GameStop (GME): 88% Shellacking Yet No Lesson Learned

Companies / Investing 2024 Feb 17, 2024 - 09:58 AM GMTBy: EWI

"Every major peak gets cinematic treatment"

Back in early 2021, the meme stock craze was going strong.

As you'll recall that craze was all over the news and revolved around favorite stocks promoted by largely novice traders via social media. This January 27, 2021 New York Times news item sums up the frenzy surrounding one of those stocks:

'Dumb Money' Is on GameStop, and It's Beating Wall Street at Its Own Game

GameStop shares have soared 1,700 percent as millions of small investors, egged on by social media, employ a classic Wall Street tactic to put the squeeze -- on Wall Street.

A few days later, after GameStop shares had fallen hard, the February 2021 Elliott Wave Financial Forecast, a monthly publication which provides analysis of major U.S. financial markets, offered this warning:

Every major peak gets cinematic treatment and the current one is no exception. ... The Wall Street Journal reported, "Netflix, MGM Race to Produce Projects About GameStop Saga."

After that big decline in Gamestop shares in late January and early February 2021, the share price did bounce back, but has since fallen dramatically. Even so, some traders are not fazed, which is testimony to the high degree of overall optimism toward financial markets.

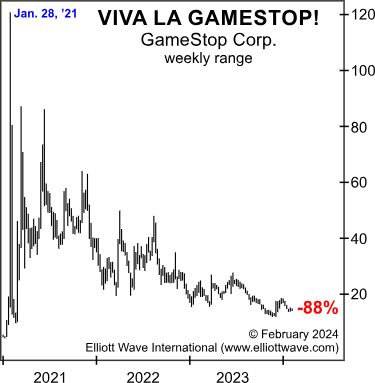

The recently published February Elliott Wave Financial Forecast provides an update with this chart and commentary:

The sustained public tolerance for falling prices is well illustrated by the resilience of retail demand for GameStop shares. GME is down 88% from its intraday high of $120.75 on January 28, 2021. But the faith in GME as a vehicle for wealth continues. ... On January 22, TheStreet's "meme maven" columnist added a host of "Reasons to Buy GameStop." There's just no quenching the demand for GME shares.

Again, this speaks to the high degree of optimism toward the market as a whole and our latest analysis of the main U.S. stock indexes is something you need to see for yourself.

As you might imagine, the main way Elliott Wave International analyzes financial markets is by employing the Elliott wave model.

If you'd like to learn the details of the Wave Principle, read Frost & Prechter's definitive text on the subject, Elliott Wave Principle: Key to Market Behavior. Here's a quote from this Wall Street classic book:

In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or "waves," that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon The Wave Principle.

Would you like to read the entire book for free?

All that's required for free access to the online version of the book is a Club EWI membership. Club EWI is the world's largest Elliott wave educational community and is free to join. Members enjoy complimentary access to a wealth of Elliott wave insights regarding financial markets, investing and trading.

Follow this link to read the book for free: Elliott Wave Principle: Key to Market Behavior.

This article was syndicated by Elliott Wave International and was originally published under the headline GameStop (GME): 88% Shellacking Yet No Lesson Learned. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.