Citigroups Survival in Doubt as 50,000 Jobs Cut

Companies / Corporate News Nov 17, 2008 - 01:20 PM GMTBy: Captain_Hook

In yet another round of massive financial layoffs, Citigroup plans to cut about 50,000 jobs .

In yet another round of massive financial layoffs, Citigroup plans to cut about 50,000 jobs .

Citigroup's layoffs are the latest in a brutal round of job cuts across the financial industry. The cuts have been sparked by unprecedented losses due to bad credit investments, as well as the subsequent precipitous drop in banking and other financial-services business amid the worst economic conditions in 70 years.

Combined with earlier cuts of more than 20,000 positions, the latest job cuts will equal a 20 percent reduction in the bank's workforce from peak levels reached in the fourth quarter of 2007.

In October, fellow blue chip American Express Co. (AXP) announced major layoffs, unveiling plans to slash 7,000 jobs. So far this year, Goldman has said it would cut 3,200 jobs, Whirlpool dropped the ax on 5,000, Yahoo cut 1,000 positions, and Hewlett-Packard shed 24,000 jobs.

Town Hall Meeting

Citigroup gave a Town Hall Meeting Presentation in which it compared its capital position to other companies, mapped out loan loss reserves, expense reductions, and other items. Let's take a look.

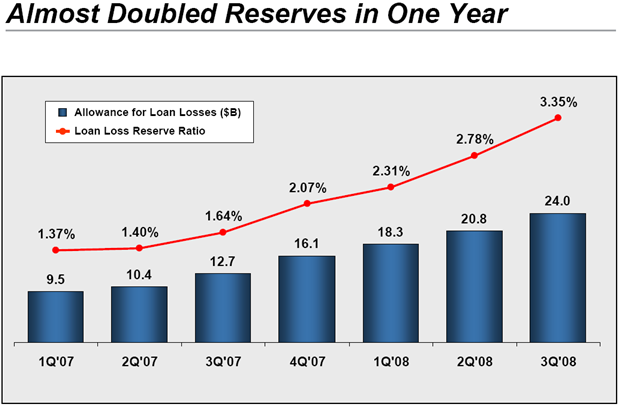

Loan Loss Reserves

Citigroup doubled loan loss reserves. Will that be enough to keep up with the deteriorating economy? Unemployment is going to soar and along with it writeoffs in credit cards, home equity lines of credit, commercial real estate, consumer loans, etc. Citigroup is still behind the curve in writeoffs in my estimation.

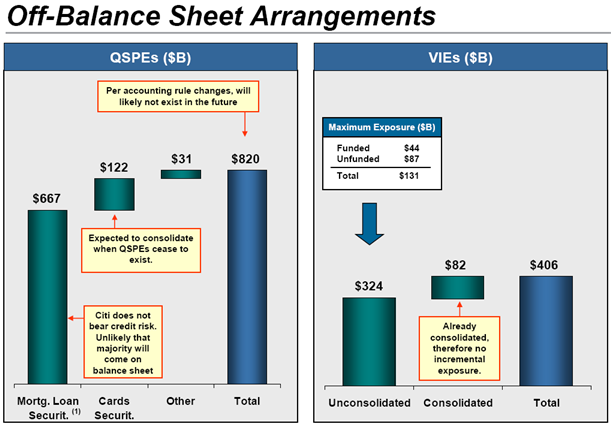

Off Balance Sheet Holdings

Citigroup notes that the majority of $667 billion is unlikely to come on balance sheet yet presumes none of it will. I question the idea that Citi has no credit risk. Just how good are the counterparty guarantees for Citigroup to assume it has no risk on $667 billion? Also note that per an accounting rule change, Citigroup will be allowed to hide whatever risk there is, off the balance sheet and pretend that it does not exist at all. These risks need to be brought on the balance sheet and fully disclosed.

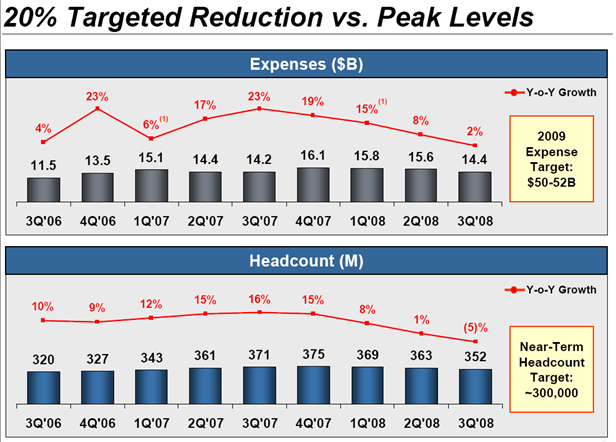

Targeted Reductions

For all the brouhaha over the layoff announcement, Citigroup's third quarter 2008 expenses are still higher than a year ago. If Citi hits is expense target of $52 billion for 2009, its expenses will be on average $13 billion per quarter or roughly where it was in 4th quarter of 2006 when the economy was humming along nicely (or so the mirage seemed).

Looking ahead from here, Citigroup is going to cut expenses by $1.4 billion per quarter (9.7%), and head count by 50,000 (14.2%) over the next 5 quarters (through the end of 2009). Is this enough? What does Citigroup do with 300,000 employees if it keeps selling off business units and assets?

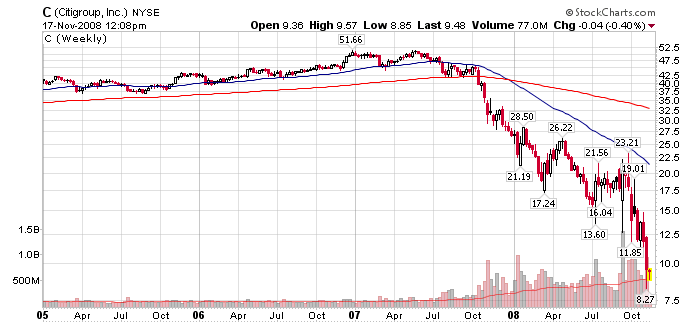

World Class Leadership Team

Citigroup praised its wold class team on the presentation. Yes, there are some new faces but a lot of old faces too. But here is the final arbiter of how good that team is.

Citigroup Weekly Chart

The chart shows the market has increasing doubts about Citigroup's survival, or if it does survive, that it survives in one piece. And the icing on the economic cake is the loss of another 50,000 jobs even if it does survive.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.