Financial Doomsday for All Asset Classes

Stock-Markets / Credit Crisis 2009 Jan 10, 2009 - 11:41 AM GMT

Employment situation… grim. Nonfarm payroll employment declined sharply in December, and the unemployment rate rose from 6.8 to 7.2 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Payroll employment fell by 524,000 over the month and by 1.9 million over the last 4 months of 2008. In December, job losses were large and widespread across most major industry sectors.

Employment situation… grim. Nonfarm payroll employment declined sharply in December, and the unemployment rate rose from 6.8 to 7.2 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Payroll employment fell by 524,000 over the month and by 1.9 million over the last 4 months of 2008. In December, job losses were large and widespread across most major industry sectors.

To add insult to injury, the Bureau of Labor Statistics added 70,000 “hypothetical” jobs in December. Could it be that the real employment numbers fell by 594,000?

“This was the most rapid deterioration in the labor market over a six-month period since 1975,” said Michael Darda , chief economist at MKM Partners LP in Greenwich, Connecticut. “Policy makers will go full throttle” until “the labor market starts to turn,” he said.

No surprises here.

Consumer credit decreased at an annual rate of 3-3/4 percent in November 2008. Revolving credit decreased at an annual rate of 3-1/2 percent, and non-revolving credit decreased at an annual rate of 4 percent.

Washington creates a “financial doomsday” for small retailers.

A new government regulation scheduled to take effect next month has thousands of retailers, thrift stores and small businesses worried they will be forced to permanently close their doors – and destroy their merchandise. Even Goodwill Industries told the station it may be forced to stop selling clothing and other children's items if testing is too expensive. The move could affect consumers who donate items for tax write-offs if the stores are not able to sell them.

What's next for equities?

-- U.S. stocks stumbled under the burden of an employment report that showed monthly job losses in line with analysts' expectations but also highlighted the longer-term struggles of the U.S. economy.

While the numbers were not as bad as the dire predictions of 700,000 or more new unemployed workers, the numbers are preliminary and subject to revision, just as the November numbers were revised upwards in this morning's report.

Bond holders are near the exits.

-- Treasuries are off to the worst annual start in more than two decades on concern debt sales will swell to unprecedented levels amid efforts by the U.S. to spur economic growth with spending increases and tax cuts. The expectation is that the proposed new stimulus package on top of the existing ones may create a supply of bonds greater than the demand for them. The huge fiscal deficit in Washington will also cause risk premiums to go up, even in the most conservative class of income securities.

-- Treasuries are off to the worst annual start in more than two decades on concern debt sales will swell to unprecedented levels amid efforts by the U.S. to spur economic growth with spending increases and tax cuts. The expectation is that the proposed new stimulus package on top of the existing ones may create a supply of bonds greater than the demand for them. The huge fiscal deficit in Washington will also cause risk premiums to go up, even in the most conservative class of income securities.

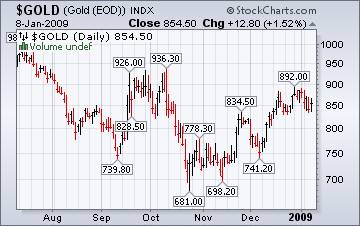

Gold pattern may mimic that of stocks and bonds.

Gold fell as the dollar gained against the euro and after oil declined, curbing the metal's appeal as an alternative investment. Bullion fell as the prospects of a European Central Bank rate cut pressured the euro, bringing the dollar's gain to 2 percent this week, as the precious metal declined 2.3 percent.

Gold fell as the dollar gained against the euro and after oil declined, curbing the metal's appeal as an alternative investment. Bullion fell as the prospects of a European Central Bank rate cut pressured the euro, bringing the dollar's gain to 2 percent this week, as the precious metal declined 2.3 percent.

Japanese stocks face reality as “window dressing” period is over.

-- ( Bloomberg ) -- Japan stocks slumped today as earnings prospects for automakers took a turn for the worse and a stronger Yen takes away the competitive edge for Japanese exports. “As we enter the earnings season, no good news can be expected,” said Yoji Takeda , who manages the equivalent of $1.1 billion at RBC Investment (Asia) Ltd. in Hong Kong. “Actual numbers and forecasts are likely to be even worse than investors expect.”

-- ( Bloomberg ) -- Japan stocks slumped today as earnings prospects for automakers took a turn for the worse and a stronger Yen takes away the competitive edge for Japanese exports. “As we enter the earnings season, no good news can be expected,” said Yoji Takeda , who manages the equivalent of $1.1 billion at RBC Investment (Asia) Ltd. in Hong Kong. “Actual numbers and forecasts are likely to be even worse than investors expect.”

Chinese stock rise on subsidies, not profits.

-- ( Bloomberg ) -- China's benchmark stock index rose for the first time in three days, led by power producers on speculation they will get subsidies from the government. The market has perceived the aid to power companies as a signal that more favorable policies will be worked out to help them,” said Wang Peng , chief investment officer at First Trust Fund Management Co. in Shanghai, which oversees the equivalent of $2.1 billion. “There won't be aggressive buying in the near future as investors are still concerned about the first-quarter earnings that may fall sharply.”

-- ( Bloomberg ) -- China's benchmark stock index rose for the first time in three days, led by power producers on speculation they will get subsidies from the government. The market has perceived the aid to power companies as a signal that more favorable policies will be worked out to help them,” said Wang Peng , chief investment officer at First Trust Fund Management Co. in Shanghai, which oversees the equivalent of $2.1 billion. “There won't be aggressive buying in the near future as investors are still concerned about the first-quarter earnings that may fall sharply.”

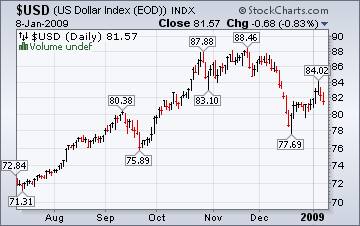

The Dollar hesitates on falling stocks.

( Reuters ) -- The U.S. dollar weakened against the yen on Thursday, as falling stocks worldwide and weak sales at top U.S. retailer Wal-Mart tempered the market's appetite for risk and reignited worries about the global economic outlook.

( Reuters ) -- The U.S. dollar weakened against the yen on Thursday, as falling stocks worldwide and weak sales at top U.S. retailer Wal-Mart tempered the market's appetite for risk and reignited worries about the global economic outlook.

The greenback also fell against the euro after the latest weekly data showed the number of Americans on unemployment benefits rose to a 26-year high.

Housing kept aloft by “weak hands.”

As the U.S. housing recession enters its fourth year, there's no sign of a recovery because speculators account for most of the rise in sales. The repossessed properties offer opportunities for investors, who typically buy homes at auction and rent them out until prices increase and they can sell. “You don't have it in strong hands, you have flippers,” said Shiller, who helped create the S&P/Case Shiller real estate price indexes . “These speculators are preventing the market from crashing now, and when they get out it could fall again.”

As the U.S. housing recession enters its fourth year, there's no sign of a recovery because speculators account for most of the rise in sales. The repossessed properties offer opportunities for investors, who typically buy homes at auction and rent them out until prices increase and they can sell. “You don't have it in strong hands, you have flippers,” said Shiller, who helped create the S&P/Case Shiller real estate price indexes . “These speculators are preventing the market from crashing now, and when they get out it could fall again.”

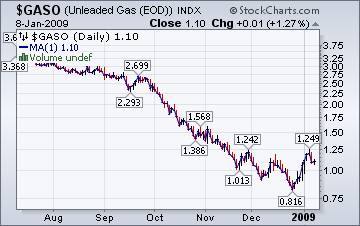

Change of trend…or a bump in the road?

The Energy Information Administration reports that, “For the first time since September 15, 2008, the national average price for regular gasoline increased. The price jumped 7.1 cents to 168.4 cents per gallon. Despite the increase, the price was 142.5 cents lower than a year ago. Although prices rose in the East Coast, Midwest, Gulf Coast and West Coast regions, prices slipped slightly in the Rocky Mountains and the Central Atlantic portion of the East Coast.”

The Energy Information Administration reports that, “For the first time since September 15, 2008, the national average price for regular gasoline increased. The price jumped 7.1 cents to 168.4 cents per gallon. Despite the increase, the price was 142.5 cents lower than a year ago. Although prices rose in the East Coast, Midwest, Gulf Coast and West Coast regions, prices slipped slightly in the Rocky Mountains and the Central Atlantic portion of the East Coast.”

Natural gas prices decreased for the week in the lower 48 states.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Natural gas spot prices increased at most market locations in the Lower 48 States, posting increases of 10 to 41 cents per MMBtu since Wednesday, December 31. Factors contributing to the climbing prices included cold winter weather prevailing throughout most of the Lower 48 States, and the increased crude oil prices.

The Energy Information Agency's Natural Gas Weekly Update reports, “ Natural gas spot prices increased at most market locations in the Lower 48 States, posting increases of 10 to 41 cents per MMBtu since Wednesday, December 31. Factors contributing to the climbing prices included cold winter weather prevailing throughout most of the Lower 48 States, and the increased crude oil prices.

More Doom Ahead?

Here's an article by Nouriel Roubini.

Last year's worst-case scenarios came true. The global financial pandemic that I and others had warned about is now upon us. But we are still only in the early stages of this crisis. My predictions for the coming year, unfortunately, are even more dire: The bubbles, and there were many, have only begun to burst.

The prevailing conventional wisdom holds that prices of many risky financial assets have fallen so much that we are at the bottom. Although it's true that these assets have fallen sharply from their peaks of late 2007, they will likely fall further still. In the next few months, the macroeconomic news in the United States and around the world will be much worse than most expect. Corporate earnings reports will shock any equity analysts who are still deluding themselves that the economic contraction will be mild and short.

Severe vulnerabilities remain in financial markets: a credit crunch that will get worse before it gets any better; deleveraging that continues as hedge funds and other leveraged players are forced to sell assets into illiquid and distressed markets, thus leading to cascading falls in asset prices, margin calls, and further deleveraging; other financial institutions going bust; a few emerging-market economies entering a full-blown financial crisis, and some at risk of defaulting on their sovereign debt.

We're on the air every Friday.

Tim Wood, John Grant and I are back in our weekly session on the markets. The market has been a real roller coaster ride this week. You will be able to access the interview by clicking here .

New IPTV program going strong.

This week's show on www.yorba.tv is packed with information about the direction of the markets. I'm on every Tuesday at 4:00 pm EDT . You can find the archives of my latest programs by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.