unemployment Rate

EUR USD Daily

Resistance 3: 1.3200/10, Resistance 2: 1.3180, Resistance 1: 1.3100/10

Latest New York: 1.2966, Support 1: 1.2900/10, Support 2: 1.2850, Support 3: 1.2780

Comments

Rate two-way despite sharp fall in GBP; likely cross spreaders supporting on the dip as active sellers attempt to push the rate lower into major support around the 1.2780 area. Bottom may be forming around under the 1.3030 area as the drop into the 1.2900 handle was on thin volume. 50 bar MA failed now likely to offer resistance and a close above suggests the bottom will be in. Sell signal from the toolbox validated by the drop but be cautious as trend line support approaching. Semi-official and sovereign bids and offers seen overnight. Technical levels around the 1.3300 area now likely to offer resistance so expect two-way action and consolidation. Look for a solid bounce from here. Aggressive traders can look to buy the next dip.

Data due Wednesday: All times EASTERN (-5 GMT)

2:00am EUR German PPI m/m

3:00am EUR ECB President Trichet Speaks

4:00am EUR Italian Trade Balance

4:30am EUR ECB President Trichet Speaks

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2009 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.