U.S. Dollar Weakens Amidst Signs of Easing Credit Crisis

Currencies / Forex Trading Dec 09, 2008 - 09:57 AM GMTBy: ForexPros

Higher equities on follow-on strength from overnight positive stock prices helped to lift the majors against the USD with most pairs setting new highs against the Greenback in late trade. GBP regained the 1.4900 handle but still off the Asian highs of 1.5051 in New York; traders note that spillover strength from EURO is helping to hold GBP firmer. Additionally, cross-spreaders continued to buy Sterling on the crosses also bringing the upside in focus. Today’s close over the 1.4940 area is the highest close in six days suggesting a near-term bottom may be forming in that rate.

Higher equities on follow-on strength from overnight positive stock prices helped to lift the majors against the USD with most pairs setting new highs against the Greenback in late trade. GBP regained the 1.4900 handle but still off the Asian highs of 1.5051 in New York; traders note that spillover strength from EURO is helping to hold GBP firmer. Additionally, cross-spreaders continued to buy Sterling on the crosses also bringing the upside in focus. Today’s close over the 1.4940 area is the highest close in six days suggesting a near-term bottom may be forming in that rate.

EURO is two-full figures higher than Friday’s close suggesting that the rate is seriously under upside bias; highest close in nine days in that pair. Aggressive traders can add to both EURO and GBP longs on the New York close this afternoon. Despite a 300-plus rally in DJIA today USD/JPY failed to advance suggesting that re has offers waiting to hold the bulls in check; overnight high prints at 93.92 went unchallenged in New York trade and the pair closes negative on the day.

USD/CHF is flirting with the important 1.2020 area on the close; making lows in late trade at 1.2017 but not holding there. Traders note that technical trade is likely to favor a close over the 1.2020 area as supportive and a close under there as negative; in my view the 1.2020 area is key to near-term direction and I would fade a rally if the market closes above 1.2020 area.

USD/CAD dropped to lows at 1.2442 overnight but that number went unchallenged in New York trade. Currently a the 1.2520 area into the end of day the rate is still off the lows enough to encourage buying the next 24 hours. In my view, the USD is set to crash this week. Look for the Greenback to falter into Tuesday’s US data as again it will not be USD supportive. For the most part, the USD is benefiting mostly from very early flight-to-quality buying into the financial crisis; now that the signs are becoming clear that the crisis is mitigating and government programs are slowly beginning to resolve the credit crunch I think the USD is headed for at least a corrective pullback. Look for the Majors to extend to the upside within the next 24-48 hours in my view.

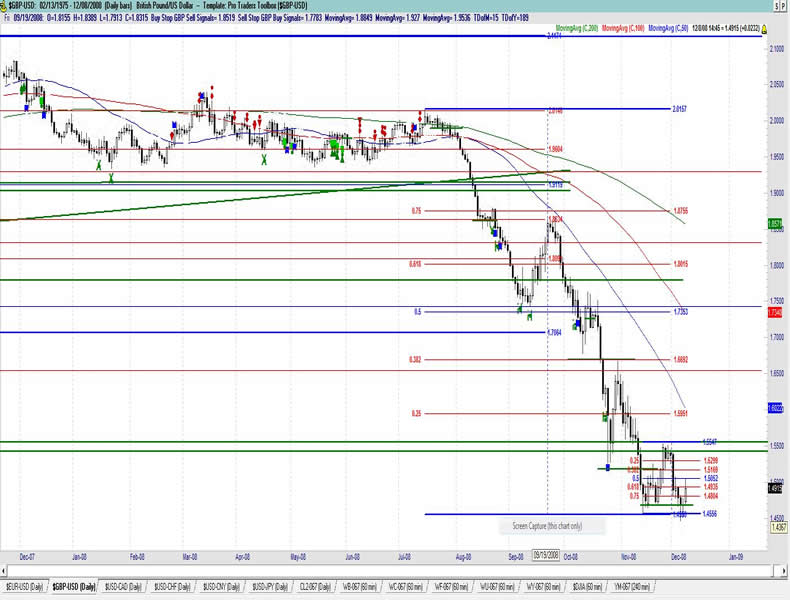

GBP/USD Daily

Resistance 3: 1.5200 , Resistance 2: 1.5100/10 , Resistance 1: 1.5050 , Latest New York: 1.4912

Support 1: 1.4550 ,Support 2: 1.4460/70 , Support 3: 1.4420

Comments

Rate rallies to start the week, some light stops reported. More upside now due on Tuesday as the market is shrugging off bearish news. Aggressive traders can look to ADD to open longs anytime looking for a push through and a close back above 1.5000. Some spillover from EURO likely. Analysts suggest 100 BP rate cut probably already fully factored in; good bids reported but supply seen from semi-official names. Traders note solid two-way action with stops cleared across several levels in both directions. Sellers hold control above 1.5100 area so far; OK to buy if flat on a dip. Profit-taking likely to result in a squeeze on the further strength. Technical trade overnight again. Traders note liquidity is only moderate and still on the lower side.

Data due Tuesday: All times EASTERN (-5 GMT)

4:30am GBP Manufacturing Production m/m

4:30am GBP Trade Balance

4:30am GBP DCLG HPI y/y

4:30am GBP Industrial Production m/m

Tentative GBP MPC Member Sentance Speaks

7:01pm GBP NIESR GDP Estimate

EURO/USD Daily

Resistance 3: 1.3080 , Resistance 2: 1.3000/10 , Resistance 1: 1.2950/60 , Latest New York: 1.2931

Support 1: 1.2580 , Support 2: 1.2550 , Support 3: 1.2480

Rate continues to hold at support, possible sovereign interest on the bid. Spillover from GBP helps hold the rate above support at 1.2750 area. Buyers are willing on dips. Possible reversal now in play but the rate needs to firm above the 1.2850 area in my view. Bids are building under the 1.2600 area as expected; sell-off likely to be bought hard now. OK to try the long side again on a dip if not already long. Aggressive traders can ADD to open longs again under the 1.2750 area near-term. Traders note stops building above the market around the 1.2950 area in size likely to help create some two-way action. Support also from cross-spreaders as they unwind Yen. Rate is an absolute screaming buy in my view—I can’t see further weakness being ignored by the buyers. Traders note the rate is finding profit-taking bids on dips so far despite the uncertainty in the market.

Data due Tuesday: All times EASTERN (-5 GMT)

2:00am EUR German Trade Balance

2:45am EUR French Gov Budget Balance

2:45am EUR French Trade Balance

5:00am EUR German ZEW Economic Sentiment

5:00am EUR ZEW Economic Sentiment

Analysis by: http://www.Forexpros.com - Written by Jason Alan Jankovsky

Forexpros offers the most definitive Forex portal on the web. It contains industry leading market analysis, up-to-the minute news and advanced trading

tools which provides brokers, traders and everyone involved in the financial market with an all-round guide to Forex.

Copyright © 2008 by ForexPros.com All rights reserved.

Disclaimer: Trading Futures and Options on Futures and Cash Forex transactions involves substantial risk of loss and may not be suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

ForexPros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.