Worthless Trillion Dollar Paper

Economics / Fiat Currency Jan 16, 2009 - 02:04 PM GMTBy: Mike_Hewitt

Recently Zimbabwe announced that it will issue a new set of notes which will include a 10 trillion, 20 trillion, 50 trillion and 100 trillion denomination. One commentator stated that these notes will be introduced to "keep pace with the hyperinflation that has caused many to abandon the country's currency."

This makes about as much sense as a doctor saying he will give his patient a larger dose of heroin to battle his addiction. The Reserve Bank of Zimbabwe (RBZ) is not battling some mysterious external force depreciating the Zimbabwe dollar. The currency is plummeting in value because the central bank is increasingly issuing more of it. These trillion dollar notes will only further exacerbate the situation.

The first Zimbabwean dollar (ZWD) was introduced in 1980 and replaced the Rhodesian dollar at par. At the time of its introduction, the Zimbabwean dollar was worth more than the U.S. dollar, with ZWD 1 = USD 1.47. However, the currency's value eroded rapidly over the years. In October 2005, the head of the RBZ, Dr. Gideon Gono, announced that "Zimbabwe will have a new currency next year." The amount of currency in circulation went from 25 billion ZWD in January 2002 to 46,882 billion ZWD by July 2006. On August 1 st 2006, old Zimbabwe dollars were exchanged at the rate of 1 revalued dollar for 1,000 old dollars.

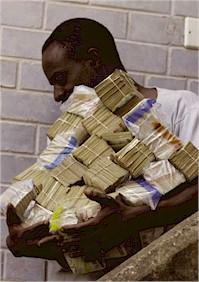

The new $50 billion note was issued by Zimbabwe's central bank on June 2008.

After the Aug 2006 revaluation the currency in circulation was 46.9 billion ZWD. Over the next 18 months, the RBZ increased the currency in circulation over 15,000 times to 716,559 billion ZWD. 1 As expected, the ZWD continued falling in value.

Reserve bank governor Dr. Gideon Gono announced on July 30 th 2008 that the Zimbabwean dollar would again be revalued. Effective August 1 st 2008, 10 billion ZWD was worth one new Zimbabwe dollar.

Shopping for groceries in Harare.

In Nov 2008, Dr. Gono issued the following statement in a press release :

"...the invisible forces of destruction have been unmasked, marking a turning point chapter when the fraudulent and speculative winds are cast into the inferno of extinction."

The reason for Zimbabwe's economic woes according to the press release was that the Zimbabwe Stock Exchange (ZSE) had become the "epicentre of economic destruction" by allowing stock brokers to bid up stock values. In a statement clearly meant to serve as a deflection of blame from the Zimbabwean government to the financial sector, Dr Gono provided the following:

"Where share prices were rising at the ridiculously bloated rates, what that effectively meant was that someone could work up with no penny at the bank, but end the day a multitrillionnaire. The next morning, the false wealth so created would show up as high demand for cash, and all this being blamed on the Central Bank."

Zimbabweans, in an effort to preserve their wealth, rushed into the ZSE which returned 300,000% in 2007. While that may seem good on the surface, the reduction of value for the ZWD more than offset any capital gains, with prices for goods and services increasing at an annualized 231 million percent according to official government estimates. The doors of the ZSE have remained shut since closing for Christmas in 2008.

History is littered with many failed currencies that were completely destroyed or revalued by the practice of over-issuance. Hyperinflation results in widespread poverty, high unemployment, mass emigration and complete or near collapse of the social order. The RBZ's monetary policy of funding government expenditures by printing additional money presents this century's first example of the inevitable consequences of hyperinflating a nation's money supply.

Notes

1 The Reserve Bank of Zimbabwe ceased releasing any official money supply figures after February 2008.

By Mike Hewitt

http://www.dollardaze.org

Mike Hewitt is the editor of www.DollarDaze.org , a website pertaining to commentary on the instability of the global fiat monetary system and investment strategies on mining companies.

Disclaimer: The opinions expressed above are not intended to be taken as investment advice. It is to be taken as opinion only and I encourage you to complete your own due diligence when making an investment decision.

Mike Hewitt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.