Stocks Bull Market End Game Bear Start Strategy

Stock-Markets / Stock Market 2025 Mar 20, 2025 - 04:16 PM GMTBy: Nadeem_Walayat

Thanks to Agent Orange the S&P is down 10% whilst Russian stocks are up 30%, so at least the Russian stocks I bought Feb / March 2022 are soaring! I get asked is the bull market over, it could be but that's not my base case so I did what I've done for the duration of this bull market which is to buy the dip in target stocks as opps materialise. We are getting a bounce off a 10% drop but what the markets are really waiting for the next leg up proper apart from Agent Orange to shut his mouth is for the Fed to indicate that the money printer is about to go brrrr again and for that we have Wednesdays Fed interest rate decision at 6pm GMT followed by Powell's forward guidance speech that will likely be dovish in the wake of the carnage inflicted by Agent Orange. Biden handed President Dump a goldilocks economy that was delivering near S&P 30% per annum, and what does Trump do? he goes and crashes it by pressing the reset button back to 1929! Alls he had to do was nothing and we'd be coasting along with probably a couple more years of easy S&P gains.

Some say there's reason to the madness because Trump is a genius and he's playing 4d chess, he's going to earn the US hundreds of billions of dollars in tariffs per year, though what about the $10 trillion in wealth destroyed over the past few weeks? Reality is that Trump is increasingly going to become like the Fuhrer in his bunker moving imaginary pieces around a map as the economy crumbles towards recession and what power he thinks he has erodes, cue Mid terms.

You know when you reboot a server there is a chance that it doesn't come back online..... that's what's Trumps trying to do to the US economy, a hard reset. The risk is he kills the economy with his 1930's tariffs playbook. What would I do if I was in Trumps shoes, I would do NOTHING! The system has been in place for over 50 years and is well embedded, start messing with it and face unintended consequences such as the derivatives markets or the banks blowing up, remember the banks are weapons of mass financial destruction and now so is President Dump!

The system generates cycles of expansion then contraction which leads to the next cycle. Whilst Trump as I have been stating for over a year is the harbinger of the stock market apocalypse! Trump is destroying demand for US goods and services and attempting to turn allies info foes never mind outright threats of annexation which are severely damaging the system that we have lived under for 50 years.

Every time President Dump opens his mouth he brings the next bear that bit closer where the best case scenario would be similar to 2022, worst case like 2008-2009. So I don't expect something long lasting i.e. 1965-82, more like 1-3 years for my portfolio anyway, maybe the nothing burger S&P will get stuck in a range, but the AI tech stocks should eventually rebound to new all time highs.

So if I were President I would continue with the system as is with minor tweaks here and there, and that is what will deliver a sustained bull market that typically runs for 5 to 6 years to be followed by a corrective bear market. Anything more significant such as tariffs will result in unintended consequences though with Trumps chaos the consequences are rather obvious i.e. a major recession and that's not even allowing for if the nut job engages in actual warfare with the likes of CANADA!

American Power = Trade + Military + US Dollar + Alliances + Tech

Trump is undermining at least 4 of the corner stones of American power! Where the risk we are now running is that of a Sept 2008 event, a collapse of the global financial system, which we came within hours of happening during September 2008! So far we have had a 7% drop in the dollar and 10% drop in the S&P, and maybe loss of GDP of 0.5%, but the more damage Trump does then the risks of Systemic Event increase that takes control of the agenda away from Trump and into the hands of the Fed in attempts to prevent financial armageddon. I suspect it could happen in the Bond Market, similar to what happened when Liz Truss crashed the UK bond market. So many countries that the US is busy alienating hold US bonds that it does not take much to spark a run on the US financial system, confidence is fragile as President Dump may soon find out.

Hey I get it Americans want to bring back jobs to America because of perceived loss due to Globalisation, reality is that the US is a globalisation winner! You want to know who really should have a big beef with globalisation? EUROPE! It should be Europe imposing tariffs on the likes of the US and China given the damage globalisation has done to EUROPE which has been forced to play follow the US leader in virtually every action!

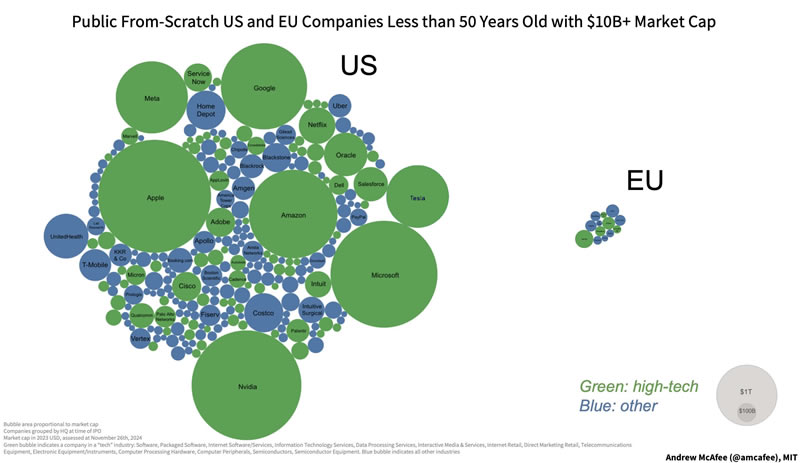

These are the facts, in 1980 the US economy was 25% of global GDP, today it is 26%, the US has BENEFITED FROM GLOBALISATION! Yes not to the extent of CHINA which as gone from about 1.5% to 16.8%! As for Europe, was 26%, today that has collapsed to near half at 14.9% of the global economy. Europe needs to stand on its own two feet and take charge and not be harassed and bullied by the US, Russia or China else continue to die an economic and political death. The US should be seeking a stronger partnership with Europe so can be called upon when the US goes to war with China but no Agent Orange has hit Europe harder than China, Agent Orange wants to push Europe into a depression as if that won't effect the US Economy! Most of Europe's woes and the rise of the far right are down to the huge negative impact of globalisation on Europe that as I pointed out in a previous article has NO tech giants! Despite many of Europe's institutions giving birth to technologies that have been siphoned off to the United States as the US seeks to do with ASML and TSMC, if you hear Trump speak it's as though what TSMC has was stolen from the US and thus he wants to take it back!

Therefore the primary focus of this article is to how best prepare for the next bear market during the last legs of this bull market as President Dump is accelerating the demise of the bull and what to do to maximise opportunities during the next bear market.

Stocks Bull Market End Game Bear Start Strategy

19th March 2024 2pm UK Time.

CONTENTS

Money Printer Getting Ready to go Brrr

Trumponomics Breaks the US Dollar

S&P Correction Trend

Deviation Against Stock Market Trend Forecast

Recession Self Fulfilling Prophecy

Next Stocks Bear Market How Bad Could it Get?

AI Stocks Portfolio Current State

Buying the Dip

Elon's Butt Must Hurt

Stocks Bull Market End Game Strategy in Brief

PSYCHOLOGY FOR SUCCESSFUL BEAR MARKET INVESTING!

Bull / Bear Strategy To Do List

The During the last legs of the bull market

During the bear market

Road Maps and Ongoing Analysis

Post bear market

FX Impact - Sterling Bear Market Hedging

AI Tech stocks During a BEAR MARKET

Draw downs from 2021 highs to lows 2022 lows

Best and Worst Stocks to Hold During the Nest Bear Market

Agent Orange Stock Market / Financial System Doomsday Scenario

The whole of this analysis has first been made available to patrons who support my work so for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Recent analysis -

Stocks, Crypto and Housing Market Waiting for Trump to Shut His Mouth!

Contents

State of the Stocks Bull Market

It's the 1990's All Over Again!

Stock Market Deviation Against Trend Forecast

When Will US Interest Rates Next Be Cut?

Nvidia DeepSeek FEAR and PANIC

Nvidia Earnings Blast Off?

AI Megatrend

Tesla is Toast!

AI Stocks Portfolio

Bear Market Strategy

FEAR RISING PRICES

UK House Prices

US Home Builders

US House Prices Momentum

US House Prices

Bitcoin Trend Forecast

Pensions Lump Sum Take it Or Leave it?

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Recent Analysis -

President Chaos Delivering Tariffs Buying Opps - Earnings GOOG, AMD, QCOM, RBLX, AMZN

Trump's Squid Game America, a Year of Black Swans and Bull Market Pumps

Earnings Black Swans - MSFT, TSLA, META, AAPL, KLAC, IBM, INTC

Trump's Squid Game America, a Year of Black Swans and Bull Market Pumps

Squid Game Stock Market 2025, S&P Detailed Trend Forecast

Stocks, Bitcoin and Crypto Markets Get High on Donald Trump Pump

Stocks Santa Rally, Bitcoin Final Pump and AI Stocks Buying Gifts

And access to my exclusive to patron's only content such as the How to Really Get Rich series.

Change the Way You THINK! How to Really Get RICH Guide

Also access to my comprehensive 3 part How to Get Rich series -

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

It's simple, you pay $7 and you get FULL access to ALL of my content -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on my patreon page and I also send a short message in case the time extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules for successful investing.

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and not get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles and 3 part guide, clear concise steps that I may eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions on a daily basis.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of each analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your buying the black swan panic events analyst.

By Nadeem Walayat

Copyright © 2005-2025 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.