Bitcoin Bull Market Bubble MANIA Rug Pulls 2024!

Currencies / Bitcoin May 19, 2024 - 04:11 PM GMTBy: Nadeem_Walayat

Dear Reader

Bitcoin sets a new all time high of $69,000 before the exchanges pulled the rug on leveraged longs by dumping BTC down to 59,976 within a few hours of the high, job done and bitcoin is back to near where it was before the rug pull. Think about that for a moment, Bitcoin just dumped near $10k in a few hours and then recovered almost all of it! And this bull market is only getting started!

Unfortunately most folks have no idea of what is coming. Even just considering Bitcoin let alone the alt-coins most crypto investors are unprepared for what is to come. The amount of manipulation and volatility is going to be HUGE as the exchanges / insiders are going to EAT retail investors alive! It's not just mayhem in prices but even the biggest exchange CONBASE is already having TRADING BLACKOUTS just as the time when most investors need to log in and manage their positions so as to prevent losses or capitalise on moves, what does CONBASE DO? SHUTS their system down where their retail customers can't even see what their deposit is let alone manage their open trades, as the CONBASE bot's rifle through the frozen stops and limit orders to see how much they can take of customer funds, only allowing access once the job is done, this has happened TWICE in just ONE WEEK!

To get some inkling of what's to come lets take a look at the previous Bitcoin bull market.

Following the breakout to a new all time high above $20k there was huge volatility on numerous days with intraday swings of 10%+. I imagine every such day felt as yesterday (5th of March) as the exchanges wiped out leveraged players. You have to understand 10% is a move that wipes out both LONGS and SHORTS! And this bull market is only now starting to break to new all time highs thus suggests expect many more such moves, and you can double even triple that for the Alt coins!

You may think you are ready but you are not! A 10% crash every few days followed by a bounce back.

This analysis on how to capitalise on the Crypto Bull Market of 2024 - Bitcoin Bull Market Bubble MANIA Rug Pulls 2024! was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Latest analysis - AI Will Turn Everyone Into Gamblers! The Greatest Wealth Transfer In History is Coming...

CONTENTS

Stock Market Inverted Seasonal Trend

China NEW STOCKS BULL MARKET!

Hyper Sensitive Markets as AI Disrupts Everything, Including Itself!

Learn How to Accumulate and Distribute

Beat FOMO and FUD with EGF Direction of Travel

MEDIFAST - Disrupted by Weight Loss Drugs

Counting Down to Nvidia Earnings

AI Stocks Portfolio Spreadsheet

RECESSION 2026?

Stocks Portfolio For A Recession of Sorts

AI Will Make Everyone Poor!

SPECULATING!

The Future of Mankind - You are Being Sold a Lie!

Universal Basic Slave Income is Coming....

Fake Full Employment

Billionaire Nazis are in Charge!

How to Get Rich University

They Want Your House!

The Greatest Wealth Transfer IN History

UK House Prices

Bitcoin Preparing for Next Leg Higher

BTC Where Next?

Bull Market Tops

BE PSYCHOLOGICALLY PREPARED FOR DAILY 10% MOVES THAT GO NOWHERE!

In terms of trend Bitcoin is doing what I expected it to do which is to first target $61k, and then $71k+ by the halving which has caught the many crypto experts off guard as they had collectively convinced themselves that Bitcoin would be CORRECTING going into it's halving event i.e. the new all time highs are penciled in by most some months AFTER the having event. Whilst my view has been that Bitcoin will likely trade to a new all time high by the halving and that this bull market will likely be compressed in time i.e. it will move a lot earlier and further than most imagine which also means will top out a lot earlier with October 2024 sticking out as a possible top whilst the consensus are focused on the bull market running into the end of 2025 which presents a huge disconnect between what most crypto folks expect to happen and what actually could happen that we are getting an early taste of this week.

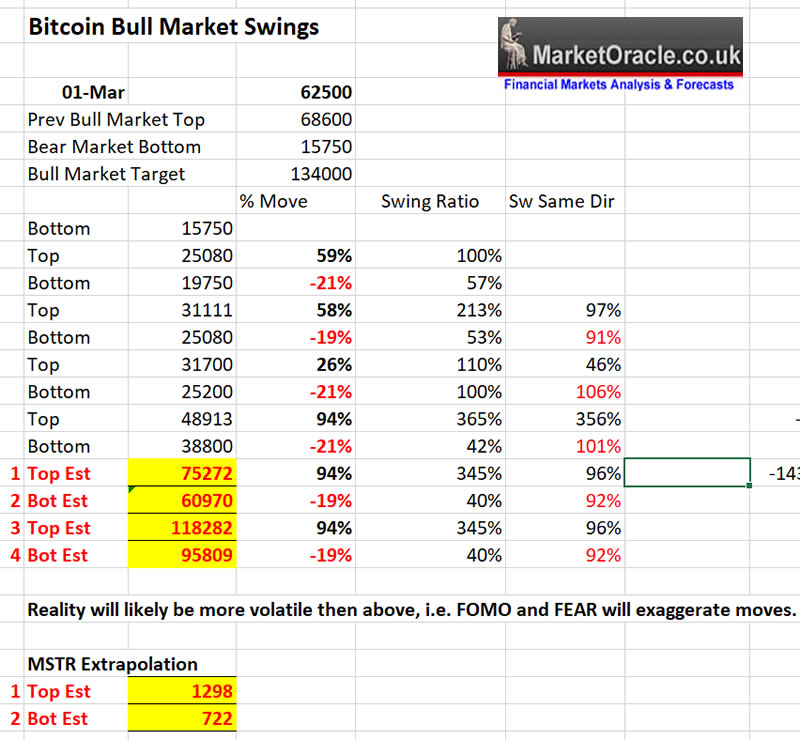

Bitcoin Swings Study

Just as the 2021 Bitcoin bull market illustrated one can expect sizeable corrections during this bull market following a break to a new all time high in addition to the 10% intra-day swings where 2021 saw 3 major down swings of -31%, -25%, and -17% before the mini bear market ahead of the actual final high.

However, the swings to date averaging just -20% for THIS bull market have been a lot milder to date. So it's a choice between using the previous bull markets swings or this bull markets swings in attempts to extrapolate how the tops and bottoms will play out. However, given that most recent price action is more important than for this exercise I have gone with the most recent swings as likely to be more representative of what could come to pass.

Swings analysis suggests Bitcoin is targeting at least $75k before the halving, followed by it's first major post new all time high correction of -19% to take the bitcoin price down to $61k before we see Bitcoins epic post halving bull run to over $100k. Whilst peak to trough .corrections will tend to be about -20%.

I also include a projection for MSTR to coincide with BTC $75k that has already been achieved Monday at BTC $69k which thus warrants an additional study of MSTR Swings as to how high this Bitcoin proxy could go during the bull market.

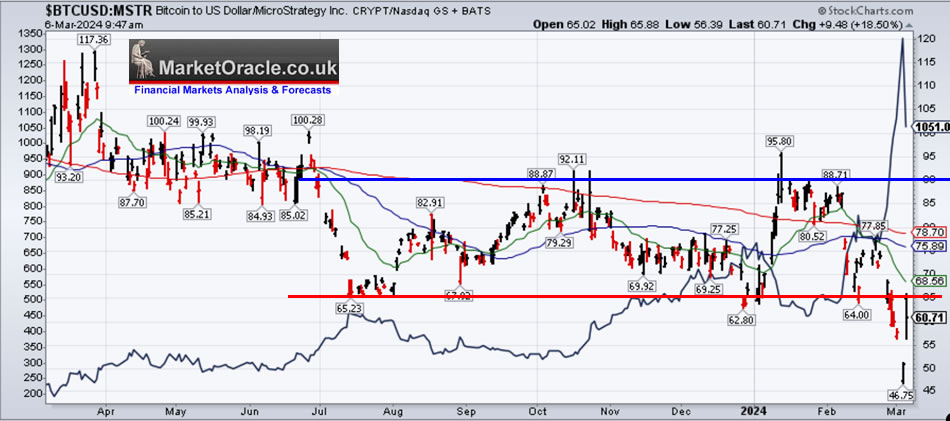

Micro Strategy Bubble Mania

Micro strategy went nuts Friday ending the session at $1106 which prompted my early Monday Morning Market brief warning that MSTR was primed for a huge pump and dump, so get ones limit orders in place to capitalise on what could turn into an epic first few days of the week, where I imagined we could even reach something like 1296 before the bubble popped. However reality turned out to be even crazier and more volatile.

MSTR pumped all the way to $1360 and more importantly gave us 3 bites at the cherry above $1300. So even if one had not been prepared beforehand for such an epic run MSTR gave us several hours to regroup and enter additional market orders to reduce ones exposure ahead oft the expected dump which to date has seen MSTR trade to a low of $1030, that's a peak to trough drop of near 25%! With likely more downside to come. Once the dust settled my position in MSTR has reduced from 79% invested as of Fridays close to currently stand at 53% invested. it may all look easy in hindsight but definitely not ahead of the event, and neither is it going to be easy going forward as we are going to see huge volatility in response to which all one can do is have one limit orders already in place in attempts to capitalise on such volatility as much as is humanly possible. It is not going to an easy ride but as long as one banks profits as one goes along then folks won't be left staring at the likes of MSTR $300 once the dust settles as I did detect some FOMO kicking in at $1300 with comments such as MSTR could fly to $3000 as it did in 2000 to which I replied "if you think like that you'll still be holding your MSTR when its next trading at $300!"

There is a great deal of FOMO baked into the current MSTR price as I mentioned in Mondays market brief where using a simple metric of MSTR X80 tells you how extreme the current price is. For instance MSTR trading at $1360 equates to discounting a Bitcoin price of $108k! Completely unsustainable and hence my warnings to not get carried away by FOMO as it is not going to last and it didn't!

The BTC divided by MSTR chart illustrates just how extreme the price action had gotten.

BTC / MSTR fair value is 80 so roughly a reading of 90 is CHEAP relative to BTC whilst a reading below 70 is EXPENSIVE, Fridays reading which prompted me to send out the market brief was 57! And the FOMO rally took things to a new extreme of 46! So despite Bitcoin pumping to $69k on Monday MSTR literally fired it's booster rockets through $1200 all the way to $1360 as I commented at the time we are looking at a potential Chernobyl nuclear meltdown! The value as of last close is 60, so MSTR at $1051 is still at an extreme, let alone the after hours quote of $1140.

Even though it is possible for MSTR to have another FOMO driven push higher along with BTC to over $70k, however as Tuesdays dump to $1030 illustrates it would likely prove temporary.

One thing is clear, MSTR will TOP before Bitcoin because it's price will be juiced to far beyond what's rationale.

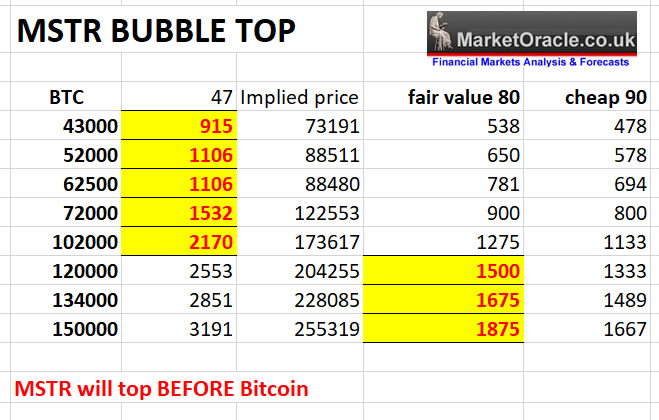

In terms of how high MSTR could go during this bull market depends on how early MSTR tops BEFORE Bitcoin, so the starting point is to have a target for Bitcoin which as per my October analysis is for a base case of $134k which as the following table illustrates I would expect MSTR to top out long before Bitcoin gets to $134k, probably around $102k at approx $2100 following which many will be puzzled as to why MSTR keeps falling whilst Bitcoin keeps marching higher, given that they had just FOMO 'd into MSTR on break above BTC $100k.

Of course if Bitcoin tops out earlier, say at $100k or later at say $170k then that will obviously play into what MSTR does, thus one needs to keep an eye out on the fair value price for MSTR during the bull market where the greater the deviation against fair value the greater the bubble MSTR will find itself in i.e. at BTC $102k the MSTR bubble price of $2170 would be 70% above fair value. Conversely should MSTR dump below fair value and the Bitcoin bull market was deemed to still be in play then that would present an opportune time to accumulate MSTR as was the case a few weeks ago when MSTR traded below $500, whilst BTC was hovering around $43k.

So do bare in mind that during the next correction MSTR could trade through fair value i.e.BTC / 80 and especially be careful of spikes such as Mondays that reversed the following day by 25%! MSTR is a very volatile stock! as the moon shot to $1360 illustrates, so whatever I imagine it can do it's probably going to out do it both to the UPSIDE AND DOWNSIDE!

How Deep could an MSTR correction go?

MSTR is an ideal stock to play the accumulation and distributing game as it will surprise in both directions which means much deeper buying opps and much greater selling opps. For instance whilst my expectations are for a deep correction to as low as $720. BUT this crazy stock could after say putting in a false bottom at $720 and rallying to back over $900 decide to take another swing lower through $720, slicing through $600 and only bottoming when it is annihilated all of the longs who had thought $720 was THE bottom! This is the nature of the MSTR beast! I know the nature of the beast but I doubt most who invest in it understand MSTR. Hey who knows we might get lucky and it behaves itself! But we don't get moon shots to $1360 and beyond without the equal risks of deep temporary pull backs!

Here are my current buying and trimming levels for MSTR.

SELL $1252 1%

SELL $1292 1%

SELL $1332 2%

SELL $1468 2%

SELL $1396 10%

SELL $1436 2%

SELL $1488 2%

SELL $1598 10%

BUY $1036 1%

BUY $1008 1%

BUY $982 1%

BUY $952 1%

BUY $912 1%

BUY $892 2%

BUY $876 2%

BUY $848 3%

BUY $806 4%

BUY $776 4%

BUY $752 5%

BUY $722 6%

My best advice is not to get greedy, do not try and buy the bottom or sell the top because if you do then you will probably make little or nothing! Remember crypto is fairy dust, magic beans, no substance, easy come, easy go, a little high, a little low. Any way the wind blows should not matter to you or me. All we are doing is dancing the Fandango so try not to get killed!

This is how to avoid getting killed in any market.

1. Don't use leverage.

2. Don't short.

3. Forget about THE TOP or THE BOTTOM instead Accumulate and Distribute as my recent video illustrated.

Understand that even if you sold all your MSTR near the current top that you got lucky! And the thing about luck is that it runs out.

The bottom line is remember crypto's are a gamble so don't get greedy! A lot of people are going to lose ALL of their gains because they got greedy.

Alt Coins

Other crypto's I have small exposure to that comprise that 1.2% other.

AVAX - This bull market

ALGO - This bull market

XLM - legacy

MATIC - Legacy

CRO - This bull market

AAVE - Legacy

RNDR - This bull market

EOS - Legacy

Mana - Legacy

Doge - Legacy

OP - This bull market

Gala - This bull market

AVAX + ALGO total more than 50% of the above.

What usually happens is that during the bull market when Bitcoin pauses i.e. corrects it passes the bull market baton onto the alt coins and so we get alt coins season that see's crypto's such as these go nuts to the upside, it's pretty simple really, traders sell some of their bitcoin that flows into alt coins as traders chase profits i.e. it is infinitely easier for an Alt coin to double then Bitcoin. Don't ask me for analysis of any of these because there is none, I just scaled in and will scale out with little regard to what they actually say they do, my main alt's such as SOL and LINK are as listed in the portfolio.

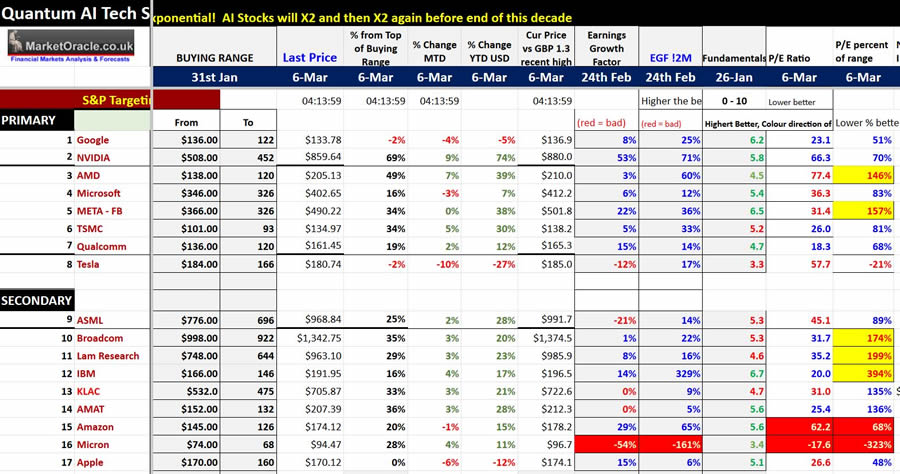

AI Tech Stocks Portfolio

After all that trimming I am now 78.8% invested, 21.2% cash so ready for a decent correction to materialise to capitalise upon, whilst the S&P continues to hold steady around 5100.

https://docs.google.com/spreadsheets/d/183aPw1ztElfFT9c2Ch9vKk1uL3LTGiEaNsM6vaHxDQM/edit?usp=sharing

Biggest changes in the portfolio over recent weeks was been trimming in Qualcom, TSMC, META, AMAT, and another big sell in AMD where I am now 34% invested of target exposure, though AMD is still my 2nd largest holding in terms of percent of portfolio at 4..5%

Which stocks are in their buy zones?

Google, Tesla and Apple are all in their buying zones which I have been adding to, so the S&P may yet to dip but several target stocks are correcting and presenting opps to accumulate.

This chart illustrates how I am accumulating Apple. currently in the pinprick buying zone above $170 that totals about 3% of target exposure, where the amount of buying increases the further the stock price drops i.e. Apple is a weak stock which I at least expect to trade into the primary buying zone and similar for Tesla, with my long standing expectations for Tesla to head sub $160 and Google sub $130 so regardless of what the S&P does there are opps to accumulate.

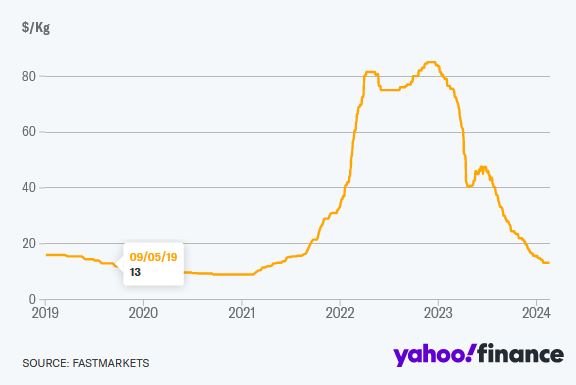

Albemarle $110

Took a huge price dump Tuesday on announcement of a 1 for 20 rights issue with the price falling from $143 to $107. I upped my exposure from 41% invested to 57% and I am contemplating further big buys as I see the downside being limited because the Lithium price is showing signs of having bottomed.

So whilst I was never expecting Albemarle to enter a raging bull market this year, nevertheless a recovery to $150 is probable as that is where it was heading until Tuesdays news, so to about 27% above the current price hence why I have been accumulating. As with everything one cannot buy or sell with the benefit of hindsight only what one can glean in the present.

(Charts courtesy of stockcharts.com)

This was a crypto special, the article I had planned to post that furthered my look at global warming, stocks and housing will be posted in about a weeks time.

This analysis on how to capitalise on the Crypto Bull Market of 2024 - Bitcoin Bull Market Bubble MANIA Rug Pulls 2024! was first made available to patrons who support my work. So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before next rises to $10 per month for new sign-ups. https://www.patreon.com/Nadeem_Walayat.

Latest analysis - AI Will Turn Everyone Into Gamblers! The Greatest Wealth Transfer In History is Coming...

CONTENTS

Stock Market Inverted Seasonal Trend

China NEW STOCKS BULL MARKET!

Hyper Sensitive Markets as AI Disrupts Everything, Including Itself!

Learn How to Accumulate and Distribute

Beat FOMO and FUD with EGF Direction of Travel

MEDIFAST - Disrupted by Weight Loss Drugs

Counting Down to Nvidia Earnings

AI Stocks Portfolio Spreadsheet

RECESSION 2026?

Stocks Portfolio For A Recession of Sorts

AI Will Make Everyone Poor!

SPECULATING!

The Future of Mankind - You are Being Sold a Lie!

Universal Basic Slave Income is Coming....

Fake Full Employment

Billionaire Nazis are in Charge!

How to Get Rich University

They Want Your House!

The Greatest Wealth Transfer IN History

UK House Prices

Bitcoin Preparing for Next Leg Higher

BTC Where Next?

Bull Market Tops

Here's what you get access to for just $7 per month -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on this page and I will also send a short message in case the extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and net get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles, clear concise steps that I will seek to update annually and may also eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive at least 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of my analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate access to all my analysis and trend forecasts do consider becoming a Patron by supporting my work for just $7 per month. https://www.patreon.com/Nadeem_Walayat lock it in before it next rises to $10 per month for new signup's.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your crypto's accumulating analyst.

By Nadeem Walayat

Copyright © 2005-2024 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.