Stock Market Rip the Face Off the Bears Rally!

Stock-Markets / Stock Markets 2024 Dec 22, 2024 - 07:18 PM GMTBy: Nadeem_Walayat

Dear Reader

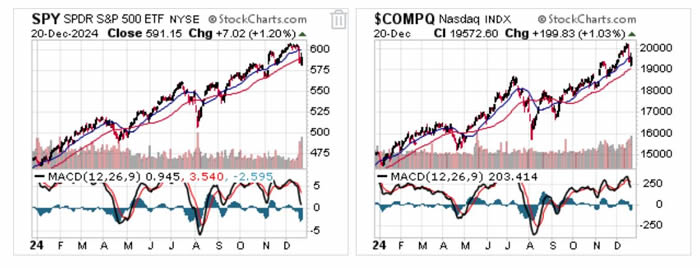

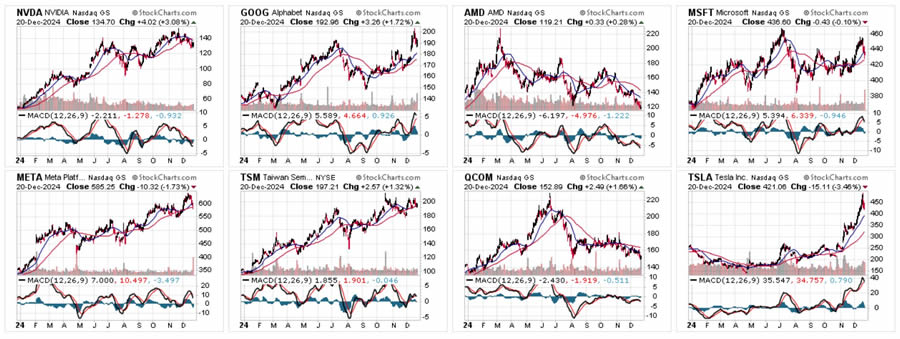

We are now into the time frame for a santa rally that runs from Monday into early January, 2024 has been another great year for AI tech stocks whilst most focus on the indices nothing burgers be it the S&P or Nasdaq (which I don't pay any attention to).

The year has delivered huge deviations against the lows and highs, unequivocal states of under and over valuations to both trim and buy into where the name of the game is to keep riding the AI gravy trains into the machine intelligence take over future, which is easier said then done given the tendency for AI stocks to FOMO which is what most AI stocks have done during the year, most recently Tesla and Broadcom.

I am working on my grande finale year end analysis, though 2025 should turn out to be another great year for stocks with S&P 7000+ incoming..... So expect stocks to continue climbing another year of a wall of worry.

Your analyst wishing all to live long and prosper!

Nadeem Walayat

https://www.patreon.com/Nadeem_Walayat

My most recent analysis - Trump Stocks and Crypto Mania 2025 Incoming as Bitcoin Breaks $100k Barrier

CONTENTS

Global Liquidity Prepares to Fire Bull Market Booster Rockets

Fed December Rate Cut

Stocks Bubble 2025

S&P Big Picture Road Map

Moores Law is NOT Dead, it is ACCELERATING!

AI Stocks Investing Perception

Stocks Portfolio

DOCU - What it Means to Never Sell At a Loss

Riding the AMD Gravy Train

Learn to Be the Man In the Middle

BTC $100k Milestone Achieved

Bitcoin Forgives You!

Bitcoin Seasonal Trend

Bitcoin - How the Bull Market Could End

Bitcoin Dominance Drop Triggers Alt Season

CRYPTO MARKET CAPS

CRYPTO EXIT STRATEGY

COINBASE

MSTR Blow Off Top

MSTR Spectrum

Micro Strategy Ponzi

Trump Ukraine Victory Incoming

Canada Living on Borrowed Time

Hacking Ageing With Supplements

Next Analysis VOTE

This article is part 1 of 2 of analysis that was first made available to patrons who support my work - Stock Market October Correction Window Into Post US Election Rip the Face Off the Bears Rally

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-ups in the New Year. https://www.patreon.com/Nadeem_Walayat.

CONTENTS

Presidential Election Year Seasonal Trend

What Does a Strong September Mean for the Stock Market?

Stock Market Up 8 Out of First 9 months

Republican vs Democrat Presidents and the Stock Market

2025 Mid Decade Year

The Risks are to the Upside!

Presidential Cycle - Best time to buy stocks

AI Tech Stocks Portfolio

LRCX Stock Split

META $596

Nvidia 5X to 30X

CEREBUS IPO NVIDIA KILLER?

Never Buy an IPO

STOP LOSSES

In Part 2-

CHINA Stocks Short Squeeze

Bubble Drivers

Fourth Reich Carving out an Empire Out of the Corpse of the US Empire

Why the US Empire Would Lose In a War Against Iran

Bitcoin Counting Down To Pump to New All Time Highs!

MSTR No Brainer

CRYPTO EXIT STRATEGY REVISITED

STOCKS BEAR MARKET STRATEGIES

CAPTALISNG ON THE NEXT BEAR MARKET

"Who controls the past controls the future: who controls the present controls the past" - George Orwell

In a heated comments section a Patron recently commented, "what have the Arabs ever invented!"

Good luck with anything that resembles the modern world without Alchemy, Algebra, and of course Algorithms and much more during Islam's 400 year golden age, of course they built on what came before, devouring Greek texts that Christian Europe was busy burning as heretical texts, mathematics including the 0-9 numeric system that originates from India which we all take for granted that would take some 500 years to be eventually adopted by Europe, without any of this there would have been no Renaissance and Enlightenment instead we would all be out working the fields today on X_VI_MMXXIV whilst probably the United States of New Arabia would now be calling the shots on the world stage, what happened? The Mongol's is what happened! The mother of all Black Swans that changed the course of history,

Another example is the nonsense that Christopher Columbus discovered America as if there weren't already millions of people living there! No wait first Europeans! WRONG AGAIN! The Vikings got there at least 500 years earlier! But the mighty Vikings got their butts kicked by the natives hence no colony survived to grow into New Uppåkra, probably something similar happened to the likes of Roanoke until the waves of mass illegal european migration managed to successful swamp native resistance.

Meanwhile Israel continues to run rings around an mentally incapacitated commander in chief.in their quest to carve out a Zionist Empire across the Middle East bought and paid for with US tax dollars where committing genocide against those who converted from Judaism to first Christianity and then Islam (by choice or force) is not enough, instead the eastern european settler colony seeks to expand it's borders deep into Lebanon all apparently based on on a 400 year window of occupation of a sliver of land over 2000 years ago as if no one lived there before or since, in which case the Native Americans and Aborigines should take note to a much longer and far more recent claim to their lands.

S&P trades to a NEW ALL TIME HIGH September! Clearly NOT following the seasonal script for a Down September as investors sat in cash seeing the Fed slash rates by 1/2% galvanised many to throw caution to the wind and start jumping in with both feet propelling the S&P to a new all time high going into the end of the month. Though what they don't appear to realise is that they are TWO YEARS LATE TO THE PARTY! Hence as folk were FOMO-ing into new highs I and probably most patrons were trimming given that we remain in the CORRECTION WINDOW! YES despite the S&P nothing burger setting new highs we remain in the correction window as illustrated by the trend of most target stocks as the S&P makes new highs.

(Charts courtesy of stockcharts.com)

ELECTION 2024 - Understand all that you seek to elect are shareholders! Politicians are deviant vested interests in maximising the return on their stock portfolios, focused on entering office to gift contracts such as the $10 trillion pissed down the toilet on the War on Terror to the corporate Oligarchy! Karl Marx got his knickers in a twist over nothing because Capitalism as he imagined it died centuries ago!

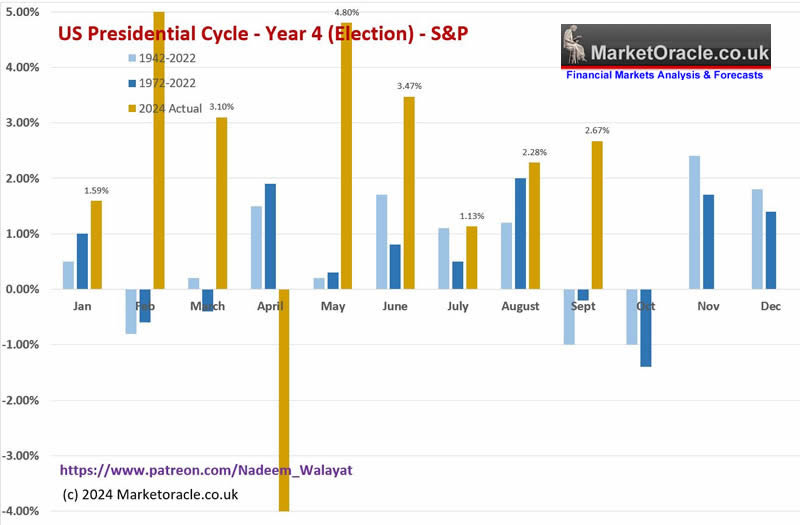

Presidential Election Year Seasonal Trend

So far the election year seasonal trend has had 4 misses out of 9 months, so on it's own as is the case with most individual pieces of analysis has been a coin flip as to whether any particular month will follow the seasonal pattern or not.

The miss for September has especially caught many including myself by surprise, though as I often state the S&P really is a nothing burger as ones focus should be on seeking to capitalise on opportunities presented in target AI tech stocks as and when they come along through use of limit orders hence why I tend to keep around 20% of my portfolio in cash most of which is deployed in limit orders, basing ones decisions on what one expects the S&P to do is a huge investing mistake!

Seasonally October should be a strong down month, BUT! Given what has transpired to date it is a COIN FLIP! Instead one should take the deviation from the September's closing prices as THE opportunities to accumulate rather then where the S&P or any stock ends October, for instance August was UP, but it gave a huge early month opportunity similar for September, so despite the months ending up strongly both gave intra month opps to accumulate just as I expect October will also regardless of where the S&P ends the month.

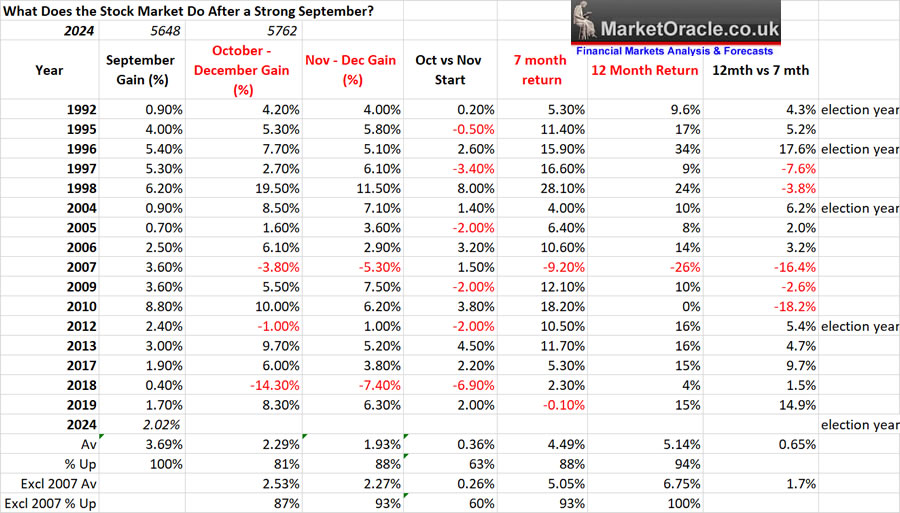

What Does a Strong September Mean for the Stock Market?

September is seasonally the weakest month of the year, and has been so for 3 years in a row until September 2024 resulting in the unexpected up closing month, though there are too factors that should be obvious -

1. Three years down in a row increases the probability for an UP September, a little more attention to detail should have flagged this as being probable.

2, That during a bull market the risks are to the UPSIDE.

Nevertheless an UP September allows one to see what this now implies for the stock market over the coming months and year.

There is a 81% to 87% chance of an Up Q4 with an average gain of 2.5% which from 5762 implies 5900 with probability slightly stronger for Nov to Dec which implies to buy the October dips, Whilst an UP October is basically a coin flip ay 63%.

For the 7 best month pattern from 1st Oct to 30th April has an 88% to 93% probability for a strong bull run with an average gain of 4.5% to 5% which from 5762 implies S&P 6050. Whilst only a marginal advantage to buying 1st Nov vs 1st Oct though again this does not account for intra month volatility.

Whilst for the full 12 months there is a 94% to 100% probability for an higher S&P with an average gain of 5.1% to 6.75% implying 6150.

Bottom line folk should seek to be invested for the bull run into April 2025, and likely continue on into September 2025 so expectations are for a bullish Q4 and 2025, with the S&P targeting a trend to above 6000 early 2025 and likely to continue trending higher during the year which means I will definitely be continuing buying any dips in target stocks during a probable volatile October.

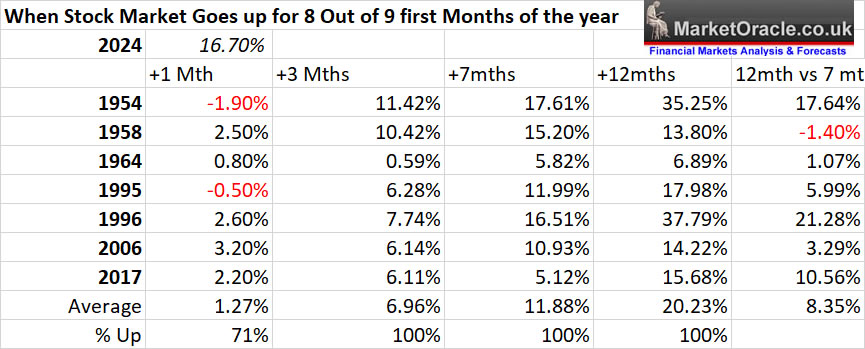

Stock Market Up 8 Out of First 9 months

A strong September during a strong year that has only seen 1 down month (April), so what does this rare pattern suggest could come next?

A bull trend for the next 12 months with a 100% hit rate to 30th Sept 2025. The pattern suggests to expect an Up Q4 with an average gain of 7%, a continuing rally all the way into the end of the seasonal strongest period of 1st Nov to 30th April for an average gain of 11.9%, but it does not end there! No summer weakness instead the bull rages all the way into the end of September for an average gain of 20%. So this one more piece of the puzzle acts to further reinforce expectations for a strong 2025.

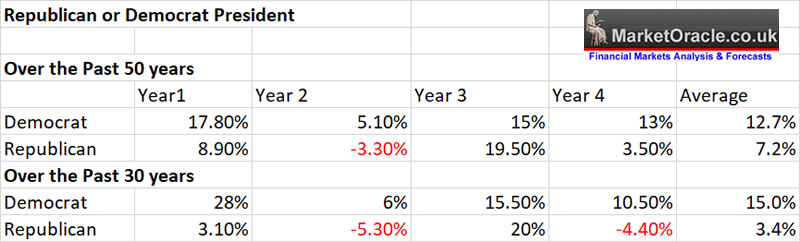

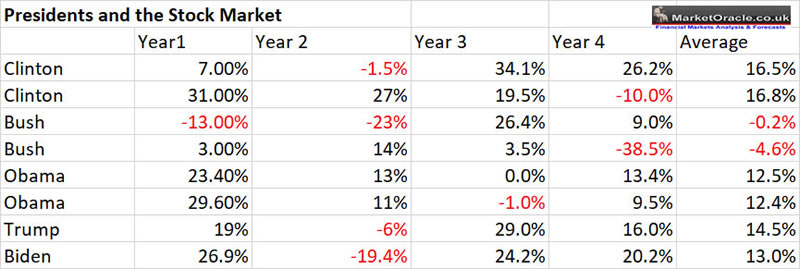

Republican vs Democrat Presidents and the Stock Market

Stock market performance based on whether the President is Democrat or Republican.

The AVERAGES data suggests a Democrat president will deliver a stronger stock market performance than Republican for the first year of their new term, likely near twice that of a Republican president, with the mid-terms particularly bad for Republicans.

A Republican or Democrat is not going to make much difference to stocks for 2025 that looks set to be another very bullish year, likely to see a gain of between +20% and +30%, which if the S&P ends 2024 at 6000 implies a target of 7200 to 7800 by the end of 2025.

Whilst 2026 (mid-term) and 2027 look set to be when the stock market hits a brick wall, but you've already known this from my big picture narrative as of Mid 2020 of the coming Quantum AI bubble mania blow off top that rolls over into a bear market that I suspect will be well under underway by early 2027.

However, here is where most analysts tend to go wrong, AVERAGES, this is an average which tend to be misleading when conducting such analysis as the following illustrates of what actually happened following the past 8 elections.

Which is why in my last article I looked at the individual charts of the past 3 election cycles individually rather than the AVERAGE.

Now don't get carried away with the presidential cycle as it is just ONE metric, presidential cycle, global liquidity cycle, debt cycle, inflation cycle, business cycle, margin debt cycle, US wars cycle and so on.... one can do similar exercises with each and I do so keep things in context, yes presidential election cycles are very useful tools but only as part of a whole landscape of analysis as what happened during both of Bush's Presidency illustrated when one would need to understand that things are NOT going to play out as the Presidential cycle suggested it should, so useful as part of ones tool kit.

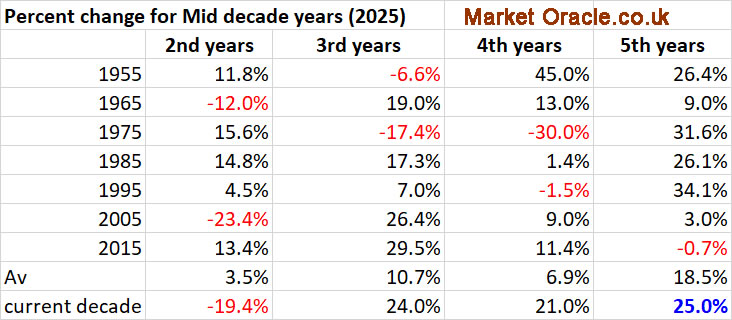

2025 Mid Decade Year

Statistically 2025 is expected to be the stronger of 2022,2023 and 2024, which again is supportive of the thesis that 2025 will see a gain of between 20% and 30% and probably nearer to 30%, i.e. a rip the face of the bears rally where those sat on the sidelines throw caution to the wind and FOMO in propelling the S&P well beyond 7000 towards 8000

This also suggests that crypto's should see a lot more upside than for instance Bitcoin $100k, and thus we could see Bitcoin trade into my original forecast target range of between $140k and $170k before the end of 2025.

The Risks are to the Upside!

Just so that we are all reading from the same page - A Correction is a Correction is a Correction, 5500 vs 5750 is not even 5%! Primary focus is to remain exposed to the AI mega-trend stocks and seek opps to accumulate as they come along, look at what happened to Chinese AI tech stocks!

I am always more positioned towards accumulating than distributing because I understand that the risks are the UPSIDE! Especially in AI tech stocks, but even I can make mistakes such as selling out of Nvidia for 3X profit at around $40, what did Nvidia do it 3x'd again! Of course I was not sat twiddling my thumbs as I continued to hold large positions in other target stocks such as META. Look at the 2022 bear market, what would have happened if one sold NOTHING going into and during it, yes it would have been painful and mentally draining with all that doom and gloom and little one could do other than make the mistake of SELLING! Which is why one of my primary rules is to never sell at a loss, stops one from doing something stoopid like selling out of META at $100 as some patrons were asking if they should do at the time. Nevertheless if you had held on for dear life you would have many multiples of the price you paid even towards the end of the the 2021 bull market!

So do not fear falling prices, even bear markets, the pain of which can be countered by maintaining a healthy cash balance so as to capitalise on such events that is fed by trimming whenever stocks fomo so no matter how many dips one buys one never runs out of money to buy the next dip as bear markets are just temporary draw downs that folk with hindsight look back on and wish they had bought the likes of Nvidia at anywhere near $20 whilst at the time $20 would have suffered a 50% draw down! Which is why I was stating throughout 2022 that investors no matter at what price they buy have to be mentally prepared for a 50% draw down because such draw downs are NORMAL for virtually EVERY STOCK! So just get the job done and thank me in a few years time.

Presidential Cycle - Best time to buy stocks

That would be during Sept to October of the 2nd year of the presidential cycle i.e. last time was during Sept to Oct 2022, don't be under any illusions by looking at the stock charts and imagining that you could have bought back then because at the time it was total carnage, blood on the streets, even Tom Lee had egg all over his face as his call for a strong 2022 went up in smoke. There was much pain for those patrons who followed me into the depths of bear market hell lows as there was maximum uncertainty, fear and doubt and all I promised was more pain as I repeated my mantra of bear markets are for getting the job done!. Draw downs are the price one pays to gain exposure to target stocks at rock bottom prices, how else can one buy Nvidia for as low as $10 bucks a share if not due to the fact that everyone was vomit selling out of Nvidia dropping down to $10 bucks! Those who thought they bought cheap at $20 were sat with a 50% draw down, everyone was sat on deep draw downs, from memory I think my average was around $16, so my draw down by $10 was 38%! That was a big draw down at the time and similar across the spectrum of AI Tech stocks, so don't imagine for a minute looking at the stock chart in hindsight that you could have would have should have because you likely would not have because if you did you would have had at least a 40% draw down! "But Nadeem I would have bought at $10", no you wouldn't at the time at $10 folk were commenting that they were going to wait for Nvidia to fall to $7.5, even $5 before buying (remember I am using post split pricing so $10 was $100 then).

What about those who never got bloodied, well they NEVER BOUGHT! Remained sat on the sidelines waiting for their perfect bottom price of S&P 3200, as the bear market bottom whisked past, and from then on it was the mantra of a bear market rally that would soon end at 3600, 3700, 3800, 3900, 4000, 4100, 4200, 4300, at 4350 ENOUGH ALREADY! You are NOT going to bloody see S&P 3500 again! You blew the bottom and now are blowing being invested in the bull market prompting me in June 2023 for folk to stick S&P 7000 before the end of 2025 on a post it note and look at it every time they felt like vomiting out of their positions in the wake of the latest nothing burger because 7k is where the S&P was heading towards, also sending the message out Mid June 2023 to all patrons.

We are in a BULL MARKET that will run for several years. I commented a few weeks ago to stick 'S&P 7000 before end of 2025' on a post it note to get folks focused on the big picture rather than S&P 4500 vs 4100 nothing burgers.

.

Here we stand October 2024 S&P trading at 5740, precisely at the half way mark both in terms of price and time to 7000! I am sure I said something similar at 3500, i.e. X2 to 7000, but would need to check.

Sometimes folk need to not think too much and just keep it simple.

KEEP that post it note in sight - Choo Choo !

So 2025 looks set to make my S&P 7000 target as of June 2023 become manifest! Though I am sure I will have stated earlier still that I expected S&P to x2 off the 3500 low to 7000 given that the first year of the bull market was accompanied by much doubt and fear, i,e, Feb 2023 Google at $80 was FINISHED, killed off by Chat GPT, should we sell and buy something else were the comments at the time? My response, It's upto you to decide what to do with youth money all I can do is show you what I am doing which is to buy more Google, well 18 months on it's trading at $175. just illustrates when stocks are cheap instead of adding more the automatic response of most investors is to want to SELL ALL!

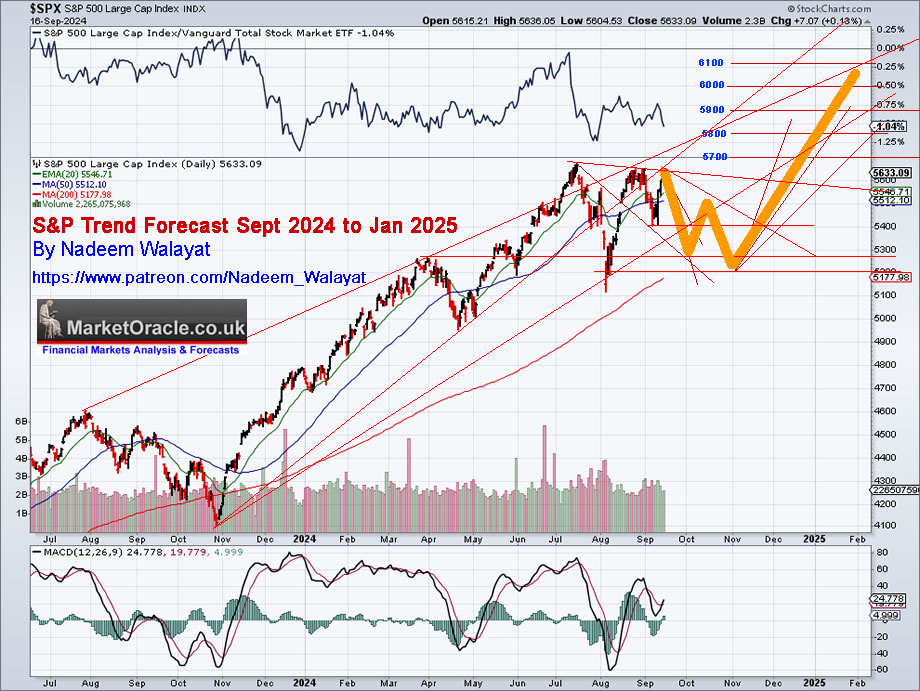

Stock Market Expected Trend

So far we are not getting the dip in the S&P, to the contrary as mentioned earlier the S&P traded to a new all time high which lowers the probability for an October dip getting down to anywhere the target of 5200, instead the S&P correcting down to 5500 looks doable from where we currently stand. Note the operative word "correction". Octobers tend to be one of the most volatile months of the year as does August and we saw what happened during August. a huge spike down that reversed to see the month close up, none of which will be visible in the monthly seasonal data. So whilst it might not seem like it right now with the S&P trading at 5740 as I write, October volatility is likely to see the S&P trade down by about 5% targeting a spike to below 5500 during the next few weeks which given the timing of will likely result in a DOWN OCTOBER, following which we will be set for that rip the face off the bears rally to well over 6000 during January 2025 as per trend forecast.

We are already getting dips in target stocks, today 8th of October I added Roblox at $36.6 and Redfin at $10, amongst others whilst trimming MSTR at $196, all whilst the S&P nothing burger treads water at 5740.

AI Tech Stocks Portfolio

My portfolio currently stands at 80% invested, 20% cash which is basically where my portfolio has been 2% all year as I play the trimming into FOMO game to buy the dips as opportunities present themselves all whilst maintaining exposure to key target stocks i.e. META and AMD have remained my largest holdings all year despite heavy trimming of META and AMD, with AMD delivering a deep draw down to reaccumulate. Whilst META is clearly too good of a stock to deliver much of any discounting events so far with the stock trading at 121% of current PE range vs 75% of future, one of the best stocks on the planet that the CNBC cartoon networks Clown Cramer deemed to be FINISHED when it was dirt cheap! The best time since the pandemic crash to buy stocks was when the MSM clowns were telling folks they were finished which illustrates why you should STOP WATCHING CNBC and ANY MSM financial news! All you get is clueless fools delivering you a sales pitch for their garbage funds, you will only MISS opportunities and LOSE money watching and reading MSM full of sales pitches, trash analysis and focused on selling FEAR so as to grab eyeballs as virtually every big story they run is a NOTHING BURGER! MSM are the Nothing Burger News Networks! But I still hear it in the comments, this clown or that clown says that Nvidia is finished, yeah well you know the script of what's going to happen next, what's finished $100 will soon X2 to $200!

Given that we remain in the correction window then there are still opps to accumulate target stocks as per the Buying Range, which I remind you is NOT trying to catch the LOWS, rather that they should be achieved during a correction and all of which were achieved during the current correction. Currently Samsung trades well into it's buying range and hence I have been busy accumulating. if as I expect we get another wave down during October than most of the AI tech stocks should deliver a third opp to accumulate during the correction window. Whilst folk and complain that stocks such as META are not falling, one has to remember we have to be grateful for what the BULL market giveths.

New Spreadsheet link as of this article as happens approx every couple of months -

https://docs.google.com/spreadsheets/d/1CFfTkXm6Kpgp5YyJZ0H_0Bv4uv-xzq68i2cLvMFAvDg/edit?usp=sharing

The previous link will now show as Archived and no longer be updated.

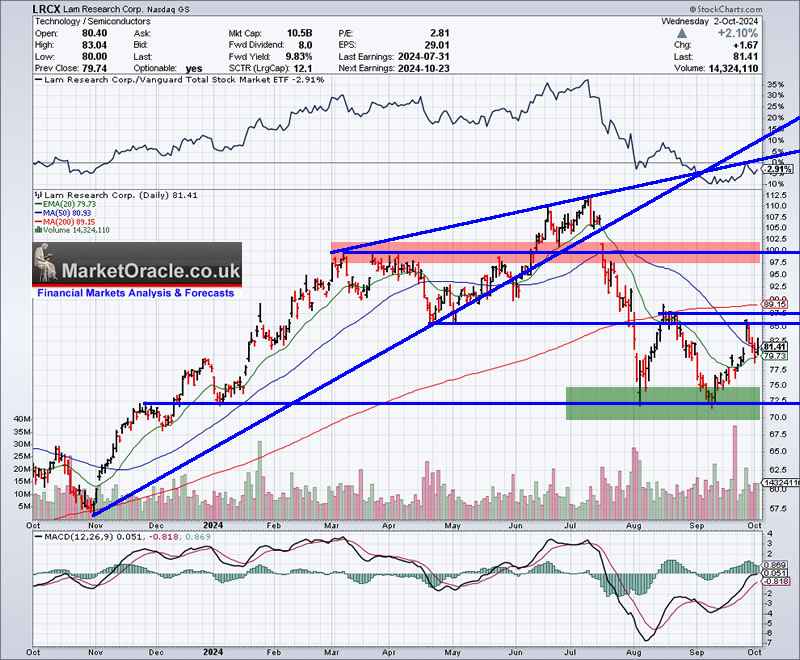

LRCX Stock Split

Investors in Lam Research the 11th stock on my AI list get 10 new crispy shares for every one held, the normal pattern for most stocks is to rise into a split and fall afterwards as a sell the news event. Lam Research did bottom out $720 on 10th September and since rose to a recent high of $860 so a 20% rally, though in reality the stock has not done anything other than follow the script for the correction window that runs from Mid July to at least Mid October following it's FOMO run to $1120.

(Charts courtesy of stockcharts.com)

I currently stand at 50% invested of target exposure (1.7%) after trimming hard into the high down to 25% invested (1.8%) in advance of it's 36% price drop due to extreme over valuation at the time of 190% of it's PE range (Column V), current at 121% still not cheap but a lot less over valued when many were FOMO-ing into the top. This illustrates the problem when folk just focus on the stock charts, they are literally flying blind, a ship without a rudder, valuations act as an anchor so one understands the degree to which the stock is drifting away from reality to over and under valuations and act accordingly. Further attenuated by the Forward PE Range, a best guess of how future earnings are likely to impact the stock price some of which tends to be discounted in the present which is at 77% for LRCX, so 122% current vs 77% future which allows one to accumulate in the present for future earnings at sub $752 depending on how much one already holds i.e. the primary objective is to maintain exposure all whilst one tries to ride the over valuation waves via trimming the FOMO and buying the dips.

META $596

META refuses to quit FOMO-ing so one can get a dip to add. Why? It's telling you that META is hitting the AI nail on the head! I trimmed some more via a limit order at $596, META is my 2nd largest position after AMD. It illustrates why BTFD works because there is no hindsight involved, all one does is buy fresh lows and then hold to trim during the bull runs, most can't do that because they can't take the pain of draw downs, when draw downs are your best friends because that's how you get to be heavily invested in stocks such as META. At $100 I told folk what they needed to know when Crown Cramer was prompting folk to panic sell at the bottom, I stated I was adding more..... the simplest messages can carry the most weight at times of maximum uncertainty fear and doubt when everyone was stating that it was game over for META, killed off by the metaverse. since whence it has more than 6X'd!

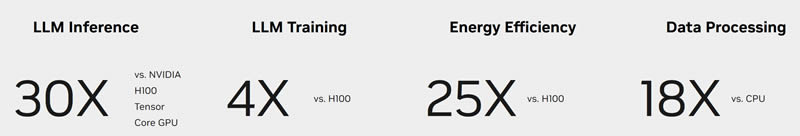

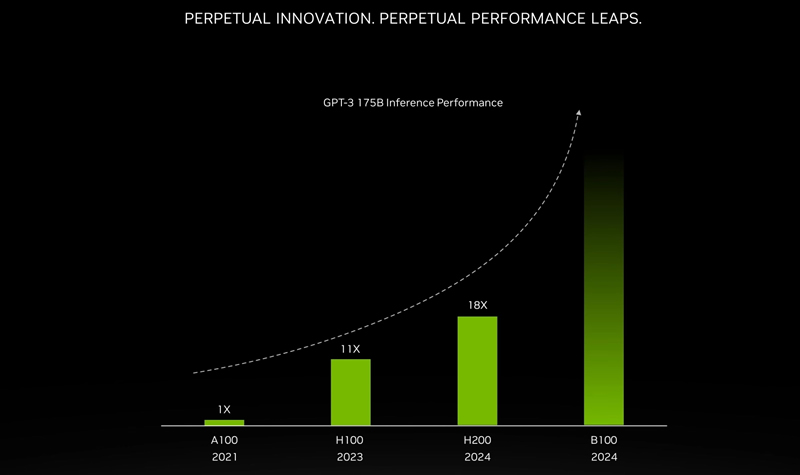

Nvidia 5X to 30X

Here's a reminder of why folk should not make the mistake of having little exposure to Nvidia, the more exposure the better - next gen accelerator (Black well) is 5x current gen H100 and depending on application and config delivers upto a 30X boost in performance, the AI bubble is nowhere near it's peak, take current deviation from the high as an opp you will regret missing, reminds me of buying bitcorn during Q4 2023, we all wanted it to dip but I nibbled a bit every other day to build up exposure, that's what folk should be doing with Nvidia.

Folk looking at the stock charts tend to forget that there is an exponential AI mega-trend underway, all these corrections are just that corrections, mere blips on the long-term trend, even 2022 will disappear on the charts and become a barely visible bump, folk who ask when to sell completely miss what is underway and will thus only make peanuts. It's not easy for the human mind to grasp exponential trends, we all make the mistake of fixating on recent highs and lows as if they mean anything and then there are the nothing burgers such as the S&P. Even if there is a big bear market coming one should not seek to sell all because the bear market will be temporary. Folk who held onto their Nvidia during the 2022 bear market should have learned the lesson that the draw down does not matter because it is temporary as I wrote at the very bottom during October 2022, it does not matter if Nvidia falls to below $100 ($10 today) because it will be temporary.

Understand Nvidia is NOT a normal stock, Nvidia IS AI! It has the potential to EAT EVERYTHING! Imagine an economic pie where one tiny sliver of that pie just keeps growing and growing, that is Nvidia, we just don't know how big it can get, today I can guess it can x2 to $240.. All those staring at the likes of OPEN AI are looking in the wrong direction because all roads lead back to NVIDIA!

CEREBUS IPO NVIDIA KILLER?

MSM Cerebras IPO hype has already started!

HEADLINES -

- Cerebras, an Nvidia Challenger, Files for IPO Confidentially

- Forget Nvidia: Billionaires Are Selling It and Buying This Top Artificial Intelligence (AI) Rival Hand Over Fist Instead

- Forget Intel and AMD - Nvidia's next big competitor might be a company you've never heard of

This is how the IPO game is played, pump the media with fake stories of how good Cerebus is and that it could take Nvidia's place to get fools to FOMO into a piece of garbage IPO.

Cerebus has about as much chance of beating Nvidia as a chicken has of beating a T-Rex!

There's going to be a flood of AI and Quantum AI IPO's going into the bubble top. Never buy an IPO! All of their metrics are fake, pumped up by the merchant banks.

There is no competitor to Nvidia, instead going down the blind alley of the next Nvidia they need to focus on those who are BUYING Nvidia hardware! That's the tech giants Google, META, Amazon and so on as all that capex will BOOST their future earnings, instead folk will blow it by shuffling their hard earning money onto the roulette wheel to see if Cerebus No 32 comes up on the spin or not.

Always run a mile when you hear x stock could be the next Nvidia or worse an Nvidia killer!

Never Buy an IPO

Here's a reminder of why you should never buy IPO's. not worth the risk. IPO's are accompanied with a huge amount of sales and marketing hype so that the insiders can offload their shares to retail crowd at an inflated valuation where the figures in the financial statements tend to be pure fantasy conjured out of thin air by the merchant banks.

It's always best to leave a stock for at least a couple of years to settle down and show it's true colours, the nearer one buys to an IPO the more likely one is to suffer huge draw downs that could become permanent.

STOP LOSSES

A Patron asks -

"Hi Nadeem, How do you plan for the unforeseen? In RUS-UKR context, recent Russian declaration/updating of Nuclear Doctrine. That a Non-Nuclear state can be nuked under this doctrine. This may or may not happen. However that is not the point. I have not put the Stop Orders on any of the shares, may be being a rookie. Should there always be a Stop Order for each share I own to hedge against black swan events? Would negative 20% Stop Orders make sense? I am saying 20% just as a random number. "

My reply

I don't use stops, it's upto you to decide what your comfortable with, yeah I know what if stocks crash 30% what then?, well they did March 2020, I sold nothing ahead or during the drop, instead backed up the truck and filled it up, investing is clearly psychological maybe you should work on that, plenty of books out there on investor psychology.

The market markers will run the stops which is why one should learn to do he opposite, instead of Selling i.e. getting stopped out BUY.

Part 2 of this extensive analysis will follow before year end, Stock Market October Correction Window Into Post US Election Rip the Face Off the Bears Rally

My most recent analysis - Trump Stocks and Crypto Mania 2025 Incoming as Bitcoin Breaks $100k Barrier

CONTENTS

Global Liquidity Prepares to Fire Bull Market Booster Rockets

Fed December Rate Cut

Stocks Bubble 2025

S&P Big Picture Road Map

Moores Law is NOT Dead, it is ACCELERATING!

AI Stocks Investing Perception

Stocks Portfolio

DOCU - What it Means to Never Sell At a Loss

Riding the AMD Gravy Train

Learn to Be the Man In the Middle

BTC $100k Milestone Achieved

Bitcoin Forgives You!

Bitcoin Seasonal Trend

Bitcoin - How the Bull Market Could End

Bitcoin Dominance Drop Triggers Alt Season

CRYPTO MARKET CAPS

CRYPTO EXIT STRATEGY

COINBASE

MSTR Blow Off Top

MSTR Spectrum

Micro Strategy Ponzi

Trump Ukraine Victory Incoming

Canada Living on Borrowed Time

Hacking Ageing With Supplements

Next Analysis VOTE

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-ups in the New Year. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes -

Stocks, Bitcoin and Crypto Markets Get High on Donald Trump Pump

Bitcoin Break Out, MSTR Rocket to the Moon! AI Tech Stocks Earnings Season

Stocks, Bitcoin, Crypto's Counting Down to President Donald Pump!

Also access to my comprehensive 3 part How to Get Rich series -

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

It's simple, you pay $7 and you get FULL access to ALL of my content -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on my patreon page and I also send a short message in case the time extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules for successful investing.

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and not get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles and 3 part guide, clear concise steps that I may eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions on a daily basis.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of each analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-ups in the New Year. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your trimming into FOMO mania analyst.

By Nadeem Walayat

Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.